please complete the schedule of cost of goods manufactured and income statment for the attached journal entries.

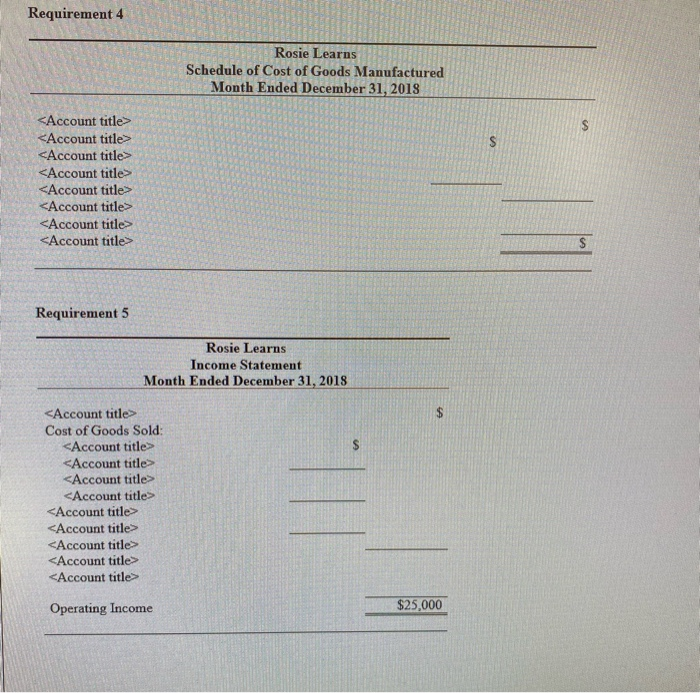

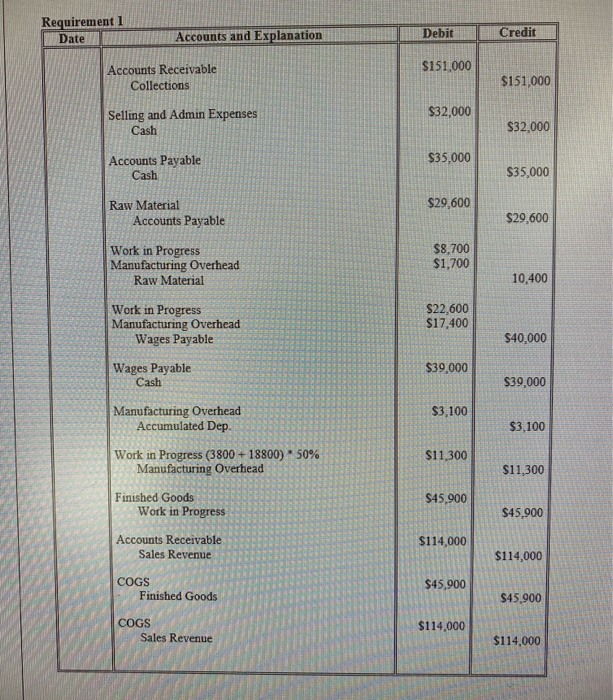

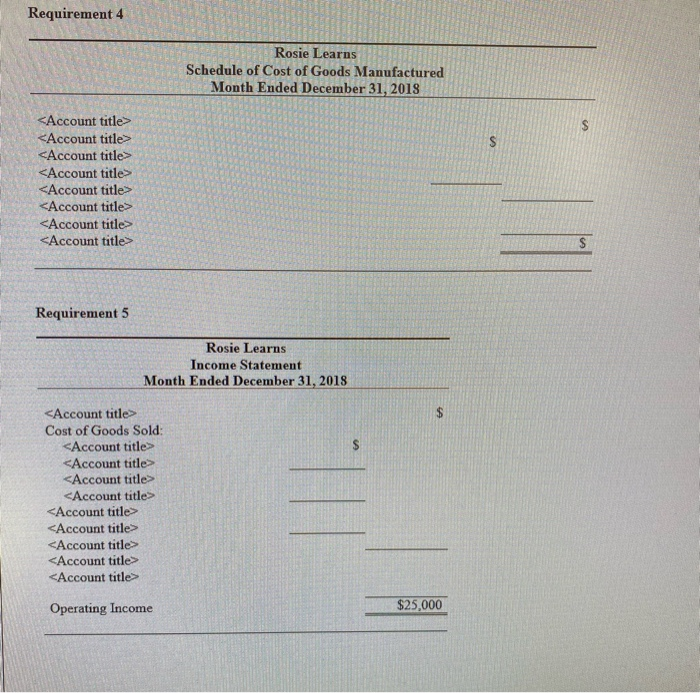

Requirement1 Date Accounts and Explanation Debit Credit $151,000 Accounts Receivable Collections $151,000 $32,000 Selling and Admin Expenses Cash $32,000 $35,000 Accounts Payable Cash $35,000 $29,600 Raw Material Accounts Payable $29,600 Work in Progress Manufacturing Overhead Raw Material $8,700 $1,700 10,400 Work in Progress Manufacturing Overhead Wages Payable $22,600 $17,400 $40,000 Wages Payable Cash $39,000 $39,000 $3,100 Manufacturing Overhead Accumulated Dep $3,100 Work in Progress (3800 + 18800) * 50% Manufacturing Overhead $11,300 $11,300 $45,900 $45,900 Finished Goods Work in Progress Accounts Receivable Sales Revenue $114,000 $114,000 COGS Finished Goods $45,900 $45,900 COGS Sales Revenue $114,000 $114,000 Requirement 4 Rosie Learns Schedule of Cost of Goods Manufactured Month Ended December 31, 2018 s

