Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the problem in its entirety as shown in the picture. Calculations too please, thank you! Problem 1- Income Taxes The following information is

Please complete the problem in its entirety as shown in the picture. Calculations too please, thank you!

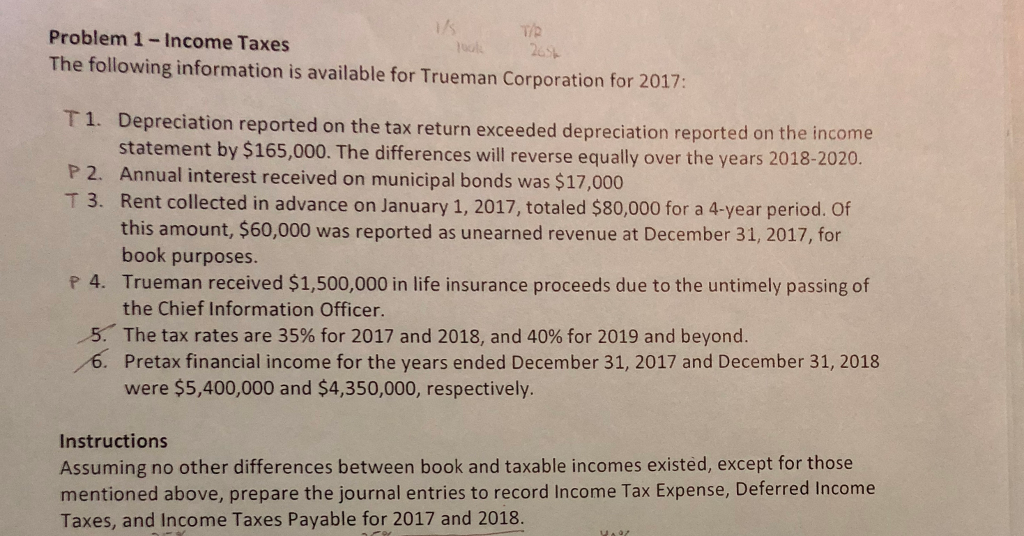

Problem 1- Income Taxes The following information is available for Trueman Corporation for 2017: 26 T1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $165,000. The differences will reverse equally over the years 2018-2020. Annual interest received on municipal bonds was $17,000 Rent collected in advance on January 1, 2017, totaled $80,000 for a 4-year period. of this amount, $60,000 was reported as unearned revenue at December 31, 2017, for book purposes. Trueman received $1,500,000 in life insurance proceeds due to the untimely passing of the Chief Information Officer P2. T3. P 4. /5, . The tax rates are 35% for 2017 and 2018, and 40% for 2019 and beyond 6. Pretax financial income for the years ended December 31, 2017 and December 31, 2018 were $5,400,000 and $4,350,000, respectively Instructions Assuming no other differences between book and taxable incomes existed, except for those mentioned above, prepare the journal entries to record Income Tax Expense, Deferred Income Taxes, and Income Taxes Payable for 2017 and 2018. Problem 1- Income Taxes The following information is available for Trueman Corporation for 2017: 26 T1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $165,000. The differences will reverse equally over the years 2018-2020. Annual interest received on municipal bonds was $17,000 Rent collected in advance on January 1, 2017, totaled $80,000 for a 4-year period. of this amount, $60,000 was reported as unearned revenue at December 31, 2017, for book purposes. Trueman received $1,500,000 in life insurance proceeds due to the untimely passing of the Chief Information Officer P2. T3. P 4. /5, . The tax rates are 35% for 2017 and 2018, and 40% for 2019 and beyond 6. Pretax financial income for the years ended December 31, 2017 and December 31, 2018 were $5,400,000 and $4,350,000, respectively Instructions Assuming no other differences between book and taxable incomes existed, except for those mentioned above, prepare the journal entries to record Income Tax Expense, Deferred Income Taxes, and Income Taxes Payable for 2017 and 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started