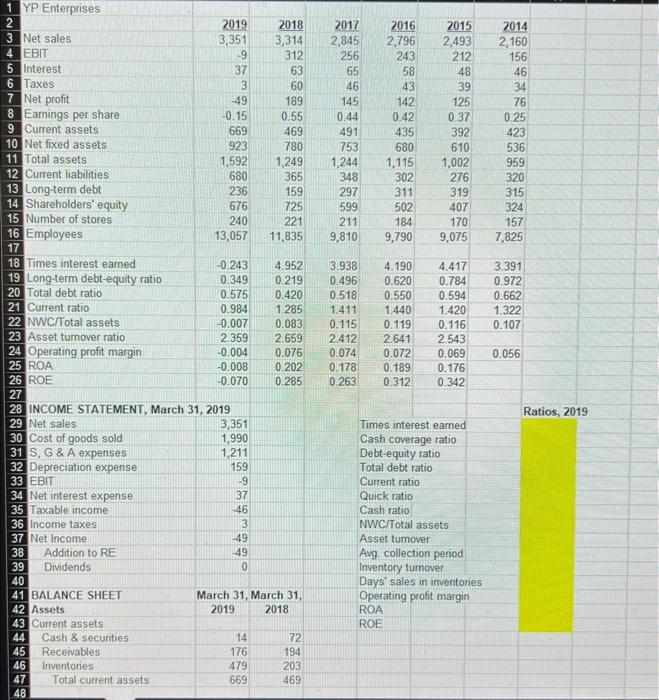

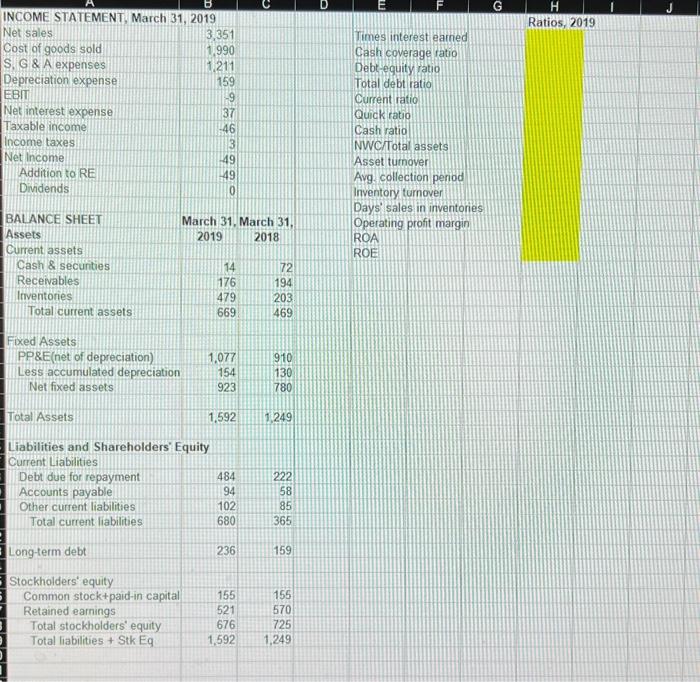

Please complete the section titled (Ratios 2019), which is highlighted using the information provided below.

