Answered step by step

Verified Expert Solution

Question

1 Approved Answer

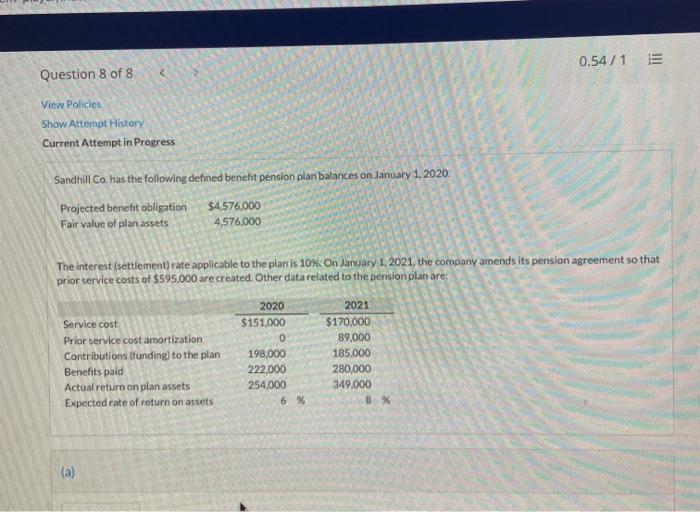

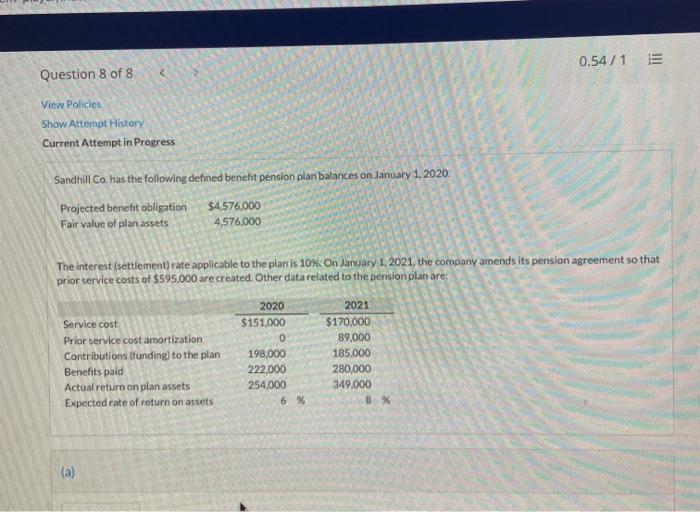

please complete the pension sheet for 2021 with correct entries and amounts. 0.54/15 Question 8 of 8 View Policies Show Attempt History Current Attempt in

please complete the pension sheet for 2021 with correct entries and amounts.

