Answered step by step

Verified Expert Solution

Question

1 Approved Answer

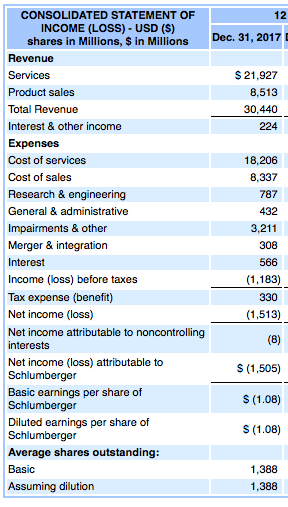

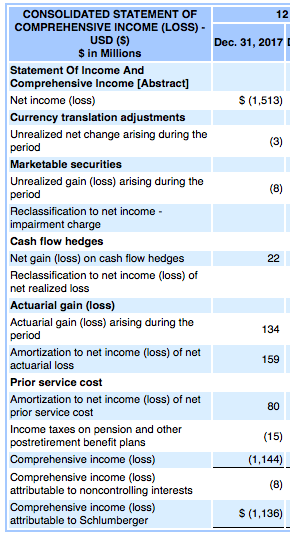

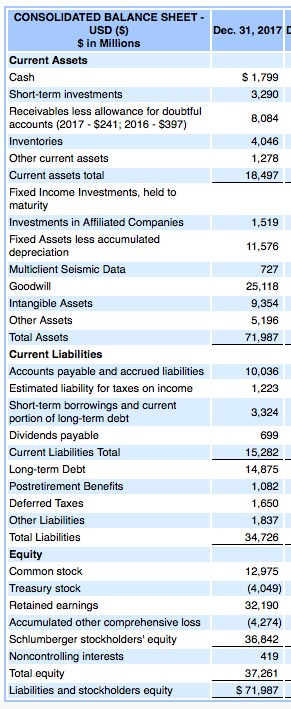

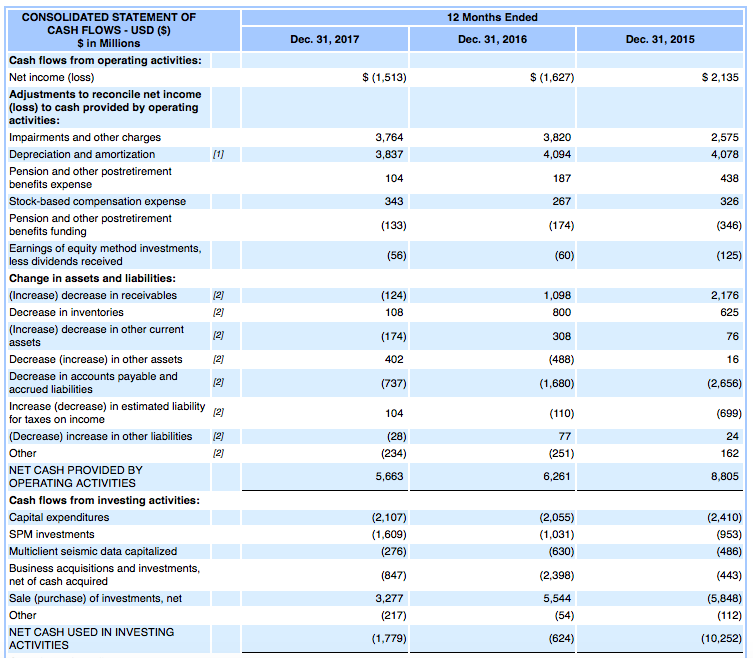

Please complete the following Statements from the given statements Income Statement Balance Statement Financial Statement CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (LOSS)- 12 USD (S) $

