Answered step by step

Verified Expert Solution

Question

1 Approved Answer

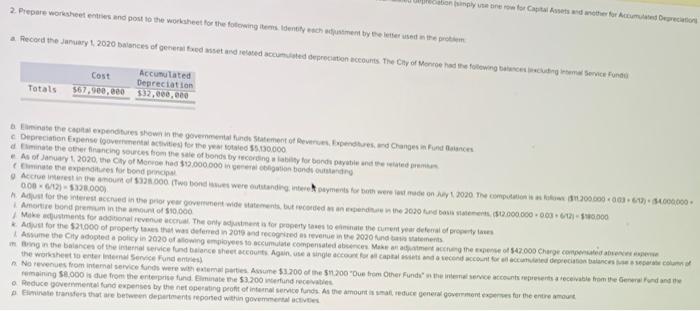

Please complete the journal entries using the information from the financial statements provided 2. Prepare worksheets and post to the worksheet for the following items

Please complete the journal entries using the information from the financial statements provided

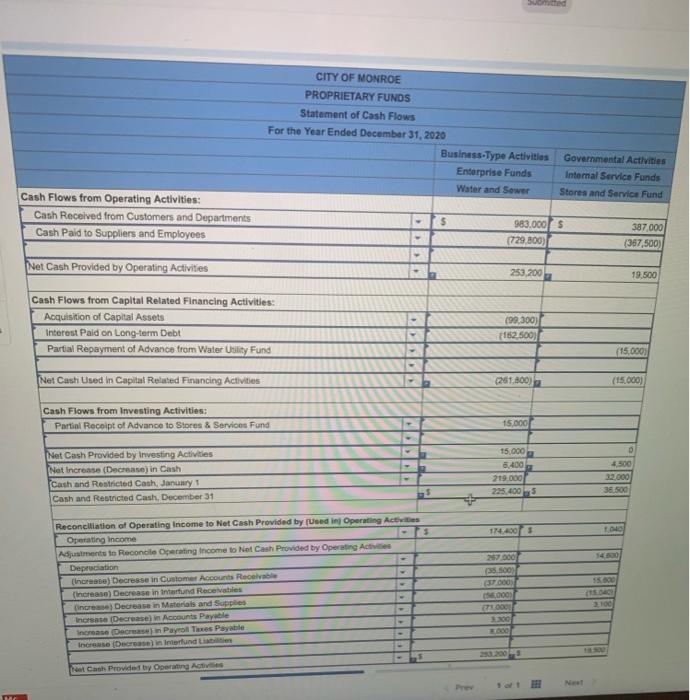

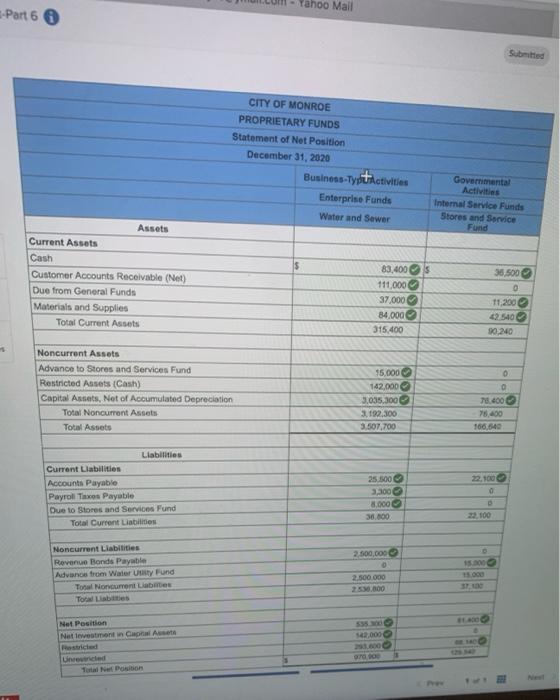

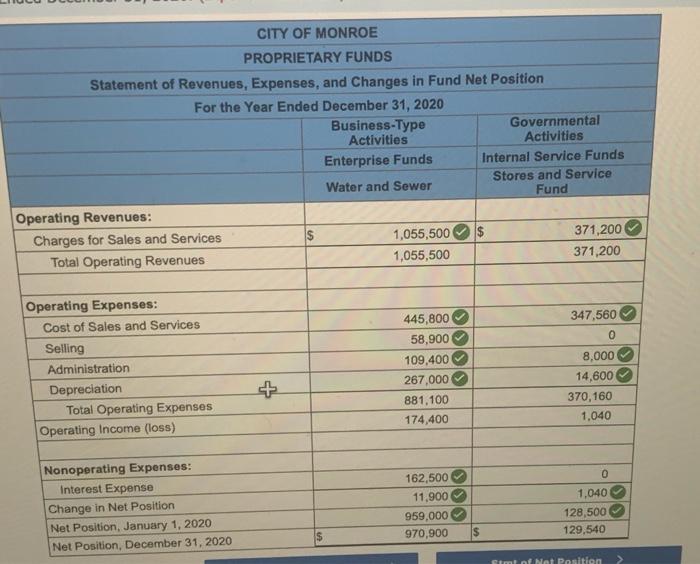

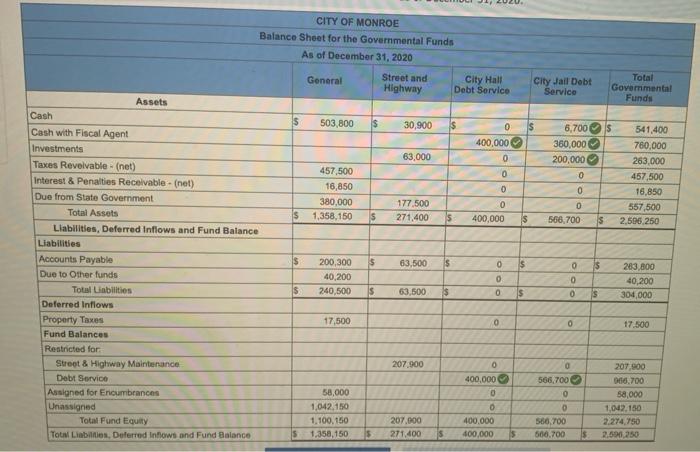

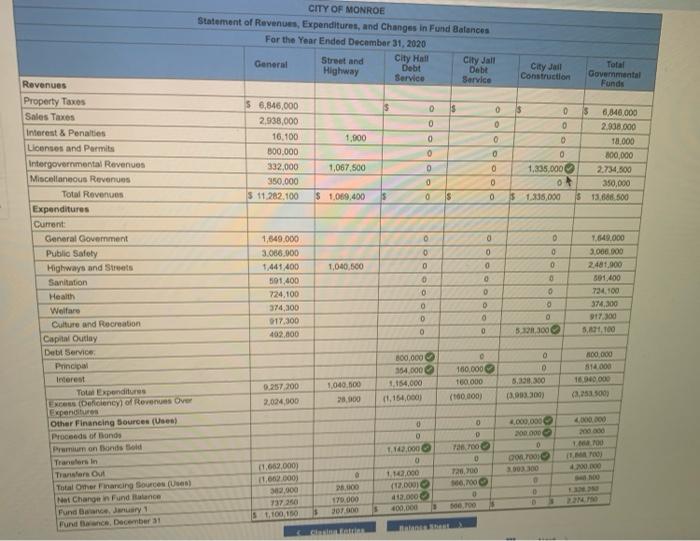

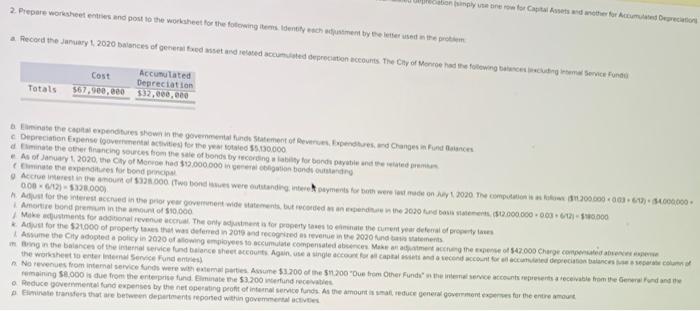

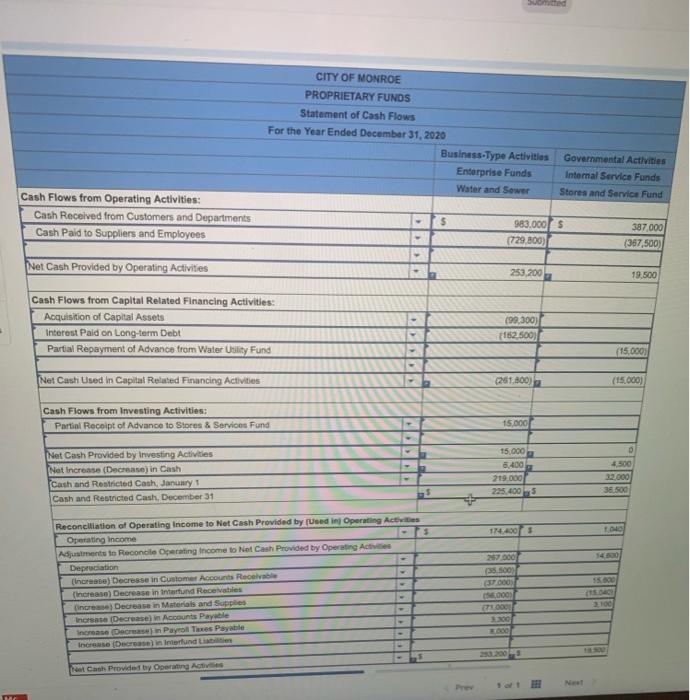

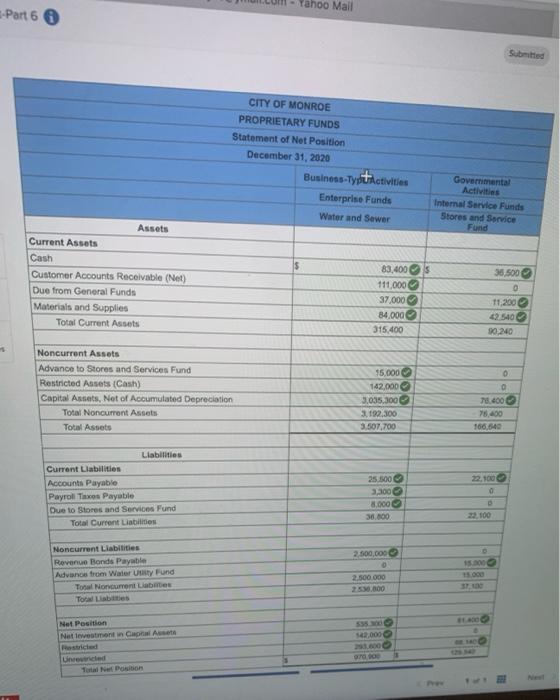

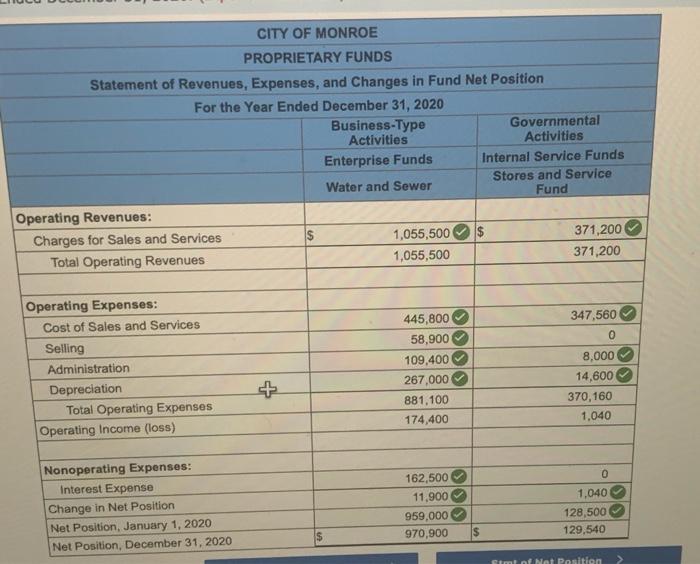

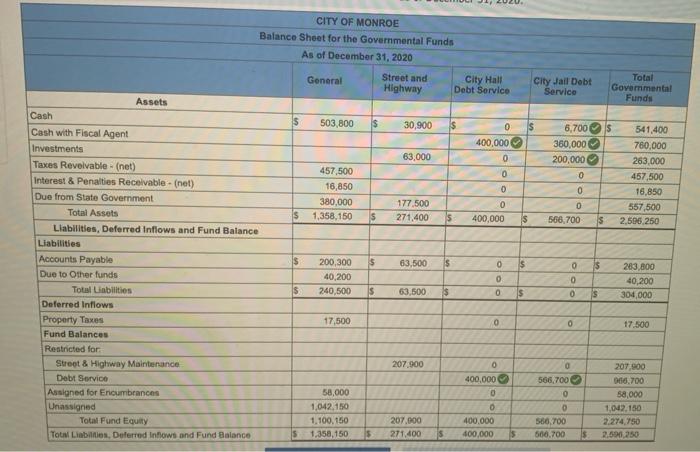

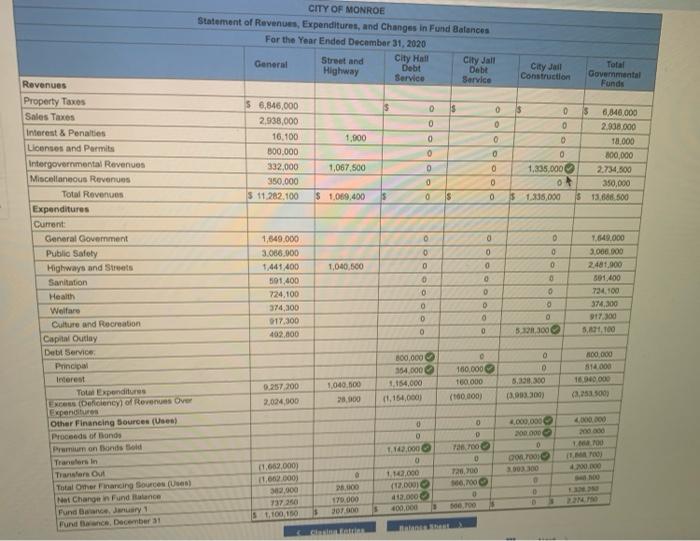

2. Prepare worksheets and post to the worksheet for the following items Identitych djustment by the lettere bonboyer for de formation Record the Sun 1, 2020 balances of generalfoed met ad related accumulated precaution accounts The Ety of the con los retowing we am Sarace Fun Accumulated Cost Depreciation 567.900.000 $32,000,000 Totals te the expenditures shown in the govern Set of Revendanges in Pundances Depreciation Expense over the year. 5.000.000 date the reach out to the sale of bons by recordingly for bordspeler As of January 2020, they of More 9.000.000 tons in the expenditures for bond Accuentres in the amount of 532.000 we bond were comes from were on 2020 The composto 1.200.000.0036054000000 0086-538000) Ajust for the rest of the year we were the 2000 now art. 5.000.000.000.000 Amontre bond premium in the amount of $10.000 Mements for even the only for resterende for Ad for the 21000 of property that was defend in 2015 and recoge 2020 Assume the City adopted a policy in 2020 flowing employees to accumulate compensated became the the expense of $42.000 Charge compte ng in the balances of the service und blance sheet Again, e a single account for capital and second controle de com