Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete this On December 31, 2020. Extreme Fitness has adjusted balances of $820,000 in Accounts Recelvable and $59,000 in Allowance for Doubtful Accounts. On

please complete this

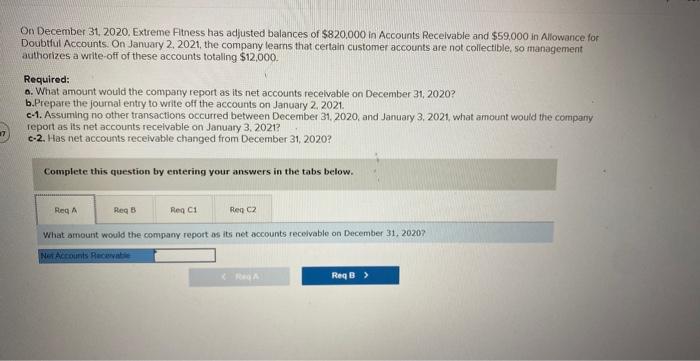

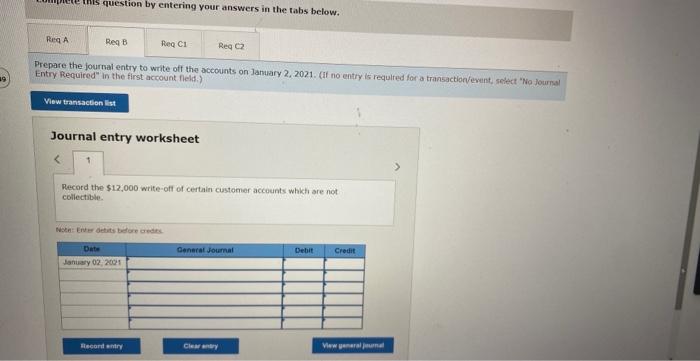

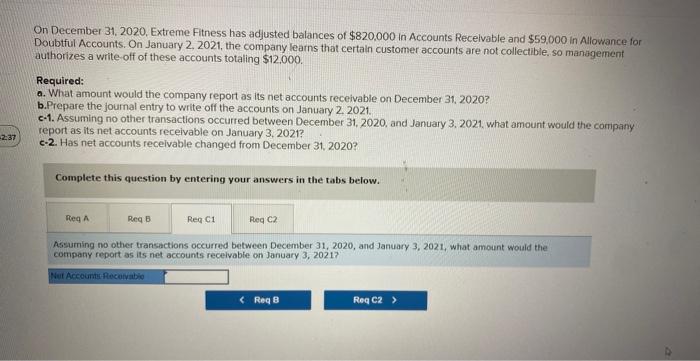

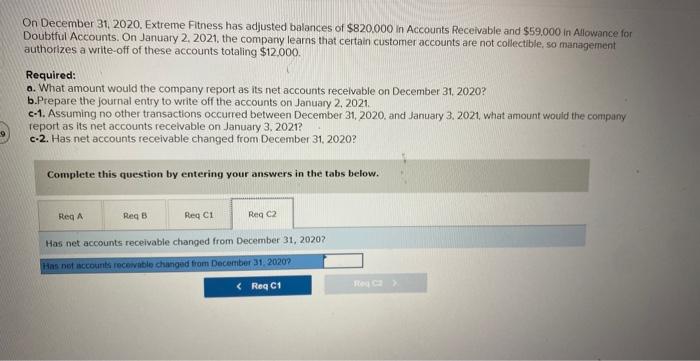

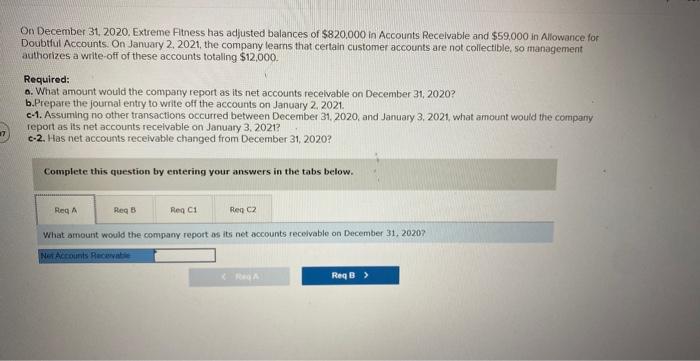

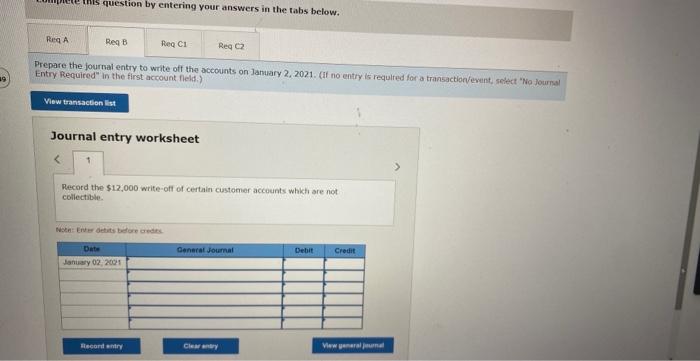

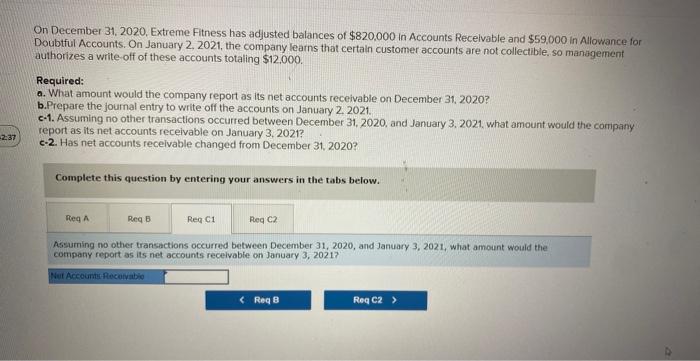

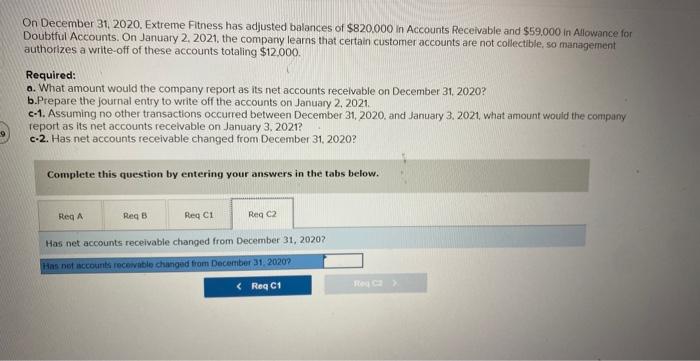

On December 31, 2020. Extreme Fitness has adjusted balances of $820,000 in Accounts Recelvable and $59,000 in Allowance for Doubtful Accounts. On January 2, 2021, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $12,000. Required: 0. What amount would the company report as its net accounts recelvable on December 31, 2020? b.Prepare the journat entry to write off the accounts on January 2.2021 c-1. Assuming no other transactions occurred between December 31, 2020, and January 3, 2021, what amount would the company report as its net accounts recelvable on January 3,2021 ? c-2. Has net accounts receivable changed from December 31,2020 ? Complete this question by entering your answers in the tabs below. What amount would the company report os its net accounts receivable on December 31,2020 ? question by entering your answers in the tabs below. Prepare the fournal entry to write off the accounts on January 2, 2021. (if no entry is requited for a transactionvevent, select "No Journal Entry Required" in the first acrount feld,? Journal entry worksheet Record the $12,000 write-off of certain customer accounts which are not coliectible- flece: End en aetith belore arodits. On December 31, 