Please complete the following Statements from the given statements

-

Income Statement

-

Balance Statement

-

Financial Statement

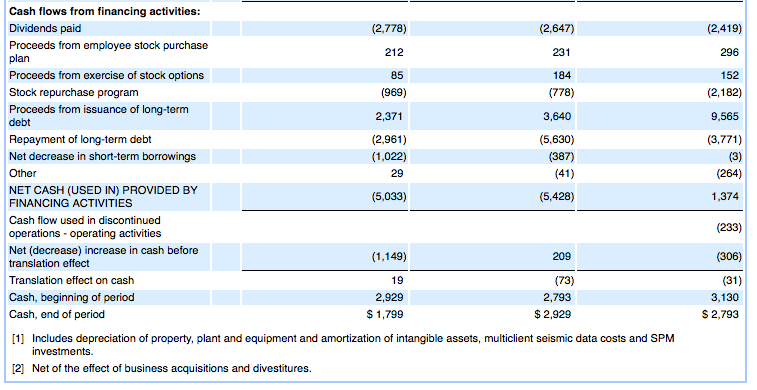

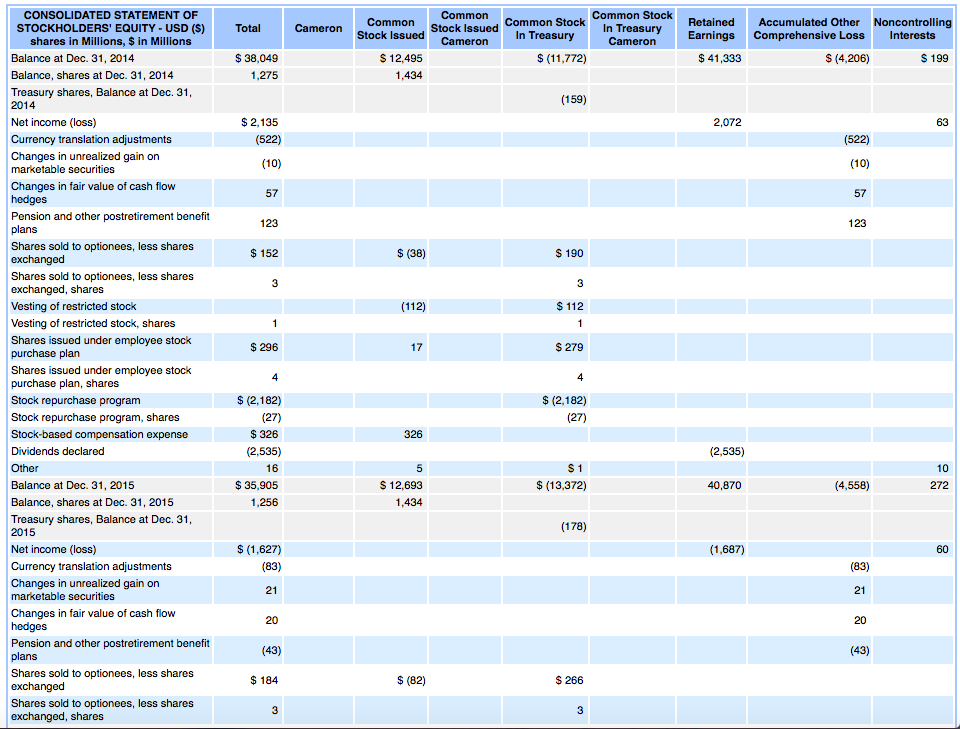

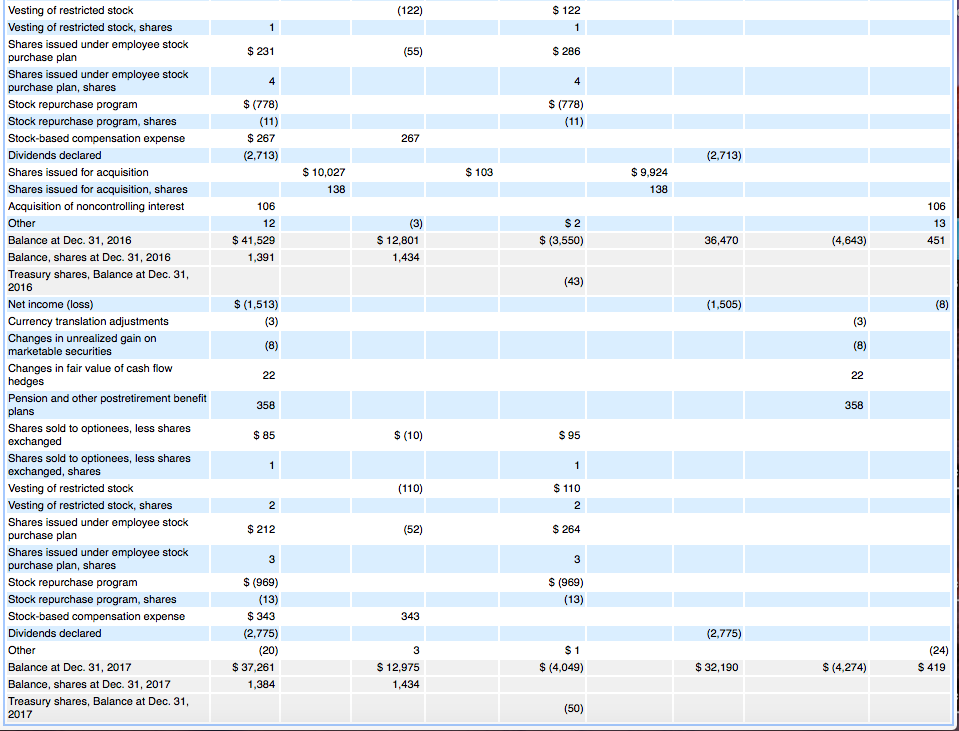

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (LOSS)- 12 USD (S) $ in Millions Dec. 31, 2017D Statement Of Income And Comprehensive Income [Abstract] Net income (loss) Currency translation adjustments Unrealized net change arising during the s (1,513) period Marketable securities Unrealized gain (loss) arising during the period Reclassification to net income - impairment charge Cash flow hedges Net gain (loss) on cash flow hedges Reclassification to net income (loss) of net realized loss Actuarial gain (loss) Actuarial gain (loss) arising during the 134 period Amortization to net income (loss) of net 159 actuarial loss Prior service cost Amortization to net income (loss) of net 80 prior service cost (15) (1,144) postretirement benefit plans Comprehensive income (loss) Comprehensive income (loss) attributable to noncontrolling interests Comprehensive income (loss) attributable to Schlumberger s (1,136) CONSOLIDATED STATEMENT OF Common Retained Accumulated Other Noncontrolling Earnings Comprehensive LossInterests on STOCKHOLDERS' EQUITY - USD (S) Total Cameron Comm In Treasury Stock Issued Stock Issued Common Stock Common Stock In Treasury shares in Millions, $ in Millions $38,049 $41,333 s (4,206) Balance at Dec. 31, 2014 Balance, shares at Dec. 31, 2014 Treasury shares, Balance at Dec. 31 $ 12,495 1,434 S (11,772) S 199 1,275 (159) 2014 Net income (loss) Currency translation adjustments Changes in unrealized gain on $2,135 (522) (10) 2,072 (10) marketable securities Changes in fair value of cash flow 57 57 Pension and other postretirement benefit 123 123 Shares sold to optionees, less shares exchanged Shares sold to optionees, less shares exchanged, shares Vesting of restricted stock Vesting of restricted stock, shares Shares issued under employee stock purchase plan Shares issued under employee stock purchase plan, shares Stock repurchase program Stock repurchase program, shares Stock-based compensation expense $152 $ (38) $190 (112) $112 $ 296 S 279 $ (2,182) $ (2,182) $ 326 (2,535) (2,535) 272 Balance at Dec. 31, 2015 Balance, shares at Dec. 31, 2015 Treasury shares, Balance at Dec. 31 S 35,905 1,256 S 12,693 1,434 $ (13,372) 40,870 (4,558) (178) 2015 Net income (loss) Currency translation adjustments Changes in unrealized gain on S(1,627) (83) (1,687) 60 marketable securities Changes in fair value of cash flow 20 20 Pension and other postretirement benefit (43) Shares sold to