the worksheetsentrasi Fundatur Norevenues from internet service funds were with me. Assume $3.200 of the 1.200 Our Other Funds in the intense accounts represents receivable from the Generaud and remaining 58.000 de from the enterprise fund. Eminate $1.200 fand receives o Reduce governmental and expenses by the net operating profit of internal funds. As the amount is reduce general governments for the entre amount Eminate transfers that we between departments reported within governmental Smeg CITY OF MONROE PROPRIETARY FUNDS Statement of Cash Flows For the Year Ended December 31, 2020 Business-Type Activities Enterprise Funds Water and Sewer Governmental Activities Internal Service Funds Stores and Service Fund Cash Flows from Operating Activities: Cash Received from Customers and Departments Cash Pald to Suppliers and Employees $ 983.000 $ 729,800) 387.000 (367,500) Net Cash Provided by Operating Activities 253.200 19.500 Cash Flows from Capital Related Financing Activities: Acquisition of Capital Assets Interest Paid on Long-term Debt Partial Repayment of Advance from Water Utility Fund (99,300) 162,500) (15,000 Net Cash Used in Capital Related Financing Activities (261.800) (15.000) Cash Flows from Investing Activities: Partial Receipt of Advance to Stores & Services Fund 15.000 0 500 Net Cash Provided by Investing Activities Net Increase (Decrease) in Cash Cash and Restricted Cash, January 1 Cash and Restricted Cash, December 31 15.000 5.400 219.000 225.4005 32.000 35.500 174.400 S 00 14.000 Reconciliation of Operating Income to Net Cash Provided by Used In Operating Activities Operating income $ Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Acties Depreciation (increase) Decrease in Customer Accounts Receivable increase) Decrease in interfund Receivables inre) Decrease in Materials and Supplies Increasa (Decrease in Accounts Payable Increase Decrease in Payroll Taxes Payable In Decrease in Interlund (35.500 000 06.000 15.000 3100 300 000 Del Cash Provided by Operating Active Net Yahoo Mail - Part 6 Submitted CITY