Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the following journal entries with the data given above, thank you. Journalize the following transactions that occurred in September 2018 for Oceanic, assuming

Please complete the following journal entries with the data given above, thank you.

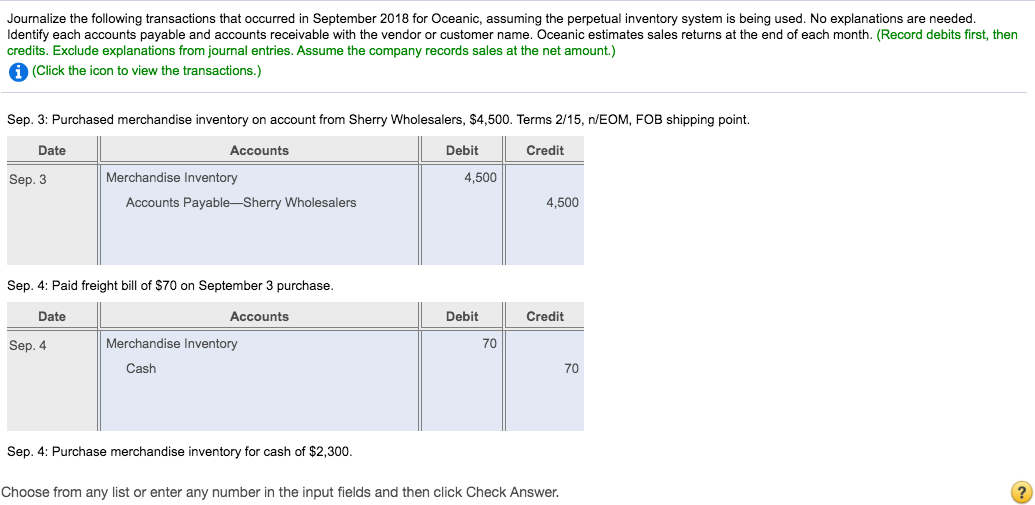

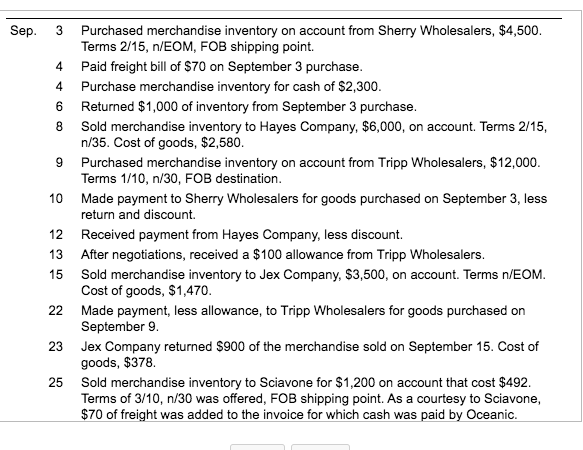

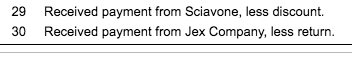

Journalize the following transactions that occurred in September 2018 for Oceanic, assuming the perpetual inventory system is being used. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Oceanic estimates sales returns at the end of each month. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount.) (Click the icon to view the transactions.) Sep. 3: Purchased merchandise inventory on account from Sherry Wholesalers, $4,500. Terms 2/15, n/EOM, FOB shipping point. Date Accounts Debit Credit Sep. 3 4,500 Merchandise Inventory Accounts PayableSherry Wholesalers 4,500 Sep. 4: Paid freight bill of $70 on September 3 purchase Date Accounts Debit Credit Sep. 4 70 Merchandise Inventory Cash 70 Sep. 4: Purchase merchandise inventory for cash of $2,300. Choose from any list or enter any number in the input fields and then click Check Answer. ? 3 4 4 6 8 9 Sep. Purchased merchandise inventory on account from Sherry Wholesalers, $4,500. Terms 2/15, n/EOM, FOB shipping point. Paid freight bill of $70 on September 3 purchase. Purchase merchandise inventory for cash of $2,300. Returned $1,000 of inventory from September 3 purchase. Sold merchandise inventory to Hayes Company, $6,000, on account. Terms 2/15, n/35. Cost of goods, $2,580. Purchased merchandise inventory on account from Tripp Wholesalers, $12,000. Terms 1/10, n/30, FOB destination. 10 Made payment to Sherry Wholesalers for goods purchased on September 3, less return and discount. 12 Received payment from Hayes Company, less discount. 13 After negotiations, received a $100 allowance from Tripp Wholesalers. 15 Sold merchandise inventory to Jex Company, $3,500, on account. Terms n/EOM. Cost of goods, $1,470. 22 Made payment, less allowance, to Tripp Wholesalers for goods purchased on September 9. 23 Jex Company returned $900 of the merchandise sold on September 15. Cost of goods, $378. 25 Sold merchandise inventory to Sciavone for $1,200 on account that cost $492. Terms of 3/10, n/30 was offered, FOB shipping point. As a courtesy to Sciavone, $70 of freight was added to the invoice for which cash was paid by Oceanic. 29 Received payment from Sciavone, less discount. Received payment from Jex Company, less return. 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started