Answered step by step

Verified Expert Solution

Question

1 Approved Answer

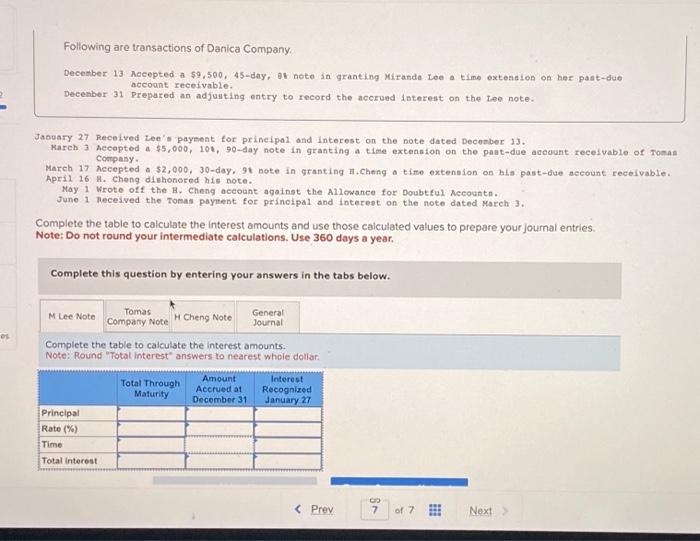

please complete the table Following are transactions of Danica Company. Decenber 13 Accepted a 59,500,45-day, b1 note in granting Miranda Lee a time extenalon on