OF MONROE PROPRIETARY FUNDS Statement of Net Position December 31, 2020 Business-typtActivities Enterprise Funds Water and Sewer Government Activities Internal Service Funds Stores and Service Fund Assets Current Assets Cash Customer Accounts Receivable (Net) Due from General Funds Materials and Supplies Total Current Assets 38.500 83.400S 111,000 37.000 84.000 315.400 11,200 42.540 90.240 0 Noncurrent Assets Advance to Stores and Services Fund Restricted Assets (Cash) Capital Assets, Not of Accumulated Depreciation Total Noncurrent Assets Total Assets 95.000 142.000 3.035.300 3.192.300 3.507,700 100 75,600 166.640 22.100 Liabilities Current Liabilities Accounts Payable Payroll Taxos Payable Due to stores and Services Fund Total Current Liabilities 25.500 3.300 8.000 30.00 32.100 2.500.000 15.000 Noncurrent Liabilities Revenue Bonds Payable Advance from Water Unt Fund Total Nourrent Lates To Labs 2.500.000 250.000 Net Position Net investment in Canal A 2,000 SPOR Uncled TN Position CITY OF MONROE PROPRIETARY FUNDS Statement of Revenues, Expenses, and Changes in Fund Net Position For the Year Ended December 31, 2020 Business-Type Governmental Activities Activities Enterprise Funds Internal Service Funds Stores and Service Water and Sewer Fund Operating Revenues: Charges for Sales and Services 1,055,500 371,200 Total Operating Revenues 1,055,500 371,200 347,560 0 Operating Expenses: Cost of Sales and Services Selling Administration Depreciation Total Operating Expenses Operating Income (loss) 445,800 58,900 109,400 267,000 881,100 174,400 + 8,000 14,600 370,160 1,040 0 Nonoperating Expenses: Interest Expense Change in Net Position Net Position, January 1, 2020 Net Position, December 31, 2020 162,500 11,900 959,000 970,900 1,040 128,500 129,540 $ tmt af Not Position CITY OF MONROE Balance Sheet for the Governmental Funds As of December 31, 2020 General Street and City Hall Total City Jail Debt Highway Debt Service Service Governmental Funds Assets Cash $ 503,800 $ 30,900 $ 0 $ 6,700S 541,400 Cash with Fiscal Agent 400,000 360,000 