2020. Extreme Fitness has adjusted balances of $820,000 in Accounts Recelvable and $59,000 in Allowance for Doubtful Accounts. On January 2, 2021, the company learns that certain customer accounts are not collectible. so management authorizes a write-off of these accounts totaling $12.000. Required: a. What amount would the company report as its net accounts receivable on December 31, 2020? b. Prepare the journal entry to write off the accounts on January 2.2021 c-1. Assuming no other transactions occurred between December 31, 2020, and January 3, 2021, what amount would the comipany report as its net accounts receivable on January 3,2021 ? c-2. Has net accounts recelvable changed from December 31, 2020? Complete this question by entering your answers in the tabs below. Assuming no other transactions occurred between December 31, 2020, and January 3, 2021, what amount would the company report as its net accounts recelvable on January 3,20217 On December 31, 2020. Extreme Fitness has adjusted balances of $820,000 in Accounts Receivable and $59,000 in Allowance for Doubtful Accounts. On January 2, 2021, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $12,000 Required: o. What amount would the company report as its net accounts recelvable on December 31,2020 ? b.Prepare the journal entry to write off the accounts on January 2,2021 . c-1. Assuming no other transactions occurred between December 31, 2020, and January 3, 2021, what amount would the compiny report as its net accounts recelvable on January 3, 2021? c-2. Has net accounts receivable changed from December 31, 2020? Complete this question by entering your answers in the tabs below. Has net accounts receivable changed from December 31,2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started