Answered step by step

Verified Expert Solution

Question

1 Approved Answer

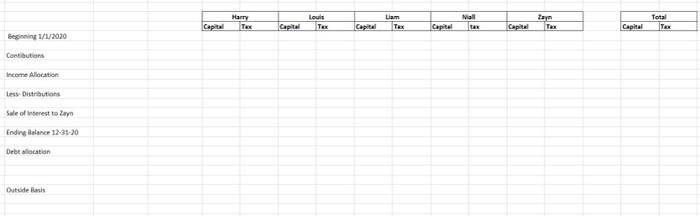

Please complete the excel for Partner's Outside Capital Account and Tax Basis Rollforward - including Liabilities. -0. General Facts: Any Direction LLC Any Direction LLC

Please complete the excel for Partner's Outside Capital Account and Tax Basis Rollforward - including Liabilities.

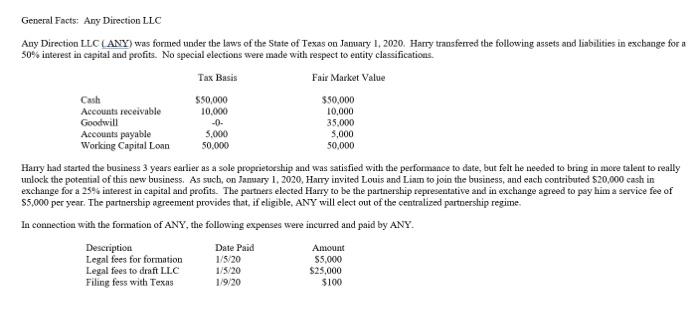

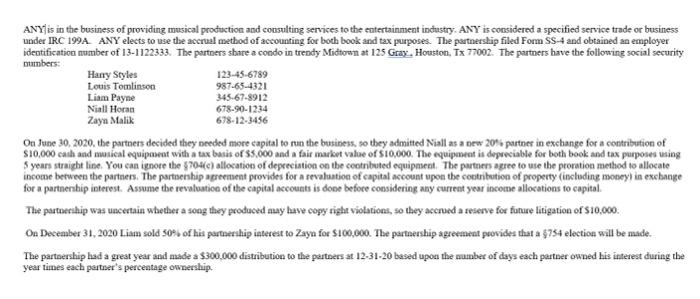

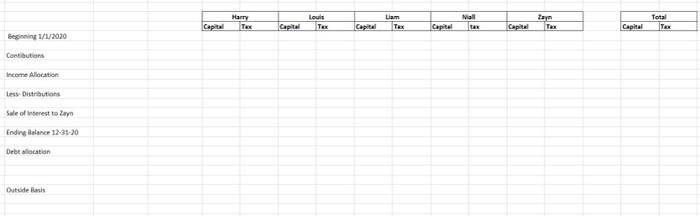

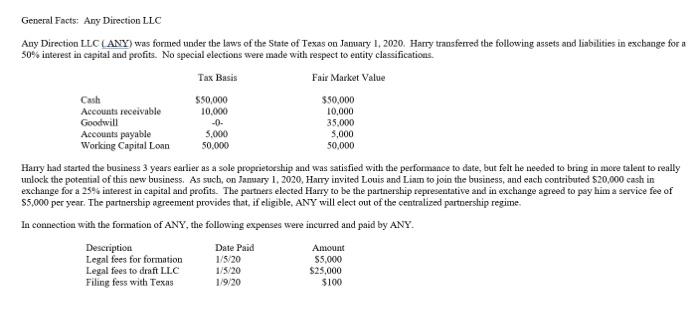

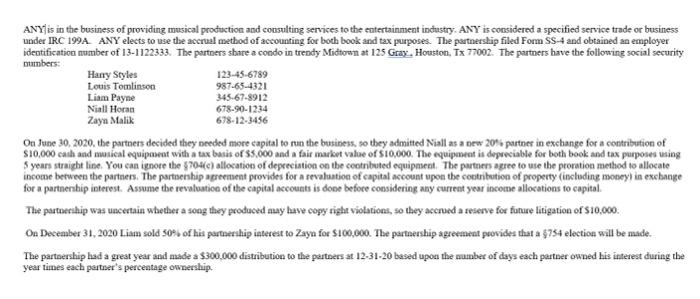

-0. General Facts: Any Direction LLC Any Direction LLC (ANY) was formed under the laws of the State of Texas on January 1, 2020. Harry transferred the following assets and liabilities in exchange for a 50% interest in capital and profits. No special elections were made with respect to entity classifications Tax Basis Fair Market Value Cash $50,000 $50,000 Accounts receivable 10.000 10,000 Goodwill 35,000 Accounts payable 5.000 5,000 Working Capital Loan 50,000 50,000 Hany had started the business 3 years earlier as a sole proprietorship and was satisfied with the performance to date, but felt he needed to bring in more talent to really unlock the potential of this new business. As such, on January 1, 2020, Harry invited Louis and Liam to join the business, and each contributed $20,000 cash in exchange for a 25% interest in capital and profits. The partners elected Harry to be the partnership representative and in exchange agreed to pay him a service fee of $5,000 per year. The partnership agreement provides that, if eligible, ANY will elect out of the centralized partnership regime. In connection with the formation of ANY, the following expenses were incurred and paid by ANY. Description Date Paid Amount Legal fees for formation 1/5/20 $5,000 Legal fees to draft LLC 1/5/20 $25,000 Filing fess with Texas 1/9/20 $100 ANY is in the business of providing musical production and consulting services to the entertainment industry. ANY is considered a specified service trade or business under IRC 199A ANY elects to use the accrual method of accounting for both book and tax purposes. The partnership filed Form $S4 and obtained an employer identification number of 13-1122333. The partners share a condo in trendy Midtown at 125 Gray, Houston, TX 77002. The partners have the following social security numbers: Harry Styles 123-456789 Louis Tomlinson 987-65-4321 Liam Payne 345-67-8912 Niall Horan 678-90-1234 Zayn Malik 678-12.3456 On June 30, 2020, the partners decided they needed more capital to run the business, so they admitted Niall as a new 2016 partner in exchange for a contribution of $10,000 cash and musical equipment with a tax basis of 55.000 and a fait market value of $10,000. The equipment is depreciable for both book and tax purposes using years straight line. You can ignore the $704(e) allocation of depreciation on the contributed equipment. The purtriers agree to use the proration method to allocate income between the partners. The partnership agreement provides for a revaluation of capital account upon the contribution of property (including money in exchange for a partnership interest. Assume the revaluation of the capital accounts is done before considering any current year income allocations to capital The partoeeship was uncertain whether a song they produced may have copyright violations, so they accrued a reserve for future litigation of $10,000 On December 31, 2020 Liam sold 50% of his partnership interest to Zaya for $100,000. The partnership agreement peovides that a $754 electice will be made. The partnership had a great year and made a $300.000 distribution to the partners at 12-31-20 based upon the number of days each partner owned his interest during the year times each