760,000 Investments 63,000 0 200,000 263.000 Taxes Revolvable - (net) 457,500 0 0 457,500 Interest & Penalties Receivable - (net) 16,850 0 0 16,850 Due from State Government 380,000 177.500 0 0 557,500 Total Assets $ 1,358,150 S 271,400 5 400,000 S 566,700 3 2,506,250 Liabilities, Deferred Inflows and Fund Balance Liabilities Accounts Payable $ 200,300 $ 63,500 $ 0 $ 0 $ 263,800 Due to Other funds 40,200 0 0 40,200 Total Liabilities $ 240,500 IS 63,500 $ 0 s 0 $ 304,000 Deferred Inflows Property Taxes 17,500 0 0 17.500 Fund Balances Restricted for Street & Highway Maintenance 207.900 0 207,900 Debt Service 400,000 566,700 086.700 Assigned for Encumbrances 58,000 0 0 68,000 Unassigned 1,042,150 0 0 1,042, 150 Total Fund Equity 1.100.150 207.000 400.000 560,700 2.274.750 Total Liabilities, Deferred Inflows and Fund Balance 1.358,150 is 271.400 400,000 506.700 15 2.590,250 Ooo CITY OF MONROE Statement of Revenues, Expenditures, and Changes in Fund Balances For the Year Ended December 31, 2020 Street and City Hall General City Wall Highway Debt Debt Service Service City Jail Construction Total Governmental Funds $ $ $ 0 0 0 0 0 0 0 1.000 56.845.000 2,938,000 16.100 300.000 -332,000 350.000 $ 11.282.100 0 0 0 1,067,500 $ 6,840,000 2.900.000 18.000 300,000 2.734.500 350,000 $13.888.500 0 0 1,335,000 0 $ 1.335,000 0 SA 0 0 - $ 1.069,400 S s 0 0 0 O 0 0 0 0 1,040,500 0 0 0 1.549.000 3.066.000 1,441,400 501.400 724,100 374,300 17.300 402.000 1.649.000 3.000.000 2481,000 301.400 724.100 37,300 917.300 0 Revenues Property Taxos Sales Taxes Interest & Penalties Lenses and Permits Intergovernmental Revenues Miscellaneous Revenues Total Revenues Expenditures Current General Government Public Safety Highways and Streets Sanitation Health Welfare Culture and Recreation Capital Outiny Debt Service Principal Interest Total Expenditures ENES (Deficiency of Revenues OVE Expenditures Other Financing Sources (Uses) Proceeds of bonds Premium on Bonds told Transfers in Transfer ou Total Omer Financing Sources (U) Ne Change in Fundance Funda