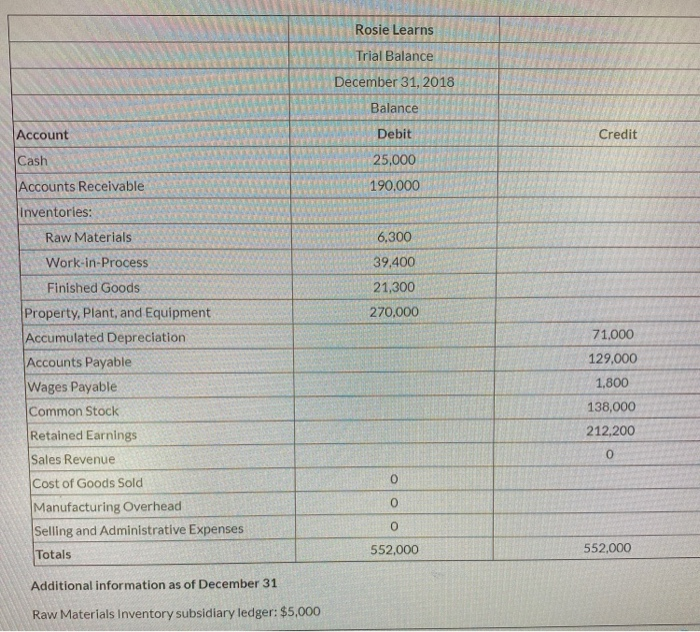

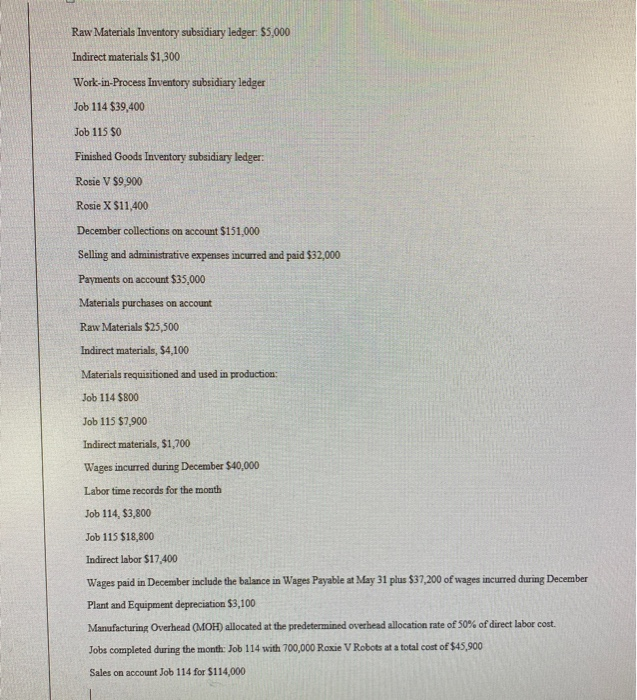

Requirement 5 Rosie Learns Income Statement Month Ended December 31, 2018 Cost of Goods Sold: Operating Income $25,000 Rosie Learns Trial Balance December 31, 2018 Balance Account Debit Credit Cash 25,000 Accounts Receivable 190,000 6,300 39.400 21,300 270.000 Inventories: Raw Materials Work-in-Process Finished Goods Property, plant, and Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Manufacturing Overhead Selling and Administrative Expenses 71.000 129,000 1,800 138,000 212,200 0 0 0 0 Totals 552,000 552,000 Additional information as of December 31 Raw Materials Inventory subsidiary ledger: $5,000 Raw Materials Inventory subsidiary ledger: $5,000 Indirect materials $1,300 Work-in-Process Inventory subsidiary ledger Job 114 $39,400 Job 115 SO Finished Goods Inventory subsidiary ledger: Rosie V $9.900 Rosie X $11,400 December collections on account $151,000 Selling and administrative expenses incurred and paid $32,000 Payments on account $35,000 Materials purchases on account Raw Materials $25,500 Indirect materials, $4,100 Materials requisitioned and used in production: Job 114 $800 Job 115 $7,900 Indirect materials, $1,700 Wages incurred during December $40,000 Labor time records for the month Job 114, $3,800 Job 115 $18,800 Indirect labor $17.400 Wages paid in December include the balance in Wages Payable at May 31 plus $37,200 of wages incurred during December Plant and Equipment depreciation $3,100 Manufacturing Overhead (MOH) allocated at the predetermined overhead allocation rate of 50% of direct labor cost. Jobs completed during the month Job 114 with 700,000 Roxie V Robots at a total cost of $45,900 Sales on account Job 114 for $114,000 Requirement1 Date Accounts and Explanation Debit Credit $151,000 Accounts Receivable Collections $151,000 $32,000 Selling and Admin Expenses Cash $32,000 $35,000 Accounts Payable Cash $35,000 $29,600 Raw Material Accounts Payable $29,600 Work in Progress Manufacturing Overhead Raw Material $8,700 $1,700 10,400 Work in Progress Manufacturing Overhead Wages Payable $22,600 $17,400 $40,000 Wages Payable Cash $39,000 $39,000 $3,100 Manufacturing Overhead Accumulated Dep $3,100 Work