partner's percentage ownership a Harry Capital Tex Louis Tex Liam TEX Nall Ita Zayn Tex Total TER Capital Capital Capital Capital Capital Beginning 1/1/2020 Contibution Income Allocation Less Distribution Sale of Interest to Zayn Ending Balance 12-01-20 Debe allocation Outside Basis -0. General Facts: Any Direction LLC Any Direction LLC (ANY) was formed under the laws of the State of Texas on January 1, 2020. Harry transferred the following assets and liabilities in exchange for a 50% interest in capital and profits. No special elections were made with respect to entity classifications Tax Basis Fair Market Value Cash $50,000 $50,000 Accounts receivable 10.000 10,000 Goodwill 35,000 Accounts payable 5.000 5,000 Working Capital Loan 50,000 50,000 Hany had started the business 3 years earlier as a sole proprietorship and was satisfied with the performance to date, but felt he needed to bring in more talent to really unlock the potential of this new business. As such, on January 1, 2020, Harry invited Louis and Liam to join the business, and each contributed $20,000 cash in exchange for a 25% interest in capital and profits. The partners elected Harry to be the partnership representative and in exchange agreed to pay him a service fee of $5,000 per year. The partnership agreement provides that, if eligible, ANY will elect out of the centralized partnership regime. In connection with the formation of ANY, the following expenses were incurred and paid by ANY. Description Date Paid Amount Legal fees for formation 1/5/20 $5,000 Legal fees to draft LLC 1/5/20 $25,000 Filing fess with Texas 1/9/20 $100 ANY is in the business of providing musical production and consulting services to the entertainment industry. ANY is considered a specified service trade or business under IRC 199A ANY elects to use the accrual method of accounting for both book and tax purposes. The partnership filed Form $S4 and obtained an employer identification number of 13-1122333. The partners share a condo in trendy Midtown at 125 Gray, Houston, TX 77002. The partners have the following social security numbers: Harry Styles 123-456789 Louis Tomlinson 987-65-4321 Liam Payne 345-67-8912 Niall Horan 678-90-1234 Zayn Malik 678-12.3456 On June 30, 2020, the partners decided they needed more capital to run the business, so they admitted Niall as a new 2016 partner in exchange for a contribution of $10,000 cash and musical equipment with a tax basis of 55.000 and a fait market value of $10,000. The equipment is depreciable for both book and tax purposes using years straight line. You can ignore the $704(e) allocation of depreciation on the contributed equipment. The purtriers agree to use the proration method to allocate income between the partners. The partnership agreement provides for a revaluation of capital account upon the contribution of property (including money in exchange for a partnership interest. Assume the revaluation of the capital accounts is done before considering any current year income allocations to capital The partoeeship was uncertain whether a song they produced may have copyright violations, so they accrued a reserve for future litigation of $10,000 On December 31, 2020 Liam sold 50% of his partnership interest to Zaya for $100,000. The partnership agreement peovides that a $754 electice will be made. The partnership had a great year and made a $300.000 distribution to the partners at 12-31-20 based upon the number of days each partner owned his interest during the year times each partner's percentage ownership a Harry Capital Tex Louis Tex Liam TEX Nall Ita Zayn Tex Total TER Capital Capital Capital Capital Capital Beginning 1/1/2020 Contibution Income Allocation Less Distribution Sale of Interest to Zayn Ending Balance 12-01-20 Debe allocation Outside Basis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started