January 1 Fundance December 31 0 O D 0 0 0 0 0 5320300 0 800,000 154.000 1.154,000 (1,164,000) 0 10 5.330 300 (3.903.300) 100.000 514.000 16.000.000 25.500 100.000 100.000 (100.000) 0.257 200 2.024.000 1.000.000 28,300 000.000 0 D 0 142.000 TO 4.000.000 200.000 0 DO 3000 72,00 6,70 MO . -O 11,602,000) 11.02.000 30.000 737260 S 100 150 1.142.000 12.00 43.00 400,000 3.8. 2000 179.000 OT 00 D soro 2. Prepare worksheets and post to the worksheet for the following items Identitych djustment by the lettere bonboyer for de formation Record the Sun 1, 2020 balances of generalfoed met ad related accumulated precaution accounts The Ety of the con los retowing we am Sarace Fun Accumulated Cost Depreciation 567.900.000 $32,000,000 Totals te the expenditures shown in the govern Set of Revendanges in Pundances Depreciation Expense over the year. 5.000.000 date the reach out to the sale of bons by recordingly for bordspeler As of January 2020, they of More 9.000.000 tons in the expenditures for bond Accuentres in the amount of 532.000 we bond were comes from were on 2020 The composto 1.200.000.0036054000000 0086-538000) Ajust for the rest of the year we were the 2000 now art. 5.000.000.000.000 Amontre bond premium in the amount of $10.000 Mements for even the only for resterende for Ad for the 21000 of property that was defend in 2015 and recoge 2020 Assume the City adopted a policy in 2020 flowing employees to accumulate compensated became the the expense of $42.000 Charge compte ng in the balances of the service und blance sheet Again, e a single account for capital and second controle de com the worksheetsentrasi Fundatur Norevenues from internet service funds were with me. Assume $3.200 of the 1.200 Our Other Funds in the intense accounts represents receivable from the Generaud and remaining 58.000 de from the enterprise fund. Eminate $1.200 fand receives o Reduce governmental and expenses by the net operating profit of internal funds. As the amount is reduce general governments for the entre amount Eminate transfers that we between