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline 1 & YP Enterprises & & & & & & & & \\ \hline 2 & & 2019 & 2018 & 2017 & 2016 & 2015 & 2014 & & \\ \hline 3 & Net sales & 3,351 & 3,314 & 2,845 & 2,796 & 2.493 & 2,160 & & \\ \hline 4 & EBIT & -9 & 312 & 256 & 243 & 212 & 156 & & \\ \hline 5 & Interest & 37 & 63 & 65 & 58 & 48 & 46 & & \\ \hline 6 & Taxes & 3 & 60 & 46 & 43 & 39 & 34 & & \\ \hline 7 N & Net profit & -49 & 189 & 145 & 142 & 125 & 76 & & \\ \hline 8 & Earnings per share & -0.15 & 0.55 & 0.44 & 0.42 & 0.37 & 0.25 & & \\ \hline 9 & Current assets & 669 & 469 & 491 & 435 & 392 & 423 & & \\ \hline 10l & Net fixed assets & 923 & 780 & 753 & 680 & 610 & 536 & & \\ \hline 11 & Total assets & 1,592 & 1,249 & 1,244 & 1,115 & 1,002 & 959 & & \\ \hline 12 & Current liabilities & 680 & 365 & 348 & 302 & 276 & 320 & & \\ \hline 13 & Long-term debt & 236 & 159 & 297 & 311 & 319 & 315 & & \\ \hline 14 & Shareholders' equity & 676 & 725 & 599 & 502 & 407 & 324 & & \\ \hline 15 & Number of stores & 240 & 221 & 211 & 184 & 170 & 157 & & \\ \hline 16 & Employees & 13,057 & 11,835 & 9,810 & 9,790 & 9,075 & 7,825 & & \\ \hline 17 & & & & & & & & & \\ \hline 18. & Times interest earned & -0.243 & 4.952 & 3.938 & 4.190 & 4.417 & 3.391 & & \\ \hline 19 & Long-term debt-equity ratio & 0.349 & 0.219 & 0.496 & 0.620 & 0.784 & 0.972 & & \\ \hline 20 & Total debt ratio & 0.575 & 0.420 & 0.518 & 0.550 & 0.594 & 0.662 & & \\ \hline 21 & Current ratio & 0.984 & 1.285 & 1.411 & 1.440 & 1.420 & 1.322 & & \\ \hline 22 & NWCITotal assets & -0.007 & 0.083 & 0.115 & 0.119 & 0.116 & 0.107 & & \\ \hline 23 & Asset turnover ratio & 2.359 & 2.659 & 2.412 & 2641 & 2.543 & & & \\ \hline 24 & Operating profit margin & -0.004 & 0.076 & 0.074 & 0.072 & 0.069 & 0.056 & & \\ \hline 25 & ROA & -0.008 & 0.202 & 0.178 & 0.189 & 0.176 & & & \\ \hline 26 & ROE & -0.070 & 0.285 & 0.263 & 0.312 & 0.342 & & & \\ \hline 27 & & & & & & & & & \\ \hline 28 & INCOME STATEMENT, March 3 & 31,2019 & & & & & & Ratios, 2019 & \\ \hline 29 & Net sales & 3,351 & & & Times intere: & t earned & & & \\ \hline 30 & Cost of goods sold & 1,990 & & & Cash covera & e ratio & & & \\ \hline 31 & S. G \& A expenses & 1,211 & & & Debt-equity : & atio & & & \\ \hline 32 & Depreciation expense & 159 & & & Total debt rat & & & & \\ \hline 33 & EBIT & -9 & & & Current ratio & & & & \\ \hline 34 & Net interest expense & 37 & & & Quick ratio & & & & \\ \hline 35 & Taxable income & -46 & & & Cash ratio & & & & \\ \hline 36 & Income taxes & 3 & & & NWC/Total a & ssets & & & \\ \hline 37 & Net income & -49 & & & Asset tumov & & & & \\ \hline 38 & Addition to RE & -49 & & & Avg collectic & n period & & & \\ \hline 39 & Dividends & 0 & & & Inventory turn & over & & & \\ \hline 40 & & & & & Days' sales & inventorie & & & \\ \hline 41 & BALANCE SHEET & March 31, N & March 31, & & Operating pre & fit margin & & & \\ \hline 42 & Assets & 2019 & 2018 & & ROA & & & & \\ \hline 43 & Current assets & & & & ROE & & & & \\ \hline 44 & Cash \& securities & 14 & 72 & & & & & & \\ \hline 45 & Receivables & 176 & 194 & & & & & & \\ \hline 46 & Inventories & 479 & 203 & & & & & & \\ \hline 47 & Total current assets & 669 & 469 & & & & & & \\ \hline 48 & & & & & & & & & \\ \hline \end{tabular}