Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the highlights and show workings. Thanks Tops Corporation is organized into two divisions, Manufacturing and Marketing. Both divisions are considered to be profit

Please complete the highlights and show workings. Thanks

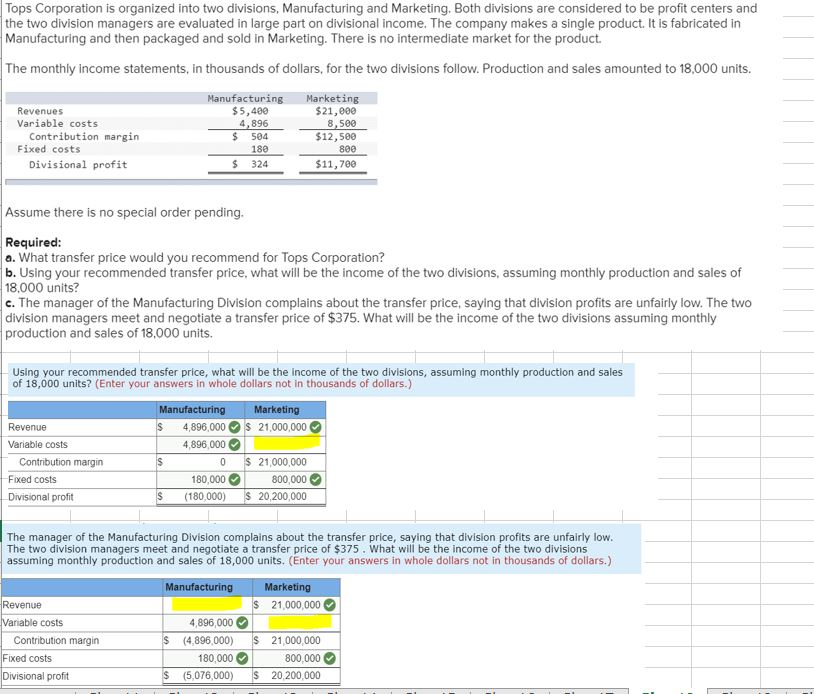

Tops Corporation is organized into two divisions, Manufacturing and Marketing. Both divisions are considered to be profit centers and the two division managers are evaluated in large part on divisional income. The company makes a single product. It is fabricated in Manufacturing and then packaged and sold in Marketing. There is no intermediate market for the product. The monthly income statements, in thousands of dollars, for the two divisions follow. Production and sales amounted to 18,000 units. Revenues Variable costs Contribution margin Fixed costs Divisional profit Manufacturing $5,480 4,896 $ 504 180 $ 324 Marketing $21,000 8,500 $12,500 800 $11,780 Assume there is no special order pending. Required: a. What transfer price would you recommend for Tops Corporation? b. Using your recommended transfer price, what will be the income of the two divisions, assuming monthly production and sales of 18,000 units? c. The manager of the Manufacturing Division complains about the transfer price, saying that division profits are unfairly low. The two division managers meet and negotiate a transfer price of $375. What will be the income of the two divisions assuming monthly production and sales of 18,000 units. Using your recommended transfer price, what will be the income of the two divisions, assuming monthly production and sales of 18,000 units? (Enter your answers in whole dollars not in thousands of dollars.) Marketing $ 21,000,000 Revenue Variable costs Manufacturing $ 4,896,000 4,896,000 0 180,000 $ (180,000) Contribution margin Fixed costs Divisional profit $ 21,000,000 800,000 $ 20,200,000 The manager of the Manufacturing Division complains about the transfer price, saying that division profits are unfairly low. The two division managers meet and negotiate a transfer price of $375. What will be the income of the two divisions assuming monthly production and sales of 18,000 units. (Enter your answers in whole dollars not in thousands of dollars.) Manufacturing Marketing $ 21,000,000 Revenue Variable costs Contribution margin Fixed costs Divisional profit $ 4,896 000 (4,896,000) 180,000 (5,076,000) $ 21,000,000 800,000 $ 20,200,000 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started