departments reported within governmental Smeg CITY OF MONROE PROPRIETARY FUNDS Statement of Cash Flows For the Year Ended December 31, 2020 Business-Type Activities Enterprise Funds Water and Sewer Governmental Activities Internal Service Funds Stores and Service Fund Cash Flows from Operating Activities: Cash Received from Customers and Departments Cash Pald to Suppliers and Employees $ 983.000 $ 729,800) 387.000 (367,500) Net Cash Provided by Operating Activities 253.200 19.500 Cash Flows from Capital Related Financing Activities: Acquisition of Capital Assets Interest Paid on Long-term Debt Partial Repayment of Advance from Water Utility Fund (99,300) 162,500) (15,000 Net Cash Used in Capital Related Financing Activities (261.800) (15.000) Cash Flows from Investing Activities: Partial Receipt of Advance to Stores & Services Fund 15.000 0 500 Net Cash Provided by Investing Activities Net Increase (Decrease) in Cash Cash and Restricted Cash, January 1 Cash and Restricted Cash, December 31 15.000 5.400 219.000 225.4005 32.000 35.500 174.400 S 00 14.000 Reconciliation of Operating Income to Net Cash Provided by Used In Operating Activities Operating income $ Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Acties Depreciation (increase) Decrease in Customer Accounts Receivable increase) Decrease in interfund Receivables inre) Decrease in Materials and Supplies Increasa (Decrease in Accounts Payable Increase Decrease in Payroll Taxes Payable In Decrease in Interlund (35.500 000 06.000 15.000 3100 300 000 Del Cash Provided by Operating Active Net Yahoo Mail - Part 6 Submitted CITY OF MONROE PROPRIETARY FUNDS Statement of Net Position December 31, 2020 Business-typtActivities Enterprise Funds Water and Sewer Government Activities Internal Service Funds Stores and Service Fund Assets Current Assets Cash Customer Accounts Receivable (Net) Due from General Funds Materials and Supplies Total Current Assets 38.500 83.400S 111,000 37.000 84.000 315.400 11,200 42.540 90.240 0 Noncurrent Assets Advance to Stores and Services Fund Restricted