Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the following tables using canadian tax laws It is January 3, 2022. Hayley Stewart, the controller for the Fraser Operating Group, is reviewing

Please complete the following tables using canadian tax laws

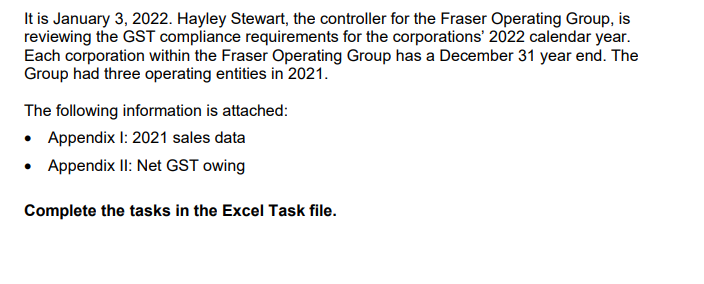

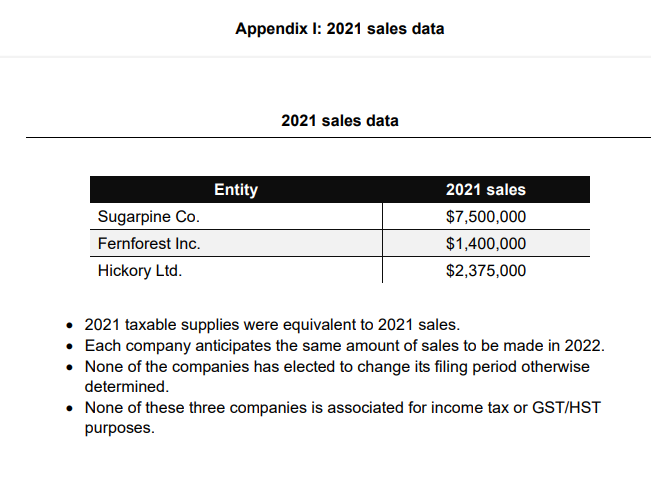

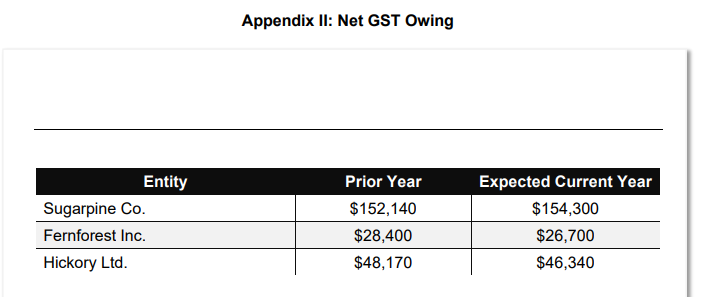

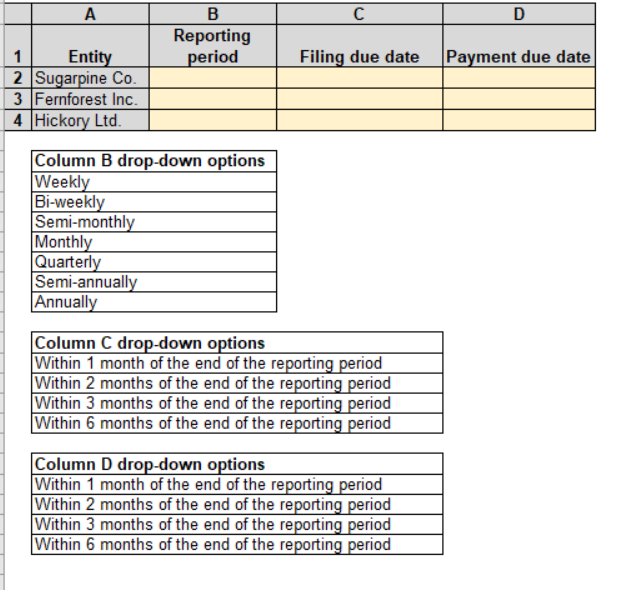

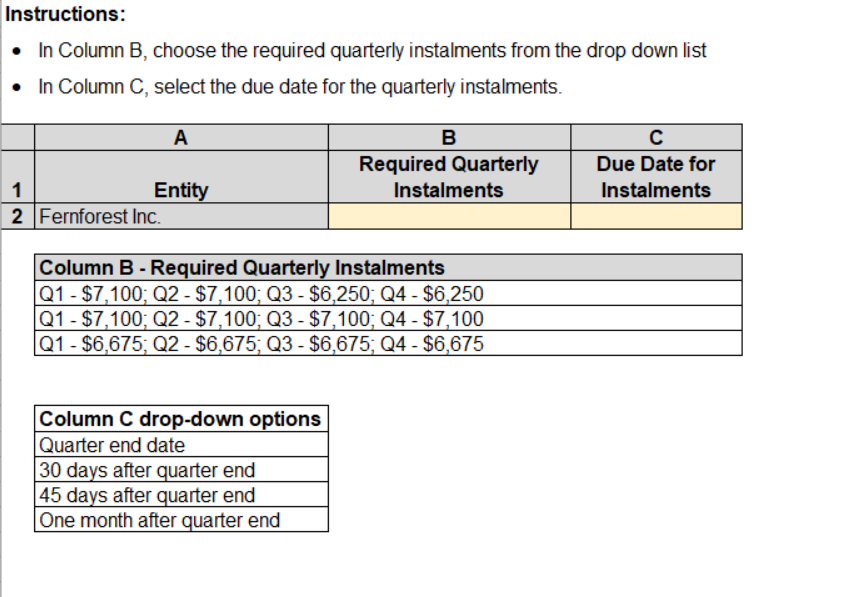

It is January 3, 2022. Hayley Stewart, the controller for the Fraser Operating Group, is reviewing the GST compliance requirements for the corporations' 2022 calendar year. Each corporation within the Fraser Operating Group has a December 31 year end. The Group had three operating entities in 2021. The following information is attached: Appendix I: 2021 sales data Appendix II: Net GST owing Complete the tasks in the Excel Task file. Appendix I: 2021 sales data 2021 sales data Entity 2021 sales Sugarpine Co. $7,500,000 Fernforest Inc. $1,400,000 Hickory Ltd. $2,375,000 2021 taxable supplies were equivalent to 2021 sales. Each company anticipates the same amount of sales to be made in 2022. None of the companies has elected to change its filing period otherwise determined. None of these three companies is associated for income tax or GST/HST purposes. Entity Sugarpine Co. Fernforest Inc. Hickory Ltd. Appendix II: Net GST Owing Prior Year $152,140 $28,400 $48,170 Expected Current Year $154,300 $26,700 $46,340 A B Reporting period 1 Entity 2 Sugarpine Co. 3 Fernforest Inc. Hickory Ltd. 4 Column B drop-down options Weekly Bi-weekly Semi-monthly Monthly Quarterly Semi-annually Annually Column C drop-down options Within 1 month of the end of the reporting period Within 2 months of the end of the reporting period Within 3 months of the end of the reporting period Within 6 months of the end of the reporting period Column D drop-down options Within 1 month of the end of the reporting period Within 2 months of the end of the reporting period Within 3 months of the end of the reporting period Within 6 months of the end of the reporting period C D Filing due date Payment due date Instructions: In Column B, choose the required quarterly instalments from the drop down list In Column C, select the due date for the quarterly instalments. A B Required Quarterly Instalments Due Date for Instalments 1 Entity 2 Fernforest Inc. Column B - Required Quarterly Instalments Q1 - $7,100; Q2 - $7,100; Q3 - $6,250; Q4 - $6,250 Q1 - $7,100; Q2 - $7,100; Q3 - $7,100; Q4 - $7,100 Q1 - $6,675; Q2 - $6,675; Q3 - $6,675; Q4 - $6,675 Column C drop-down options Quarter end date 30 days after quarter end 45 days after quarter end One month after quarter end It is January 3, 2022. Hayley Stewart, the controller for the Fraser Operating Group, is reviewing the GST compliance requirements for the corporations' 2022 calendar year. Each corporation within the Fraser Operating Group has a December 31 year end. The Group had three operating entities in 2021. The following information is attached: Appendix I: 2021 sales data Appendix II: Net GST owing Complete the tasks in the Excel Task file. Appendix I: 2021 sales data 2021 sales data Entity 2021 sales Sugarpine Co. $7,500,000 Fernforest Inc. $1,400,000 Hickory Ltd. $2,375,000 2021 taxable supplies were equivalent to 2021 sales. Each company anticipates the same amount of sales to be made in 2022. None of the companies has elected to change its filing period otherwise determined. None of these three companies is associated for income tax or GST/HST purposes. Entity Sugarpine Co. Fernforest Inc. Hickory Ltd. Appendix II: Net GST Owing Prior Year $152,140 $28,400 $48,170 Expected Current Year $154,300 $26,700 $46,340 A B Reporting period 1 Entity 2 Sugarpine Co. 3 Fernforest Inc. Hickory Ltd. 4 Column B drop-down options Weekly Bi-weekly Semi-monthly Monthly Quarterly Semi-annually Annually Column C drop-down options Within 1 month of the end of the reporting period Within 2 months of the end of the reporting period Within 3 months of the end of the reporting period Within 6 months of the end of the reporting period Column D drop-down options Within 1 month of the end of the reporting period Within 2 months of the end of the reporting period Within 3 months of the end of the reporting period Within 6 months of the end of the reporting period C D Filing due date Payment due date Instructions: In Column B, choose the required quarterly instalments from the drop down list In Column C, select the due date for the quarterly instalments. A B Required Quarterly Instalments Due Date for Instalments 1 Entity 2 Fernforest Inc. Column B - Required Quarterly Instalments Q1 - $7,100; Q2 - $7,100; Q3 - $6,250; Q4 - $6,250 Q1 - $7,100; Q2 - $7,100; Q3 - $7,100; Q4 - $7,100 Q1 - $6,675; Q2 - $6,675; Q3 - $6,675; Q4 - $6,675 Column C drop-down options Quarter end date 30 days after quarter end 45 days after quarter end One month after quarter endStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started