in Progress (3800 + 18800) * 50% Manufacturing Overhead $11,300 $11,300 $45,900 $45,900 Finished Goods Work in Progress Accounts Receivable Sales Revenue $114,000 $114,000 COGS Finished Goods $45,900 $45,900 COGS Sales Revenue $114,000 $114,000 Requirement 4 Rosie Learns Schedule of Cost of Goods Manufactured Month Ended December 31, 2018 s Requirement 5 Rosie Learns Income Statement Month Ended December 31, 2018 Cost of Goods Sold: Operating Income $25,000 Rosie Learns Trial Balance December 31, 2018 Balance Account Debit Credit Cash 25,000 Accounts Receivable 190,000 6,300 39.400 21,300 270.000 Inventories: Raw Materials Work-in-Process Finished Goods Property, plant, and Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Manufacturing Overhead Selling and Administrative Expenses 71.000 129,000 1,800 138,000 212,200 0 0 0 0 Totals 552,000 552,000 Additional information as of December 31 Raw Materials Inventory subsidiary ledger: $5,000 Raw Materials Inventory subsidiary ledger: $5,000 Indirect materials $1,300 Work-in-Process Inventory subsidiary ledger Job 114 $39,400 Job 115 SO Finished Goods Inventory subsidiary ledger: Rosie V $9.900 Rosie X $11,400 December collections on account $151,000 Selling and administrative expenses incurred and paid $32,000 Payments on account $35,000 Materials purchases on account Raw Materials $25,500 Indirect materials, $4,100 Materials requisitioned and used in production: Job 114 $800 Job 115 $7,900 Indirect materials, $1,700 Wages incurred during December $40,000 Labor time records for the month Job 114, $3,800 Job 115 $18,800 Indirect labor $17.400 Wages paid in December include the balance in Wages Payable at May 31 plus $37,200 of wages incurred during December Plant and Equipment depreciation $3,100 Manufacturing Overhead (MOH) allocated at the predetermined overhead allocation rate of 50% of direct labor cost. Jobs completed during the month Job 114 with 700,000 Roxie V Robots at a total cost of $45,900 Sales on account Job 114 for $114,000

please complete the schedule of cost of goods manufactured and income statment for the attached journal entries.

please complete the schedule of cost of goods manufactured and income statment for the attached journal entries.