Assets (Cash) Capital Assets, Not of Accumulated Depreciation Total Noncurrent Assets Total Assets 95.000 142.000 3.035.300 3.192.300 3.507,700 100 75,600 166.640 22.100 Liabilities Current Liabilities Accounts Payable Payroll Taxos Payable Due to stores and Services Fund Total Current Liabilities 25.500 3.300 8.000 30.00 32.100 2.500.000 15.000 Noncurrent Liabilities Revenue Bonds Payable Advance from Water Unt Fund Total Nourrent Lates To Labs 2.500.000 250.000 Net Position Net investment in Canal A 2,000 SPOR Uncled TN Position CITY OF MONROE PROPRIETARY FUNDS Statement of Revenues, Expenses, and Changes in Fund Net Position For the Year Ended December 31, 2020 Business-Type Governmental Activities Activities Enterprise Funds Internal Service Funds Stores and Service Water and Sewer Fund Operating Revenues: Charges for Sales and Services 1,055,500 371,200 Total Operating Revenues 1,055,500 371,200 347,560 0 Operating Expenses: Cost of Sales and Services Selling Administration Depreciation Total Operating Expenses Operating Income (loss) 445,800 58,900 109,400 267,000 881,100 174,400 + 8,000 14,600 370,160 1,040 0 Nonoperating Expenses: Interest Expense Change in Net Position Net Position, January 1, 2020 Net Position, December 31, 2020 162,500 11,900 959,000 970,900 1,040 128,500 129,540 $ tmt af Not Position CITY OF MONROE Balance Sheet for the Governmental Funds As of December 31, 2020 General Street and City Hall Total City Jail Debt Highway Debt Service Service Governmental Funds Assets Cash $ 503,800 $ 30,900 $ 0 $ 6,700S 541,400 Cash with Fiscal Agent 400,000 360,000 760,000 Investments 63,000 0 200,000 263.000 Taxes Revolvable - (net) 457,500 0 0 457,500 Interest & Penalties Receivable - (net) 16,850 0 0 16,850 Due from State Government 380,000 177.500 0 0 557,500 Total Assets $ 1,358,150 S 271,400 5 400,000 S 566,700 3 2,506,250 Liabilities, Deferred Inflows and Fund Balance Liabilities Accounts Payable $ 200,300 $ 63,500 $ 0 $ 0 $ 263,800 Due to Other funds 40,200 0 0 40,200 Total Liabilities $ 240,500 IS 