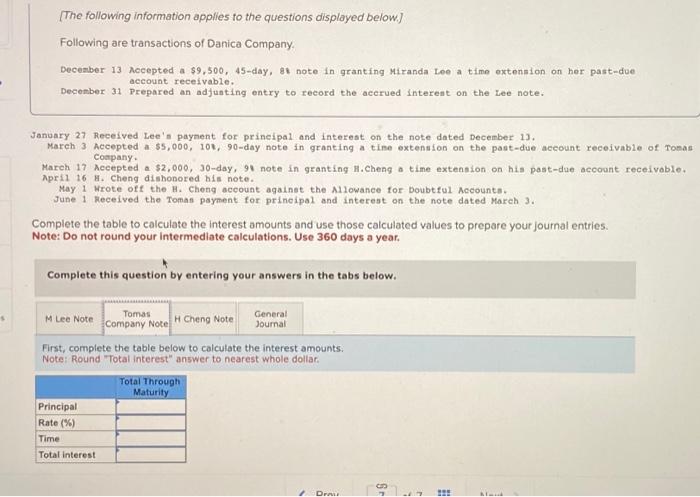

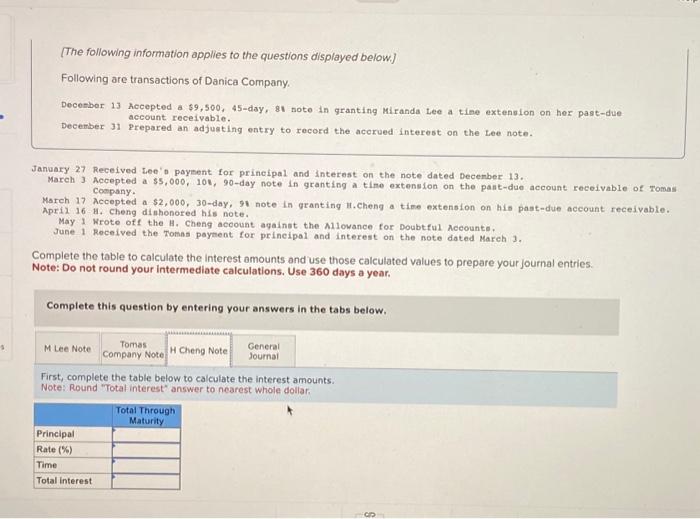

please complete the table

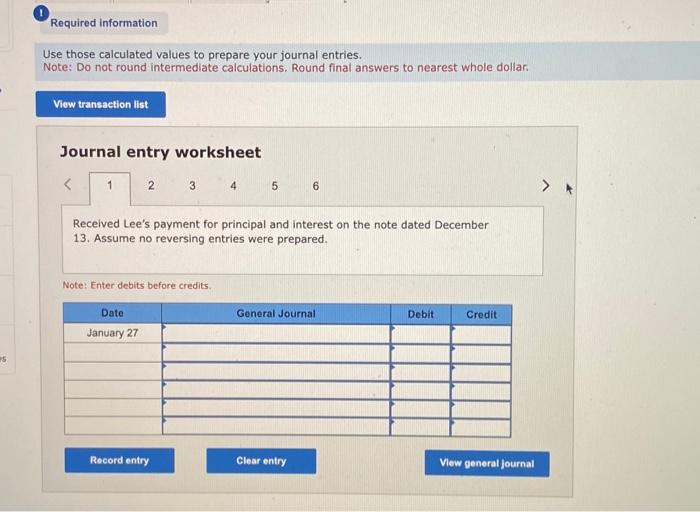

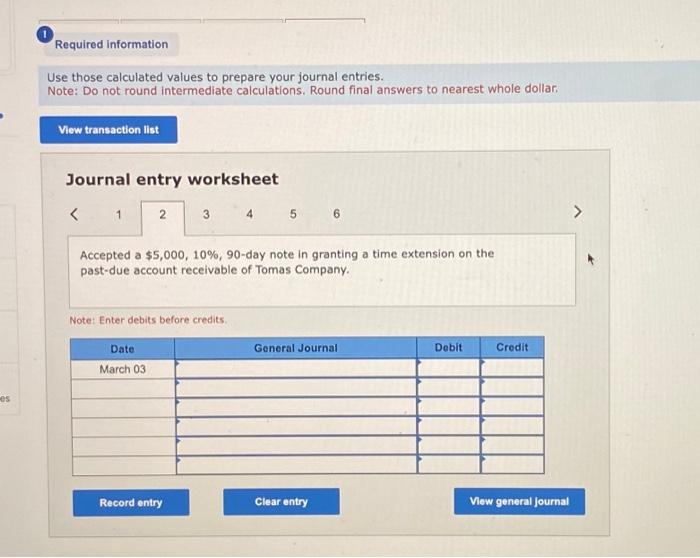

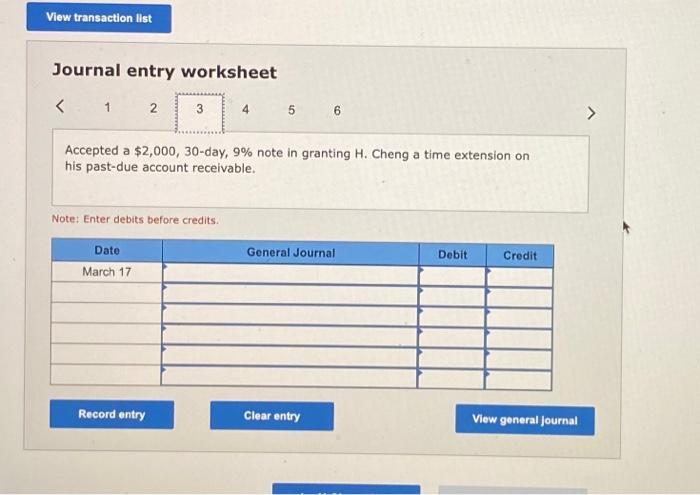

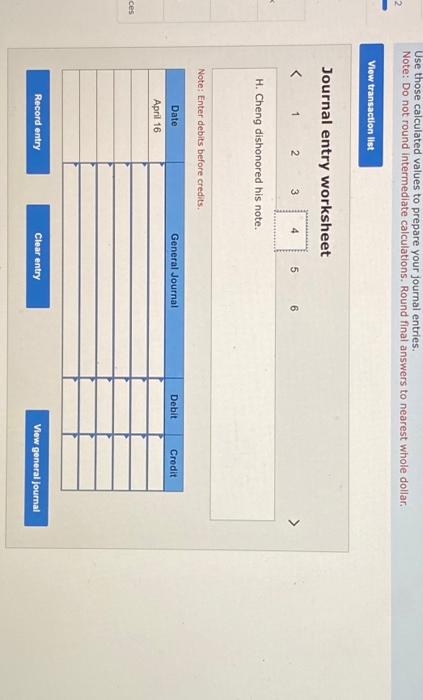

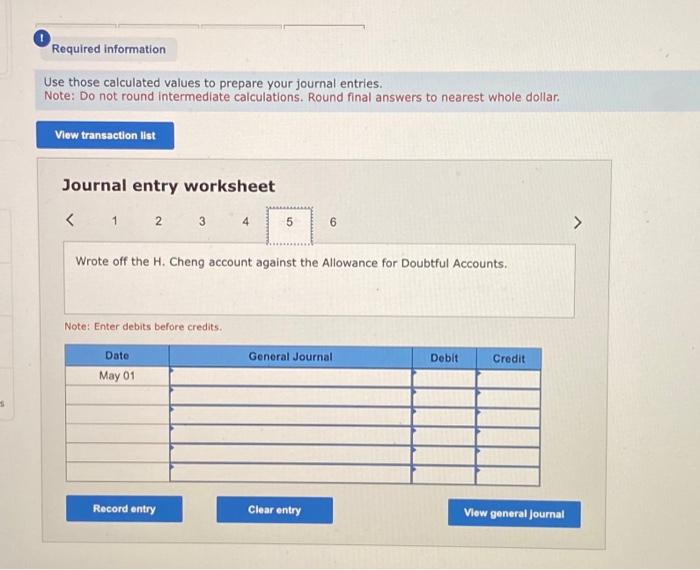

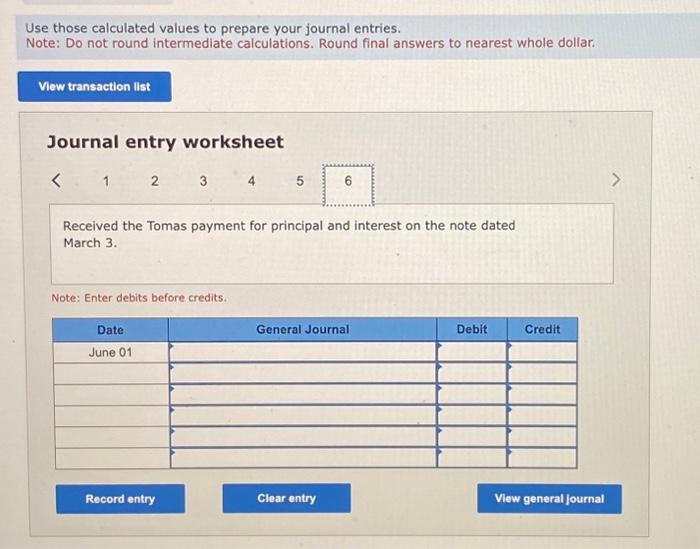

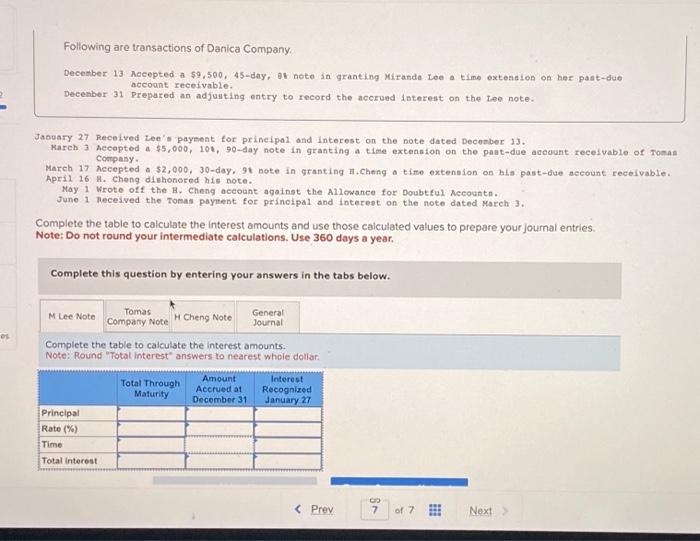

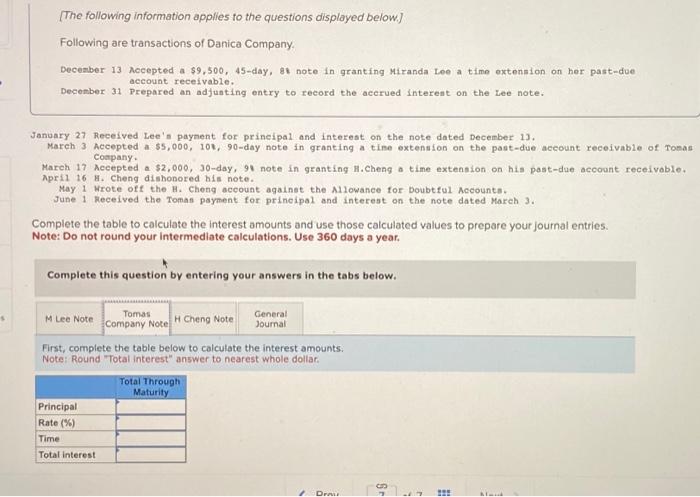

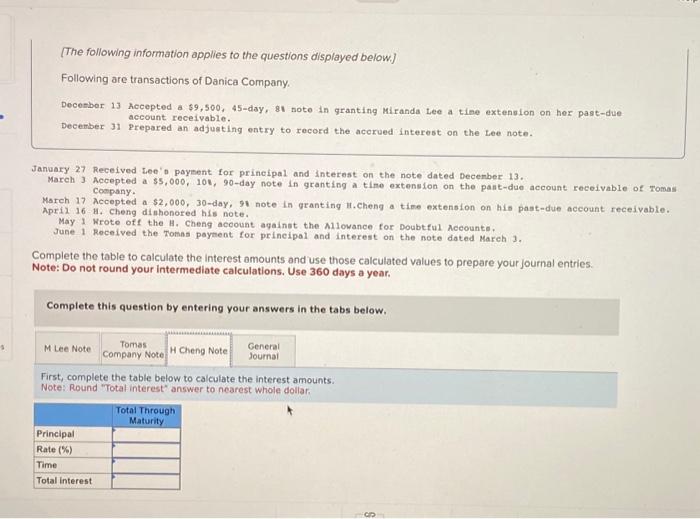

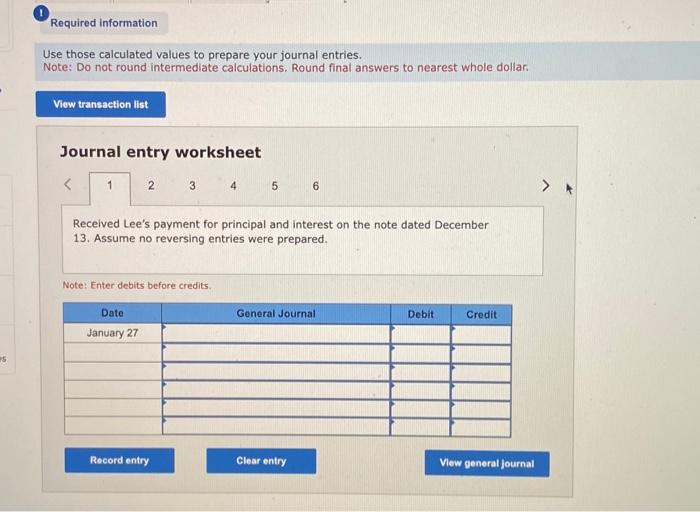

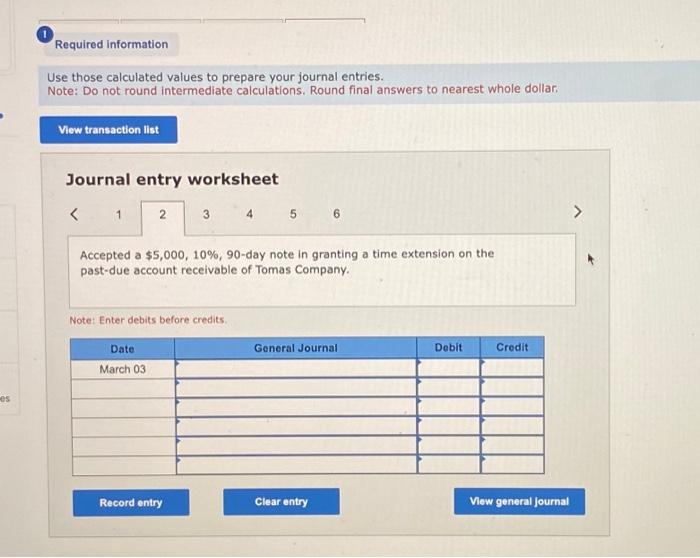

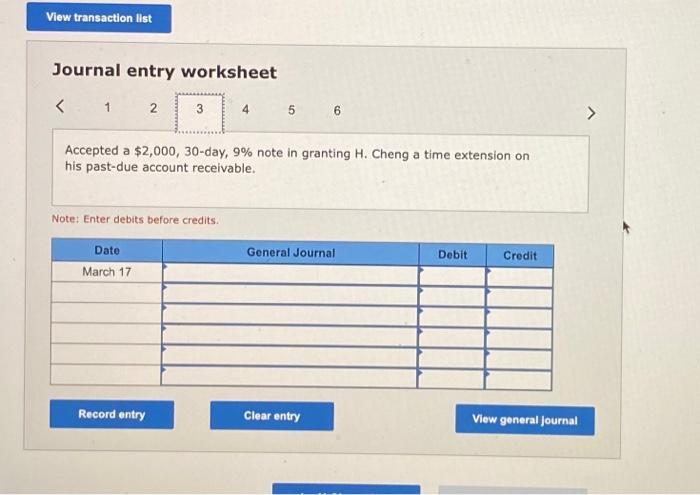

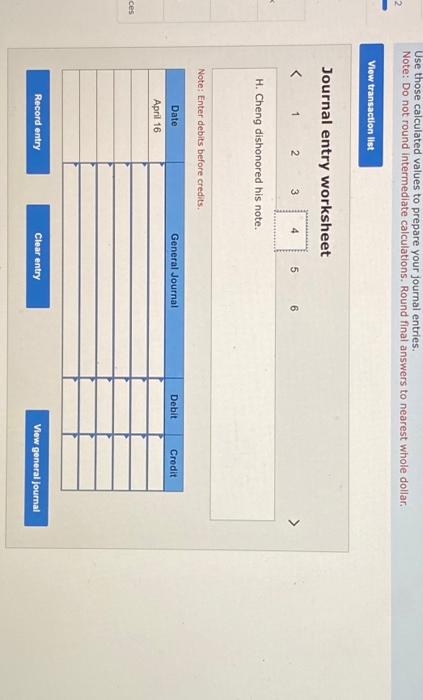

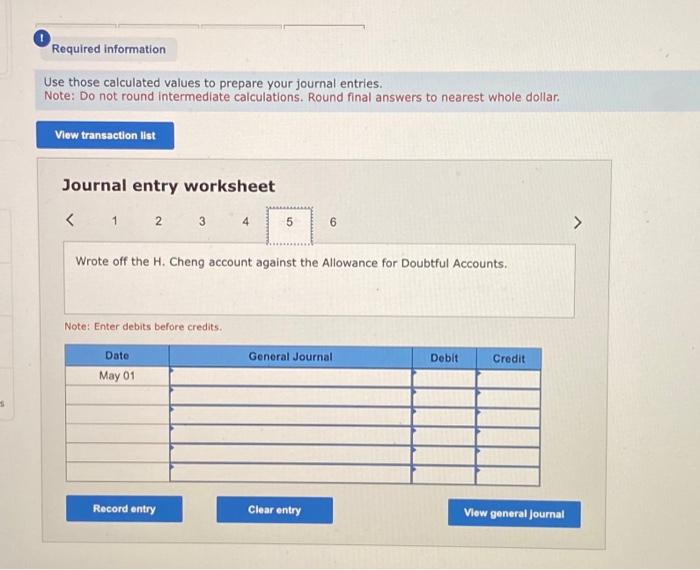

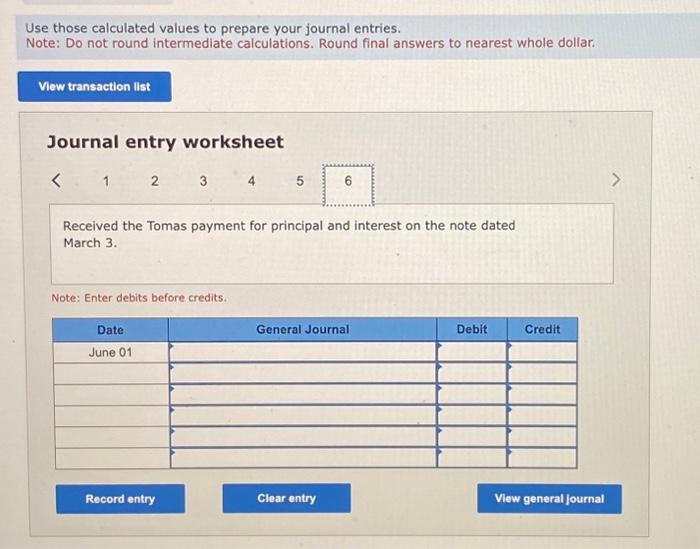

Following are transactions of Danica Company. Decenber 13 Accepted a 59,500,45-day, b1 note in granting Miranda Lee a time extenalon on her past-due account receivable. Decenber 31 Prepared an adjunting entry to record the accrued interest on the Lee note. January 27 