Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the parts with all steps needed. These are practice questions and I need help solving it. 1. Consider an economy with two risky

Please complete the parts with all steps needed. These are practice questions and I need help solving it.

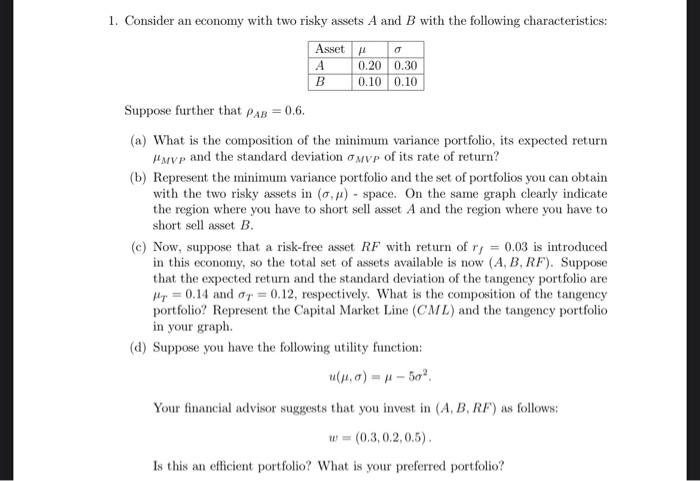

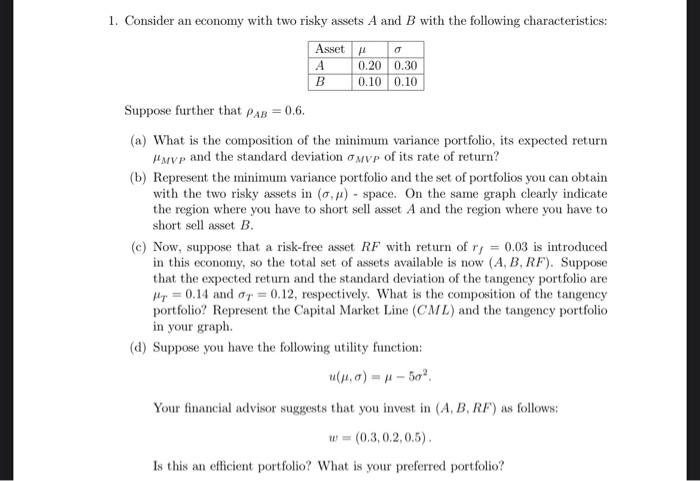

1. Consider an economy with two risky assets A and B with the following characteristics: Suppose further that AB=0.6. (a) What is the composition of the minimum variance portfolio, its expected return MVP and the standard deviation MVP of its rate of return? (b) Represent the minimum variance portfolio and the set of portfolios you can obtain with the two risky assets in (,) - space. On the same graph clearly indicate the region where you have to short sell asset A and the region where you have to short sell asset B. (c) Now, suppose that a risk-free asset RF with return of rf=0.03 is introduced in this economy, so the total set of assets available is now (A,B,RF). Suppose that the expected return and the standard deviation of the tangency portfolio are T=0.14 and T=0.12, respectively. What is the composition of the tangency portfolio? Represent the Capital Market Line (CML) and the tangency portfolio in your graph. (d) Suppose you have the following utility function: u(,)=52. Your financial advisor suggests that you invest in (A,B,RF) as follows: w=(0.3,0.2,0.5). Is this an efficient portfolio? What is your preferred portfolio? 1. Consider an economy with two risky assets A and B with the following characteristics: Suppose further that AB=0.6. (a) What is the composition of the minimum variance portfolio, its expected return MVP and the standard deviation MVP of its rate of return? (b) Represent the minimum variance portfolio and the set of portfolios you can obtain with the two risky assets in (,) - space. On the same graph clearly indicate the region where you have to short sell asset A and the region where you have to short sell asset B. (c) Now, suppose that a risk-free asset RF with return of rf=0.03 is introduced in this economy, so the total set of assets available is now (A,B,RF). Suppose that the expected return and the standard deviation of the tangency portfolio are T=0.14 and T=0.12, respectively. What is the composition of the tangency portfolio? Represent the Capital Market Line (CML) and the tangency portfolio in your graph. (d) Suppose you have the following utility function: u(,)=52. Your financial advisor suggests that you invest in (A,B,RF) as follows: w=(0.3,0.2,0.5). Is this an efficient portfolio? What is your preferred portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started