Answered step by step

Verified Expert Solution

Question

1 Approved Answer

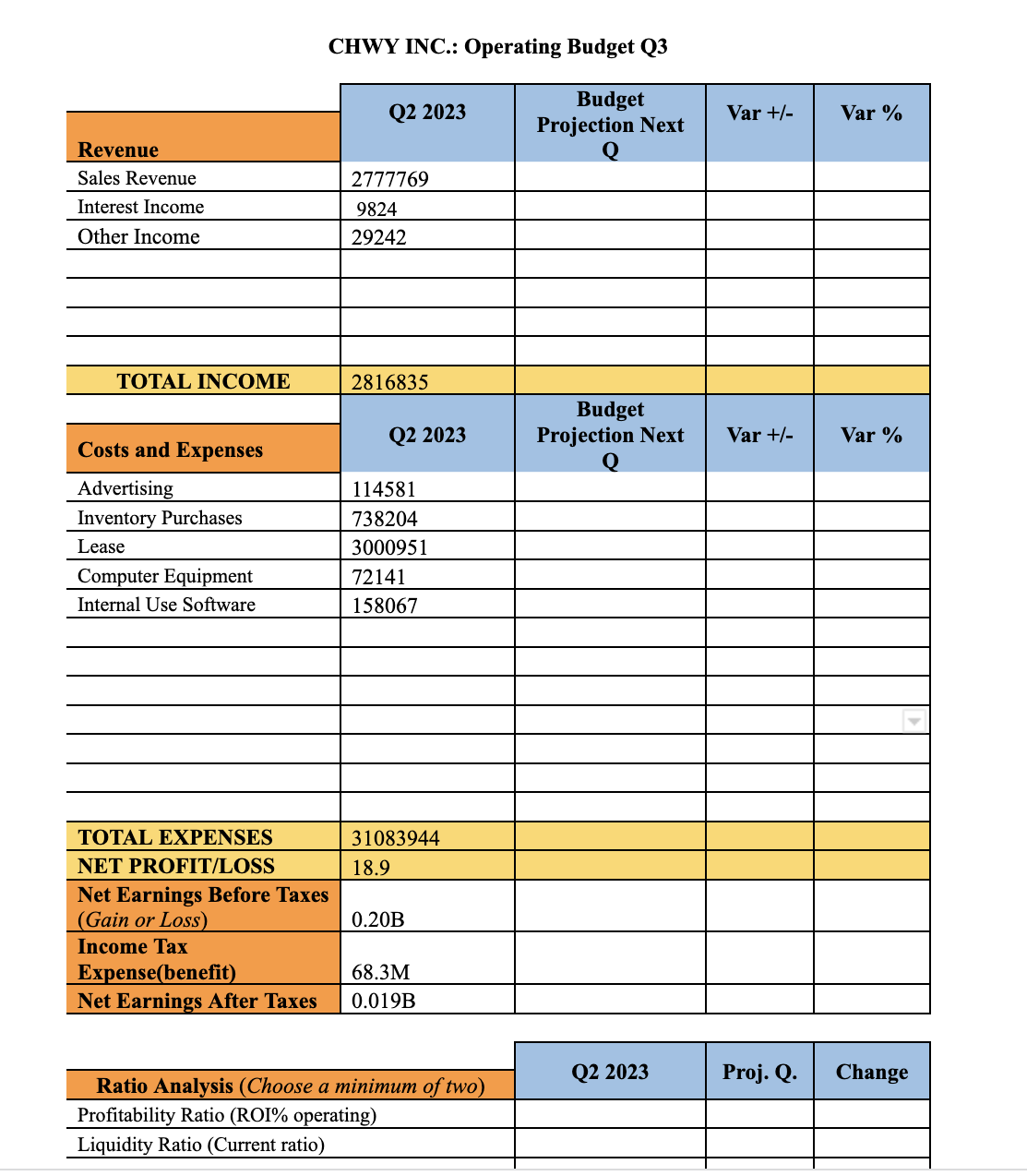

Please complete the rest of the operating budget analysis for CHEWY INC (CHWY via New York Stock Exchange) using your own scholarly source. I included

- Please complete the rest of the operating budget analysis for CHEWY INC (CHWY via New York Stock Exchange) using your own scholarly source. I included the excel link to the financial statements from Mergent online but you can use whatever scholarly source.

- I have incorporated the Word document via Google Drive for the budget analysis worksheet. Please let me know if the link isn't accessible.

https://docs.google.com/document/d/1VLuvcUgVyXzs6vFMMQp3Br0l15Vg15eB/edit?usp=sharing&ouid=102437129488862910608&rtpof=true&sd=true

https://docs.google.com/spreadsheets/d/1zKUdhcC-foEzGFcfYFF2oyudvBHCLc7J/edit?usp=sharing&ouid=102437129488862910608&rtpof=true&sd=true

Revenue Sales Revenue Interest Income Other Income TOTAL INCOME Costs and Expenses Advertising Inventory Purchases Lease Computer Equipment Internal Use Software TOTAL EXPENSES NET PROFIT/LOSS Net Earnings Before Taxes (Gain or Loss) Income Tax Expense(benefit) Net Earnings After Taxes CHWY INC.: Operating Budget Q3 Budget Projection Next Q2 2023 2777769 9824 29242 2816835 Q2 2023 114581 738204 3000951 72141 158067 31083944 18.9 0.20B 68.3M 0.019B Ratio Analysis (Choose a minimum of two) Profitability Ratio (ROI% operating) Liquidity Ratio (Current ratio) Budget Projection Next Q2 2023 Var +/- Var +/- Proj. Q. Var % Var % Change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started