Received Lee' payment for prineipal and interest on the note dated Decesber 13. Narch 3 Accepted a $5,000,101,90-day note in granting a time extension on the past-due aceount receivable of romas company. March 17 Accepted a $2,000,30-day, 9t note in granting H,Chnng a time extention on bis past-due account receivable. April 16 f. Cheng diehondred his note. Nay 1 Wrote oft the H. Cheng aceount against the Allewance for Doubtful Aceountn. June 1 Meceived the Tomas payment for principal and interest on the note dated Mareh 3. Complete the table to calculate the interest amounts and use those caiculated values to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. Complete the table to calculate the interest amounts. Note: Round "Total interest" answers to nearest whole dollar: [The following information applies to the questions displayed below.] Following are transactions of Danica Company. Decesber 13 Accepted a $9,500,45-day, gi note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjunting entry to record the acerued interent on the lee note. January 27 Received Lee's paynent for prineipal and interest on the note dated Decerber 13 . Mareh 3 Accepted a $5,000,101,90-day note in granting a time extension on the past-due account receivable of Tona Conpany. March 17 Accepted a $2,000,30-day, 91 note in granting H. Cheng a time extension on his past-due acoount receivable, hpril 16 \&. Cheng dishonored h note. May 1 Wrote oft the H. Cheng account against the Allowance for Doubtful Accounts. June 1 Received the Toman payment for prineipal and interest on the note dated Mareh 3. Complete the table to calculate the interest amounts and use those calculated values to prepare your joumal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. First, complete the table below to calculate the interest amounts: Note: Round "Total interest" answer to nearest whole dollar. [The following information applies to the questions displayed below] Following are transactions of Danica Company. Decerber 