Answered step by step

Verified Expert Solution

Question

1 Approved Answer

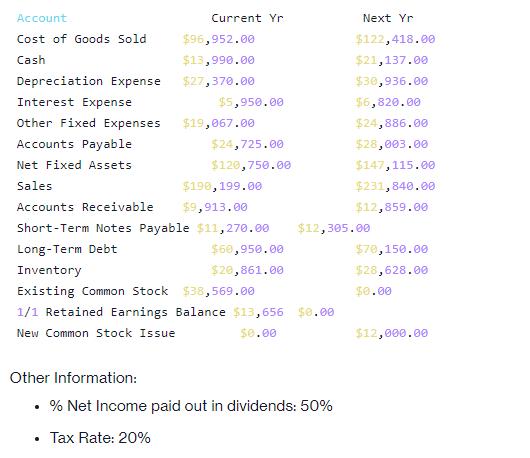

Please complete the following: Prepare Net Income Statements for both years Prepare Balance Sheets for both years Prepare Cash Flow Statement for Next Year Account

Please complete the following:

Prepare Net Income Statements for both years

Prepare Balance Sheets for both years

Prepare Cash Flow Statement for Next Year

Prepare Net Income Statements for both years

Prepare Balance Sheets for both years

Prepare Cash Flow Statement for Next Year

Account Cost of Goods Sold Cash Current Yr $96,952.00 $13,990.00 $27,370.00 Depreciation Expense Interest Expense Other Fixed Expenses Accounts Payable Net Fixed Assets Sales Accounts Receivable Short-Term Notes Payable $11,270.00 Long-Term Debt Inventory Existing Common Stock $38,569.00 $5,950.00 $19,067.00 $24,725.00 $120,750.00 $190,199.00 $9,913.00 $60,950.00 $20,861.00 $12,305.00 1/1 Retained Earnings Balance $13,656 $0.00 New Common Stock Issue $0.00 Next Yr $122,418.00 $21,137.00 $30,936.00 $6,820.00 $24,886.00 $28,003.00 $147,115.00 $231,840.00 $12,859.00 Other Information: % Net Income paid out in dividends: 50% Tax Rate: 20% $70,150.00 $28,628.00 $0.00 $12,000.00

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Net Income Statements For the Current Year Sales 19019900 Cost of Goods Sold 9695200 Depreciation Expense 2737000 Interest Expense 595000 Other Fixe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started