optionees, less shares exchanged Shares sold to optionees, less shares exchanged, shares 184 $(82) $ 266 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (LOSS)- 12 USD (S) $ in Millions Dec. 31, 2017D Statement Of Income And Comprehensive Income [Abstract] Net income (loss) Currency translation adjustments Unrealized net change arising during the s (1,513) period Marketable securities Unrealized gain (loss) arising during the period Reclassification to net income - impairment charge Cash flow hedges Net gain (loss) on cash flow hedges Reclassification to net income (loss) of net realized loss Actuarial gain (loss) Actuarial gain (loss) arising during the 134 period Amortization to net income (loss) of net 159 actuarial loss Prior service cost Amortization to net income (loss) of net 80 prior service cost (15) (1,144) postretirement benefit plans Comprehensive income (loss) Comprehensive income (loss) attributable to noncontrolling interests Comprehensive income (loss) attributable to Schlumberger s (1,136) CONSOLIDATED STATEMENT OF Common Retained Accumulated Other Noncontrolling Earnings Comprehensive LossInterests on STOCKHOLDERS' EQUITY - USD (S) Total Cameron Comm In Treasury Stock Issued Stock Issued Common Stock Common Stock In Treasury shares in Millions, $ in Millions $38,049 $41,333 s (4,206) Balance at Dec. 31, 2014 Balance, shares at Dec. 31, 2014 Treasury shares, Balance at Dec. 31 $ 12,495 1,434 S (11,772) S 199 1,275 (159) 2014 Net income (loss) Currency translation adjustments Changes in unrealized gain on $2,135 (522) (10) 2,072 (10) marketable securities Changes in fair value of cash flow 57 57 Pension and other postretirement benefit 123 123 Shares sold to optionees, less shares exchanged Shares sold to optionees, less shares exchanged, shares Vesting of restricted stock Vesting of restricted stock, shares Shares issued under employee stock purchase plan Shares issued under employee stock purchase plan, shares Stock repurchase program Stock repurchase program, shares Stock-based compensation expense $152 $ (38) $190 (112) $112 $ 296 S 279 $ (2,182) $ (2,182) $ 326 (2,535) (2,535) 272 Balance at Dec. 31, 2015 Balance, shares at Dec. 31, 2015 Treasury shares, Balance at Dec. 31 S 35,905 1,256 S 12,693 1,434 $ (13,372) 40,870 (4,558) (178) 2015 Net income (loss) Currency translation adjustments Changes in unrealized gain on S(1,627) (83) (1,687) 60 marketable securities Changes in fair value of cash flow 20 20 Pension and other postretirement benefit (43) Shares sold to optionees, less shares exchanged Shares sold to optionees, less shares exchanged, shares 184 $(82) $ 266

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started