Answered step by step

Verified Expert Solution

Question

1 Approved Answer

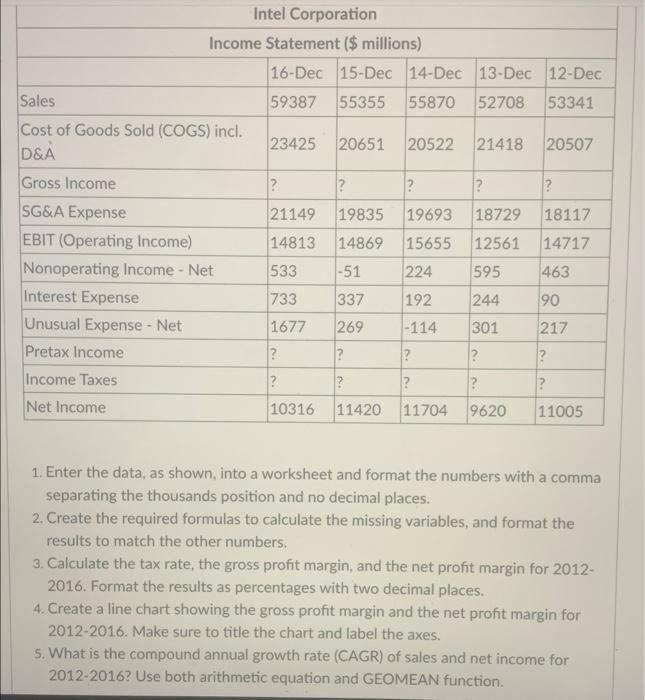

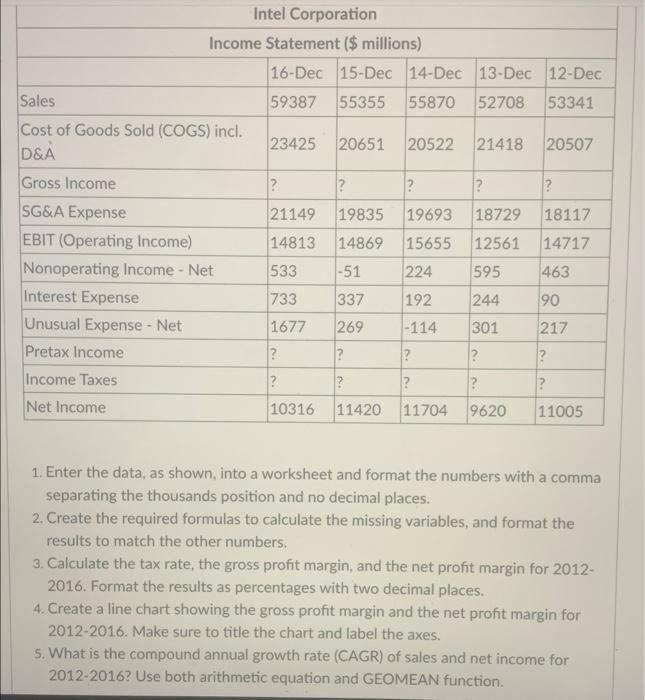

please complete the questions Intel Corporation Income Statement ($ millions) 16-Dec 15-Dec 14-Dec 13-Dec 12-Dec 59387 55355 55870 52708 53341 Sales Cost of Goods Sold

please complete the questions

Intel Corporation Income Statement ($ millions) 16-Dec 15-Dec 14-Dec 13-Dec 12-Dec 59387 55355 55870 52708 53341 Sales Cost of Goods Sold (COGS) incl. 23425 20651 20522 21418 20507 D&A Gross Income ? ? ? ? ? SG&A Expense 21149 19835 19693 18729 18117 EBIT (Operating Income) 14813 14869 15655 12561 14717 Nonoperating Income - Net 533 -51 224 595 463 Interest Expense 733 337 192 244 90 Unusual Expense - Net 1677 269 -114 301 217 Pretax Income ? ? ? ? ? Income Taxes ? ? ? ? ? Net Income 10316 11420 11704 9620 11005 1. Enter the data, as shown, into a worksheet and format the numbers with a comma separating the thousands position and no decimal places. 2. Create the required formulas to calculate the missing variables, and format the results to match the other numbers. 3. Calculate the tax rate, the gross profit margin, and the net profit margin for 2012- 2016. Format the results as percentages with two decimal places. 4. Create a line chart showing the gross profit margin and the net profit margin for 2012-2016. Make sure to title the chart and label the axes. 5. What is the compound annual growth rate (CAGR) of sales and net income for 2012-2016? Use both arithmetic equation and GEOMEAN function

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started