63,500 $ 0 s 0 $ 304,000 Deferred Inflows Property Taxes 17,500 0 0 17.500 Fund Balances Restricted for Street & Highway Maintenance 207.900 0 207,900 Debt Service 400,000 566,700 086.700 Assigned for Encumbrances 58,000 0 0 68,000 Unassigned 1,042,150 0 0 1,042, 150 Total Fund Equity 1.100.150 207.000 400.000 560,700 2.274.750 Total Liabilities, Deferred Inflows and Fund Balance 1.358,150 is 271.400 400,000 506.700 15 2.590,250 Ooo CITY OF MONROE Statement of Revenues, Expenditures, and Changes in Fund Balances For the Year Ended December 31, 2020 Street and City Hall General City Wall Highway Debt Debt Service Service City Jail Construction Total Governmental Funds $ $ $ 0 0 0 0 0 0 0 1.000 56.845.000 2,938,000 16.100 300.000 -332,000 350.000 $ 11.282.100 0 0 0 1,067,500 $ 6,840,000 2.900.000 18.000 300,000 2.734.500 350,000 $13.888.500 0 0 1,335,000 0 $ 1.335,000 0 SA 0 0 - $ 1.069,400 S s 0 0 0 O 0 0 0 0 1,040,500 0 0 0 1.549.000 3.066.000 1,441,400 501.400 724,100 374,300 17.300 402.000 1.649.000 3.000.000 2481,000 301.400 724.100 37,300 917.300 0 Revenues Property Taxos Sales Taxes Interest & Penalties Lenses and Permits Intergovernmental Revenues Miscellaneous Revenues Total Revenues Expenditures Current General Government Public Safety Highways and Streets Sanitation Health Welfare Culture and Recreation Capital Outiny Debt Service Principal Interest Total Expenditures ENES (Deficiency of Revenues OVE Expenditures Other Financing Sources (Uses) Proceeds of bonds Premium on Bonds told Transfers in Transfer ou Total Omer Financing Sources (U) Ne Change in Fundance Funda January 1 Fundance December 31 0 O D 0 0 0 0 0 5320300 0 800,000 154.000 1.154,000 (1,164,000) 0 10 5.330 300 (3.903.300) 100.000 514.000 16.000.000 25.500 100.000 100.000 (100.000) 0.257 200 2.024.000 1.000.000 28,300 000.000 0 D 0 142.000 TO 4.000.000 200.000 0 DO 3000 72,00 6,70 MO . -O 11,602,000) 11.02.000 30.000 737260 S 100 150 1.142.000 12.00 43.00 400,000 3.8. 2000 179.000 OT 00 D soro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started