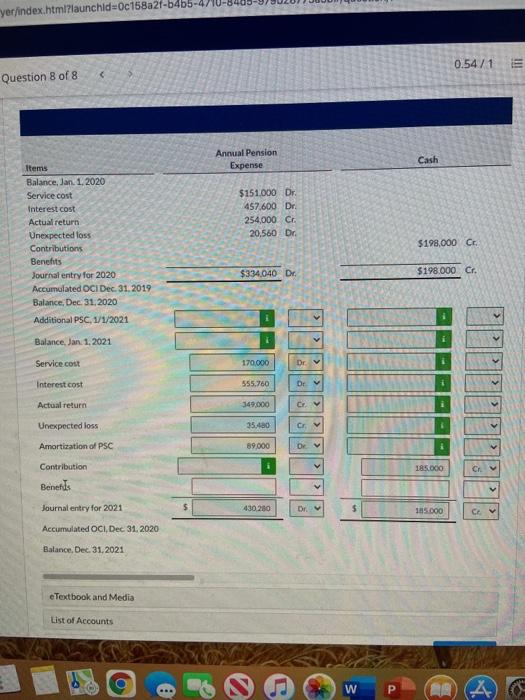

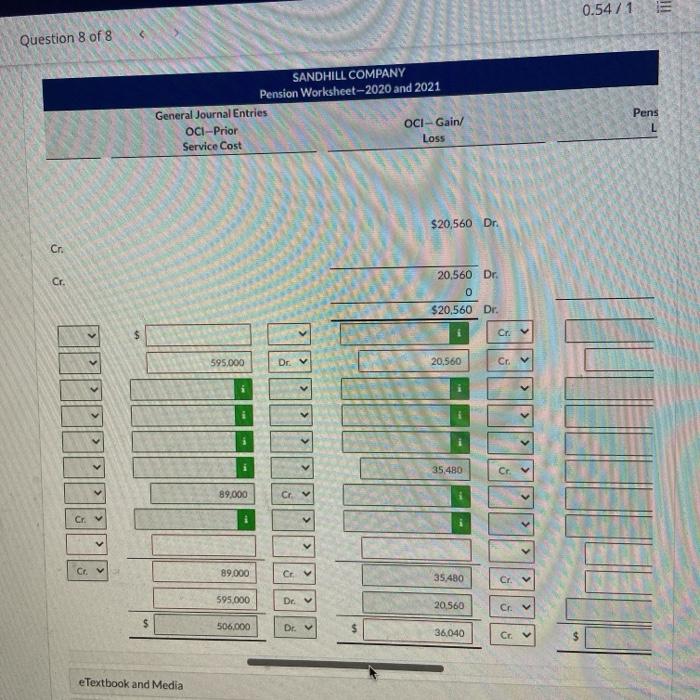

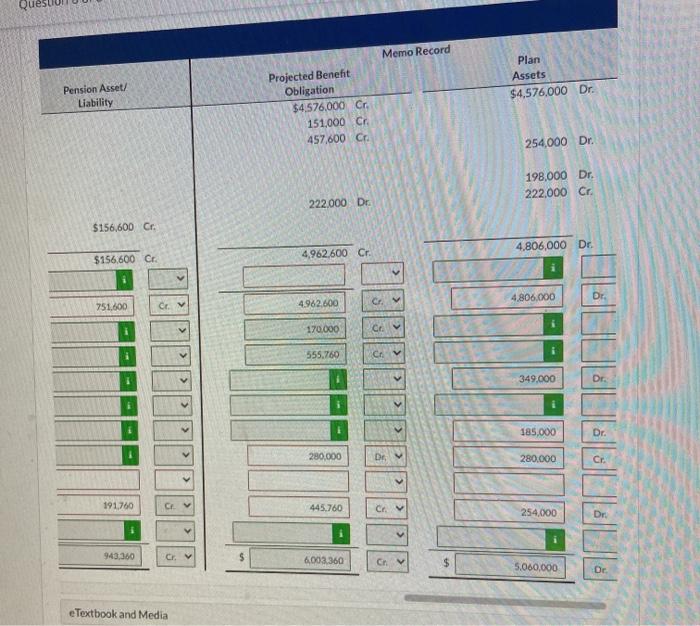

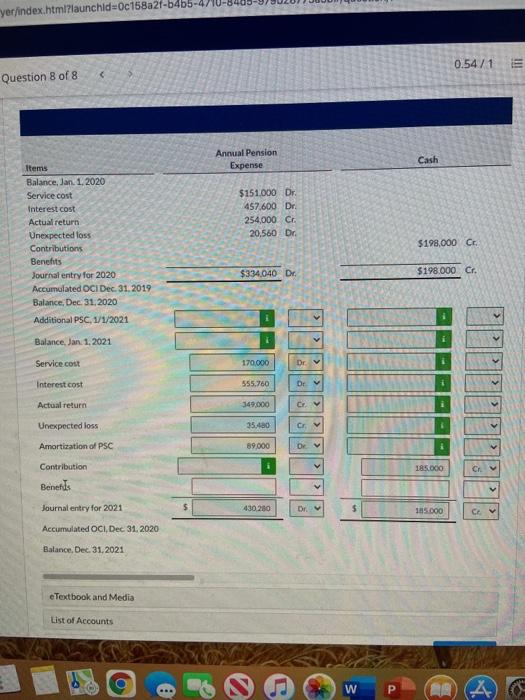

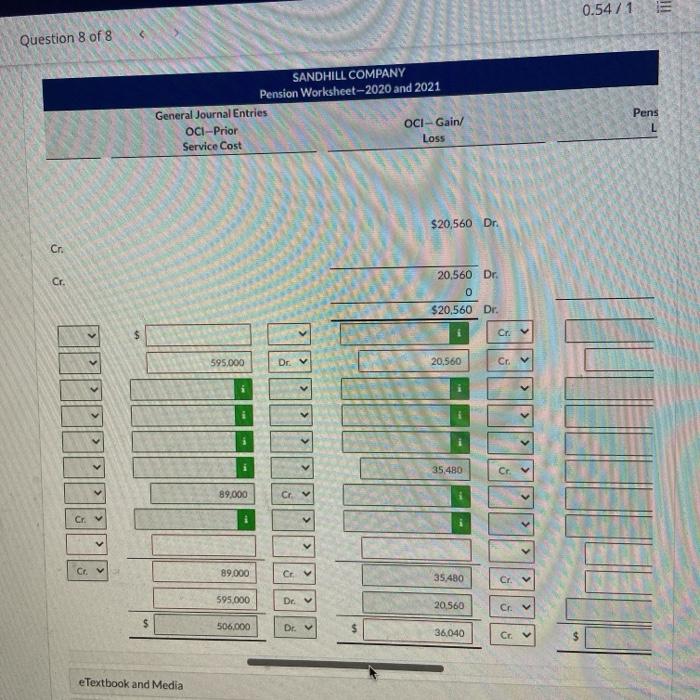

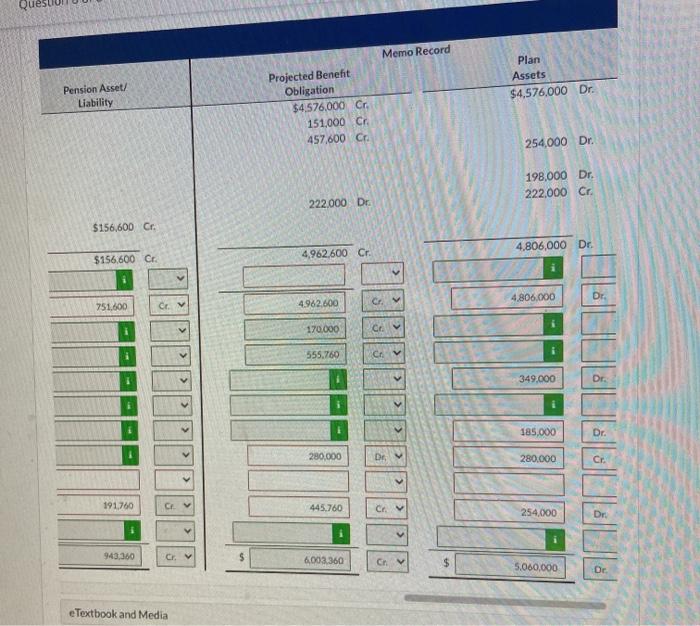

0.54/15 Question 8 of 8 View Policies Show Attempt History Current Attempt in Progress Sandhill Co has the following defined benefit pension plan balances on January 1, 2020. Projected benefit obligation $4,576,000 Fair value of plan assets 4,576,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $595.000 are created, Other data related to the pension plan are: Service cost Prior service cost amortization Contributions tfunding to the plan Benefits pald Actual return on plan assets Expected rate of return on assets 2020 $151,000 0 198,000 222.000 254.000 6 % 2021 $170,000 89,000 185.000 280,000 349.000 BX (a) yer/index.html?launchid=0c158a27-b4b5- 0.54 / 1 Question 8 of 8 Annual Pension Expense Cash Items Balance, Jan. 1.2020 Service cost Interest cost Actual return Unexpected loss Contributions Benefits Journal entry for 2020 Accumulated DCI Dec. 31. 2019 Balance, Dec 31, 2020 $151.000 Dr. 457,600 Dr. 254,000 C 20,560 Dr. $198.000 CC $334,040 Dr. $198.000 Cr. Additional PSC, 1/1/2021 Balance, Jan 1, 2021 T Service cost 170.000 Dr Interest.cost 555.760 Dr Actual return 349.000 Cr. Unexpected loss 35.480 Cr. Amortization of PSC 89.000 De Contribution 185.000 Cr Benelds Journal entry for 2021 5 430 200 Dr. 185.000 CE Accumulated OCI, Dec 31, 2020 Balance, Dec. 31.2021 e Textbook and Media List of Accounts ... W P 0.5471 Question 8 of 8 SANDHILL COMPANY Pension Worksheet --2020 and 2021 General Journal Entries OCI-Prior OCI - Gain/ Service Cost Loss Pens L $20,560 Dr. Cr Cr. 20,560 Dr. 0 $20,560 Dr. $ Cr. 595.000 Dr. 20.560 Cr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started