13 hecepted a $9,500,45-day, 81 note in granting Miranda tee a tine extengion on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the Lee note. January 27 Received Lee's payment for principal and interest on the note dated Decenber 13. March 3 Accepted a $5,000,106,90-day note in granting a time extension on the pant-due account receivable of Tomas. Cospany. March 17 Accepted a $2,000,30-day, 91 note in granting H, Cheng a tie extension on his past-due account receivable. April 1611, cheng dilhonored his note. May 1 Nrote off the 1. . Cheng account against the Mllowance for Doubtful Mecounte. June 1 Roceived the Tomas peyment for prineipal and interest on the note dated March 3. Complete the table to calculate the interest amounts and use those calculated values to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. First, complete the table below to calculate the interest amounts. Note: Round "Total interest" answer to nearest whole dollar. Use those calculated values to prepare your journal entries. Note: Do not round intermedlate calculations. Round final answers to nearest whole dollar. Journal entry worksheet 56 Received Lee's payment for principal and interest on the note dated December 13. Assume no reversing entries were prepared. Note: Enter debits before credits. Use those calculated values to prepare your journal entries. Note: Do not round intermediate calculations. Round final answers to nearest whole dollar. Journal entry worksheet 3456 Accepted a $5,000,10%,90-day note in granting a time extension on the past-due account receivable of Tomas Company. Note: Enter debits before credits. Journal entry worksheet 6 Accepted a $2,000,30-day, 9% note in granting H. Cheng a time extension on his past-due account receivable. Note: Enter debits before credits. Use those calculated values to prepare your journal entries. Note: Do not round intermediate calculations. Round final answers to nearest whole dollar:- Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started