Please complete this part.

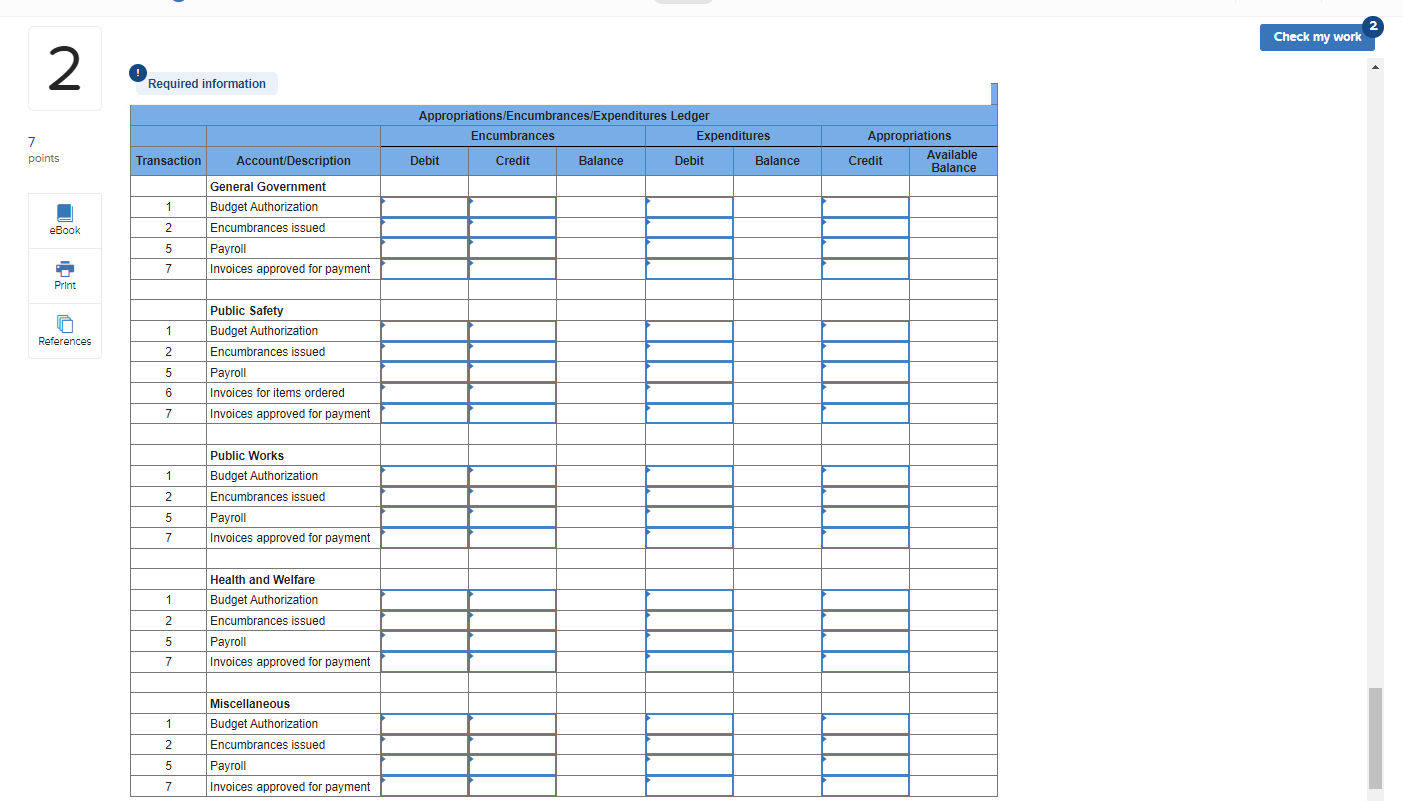

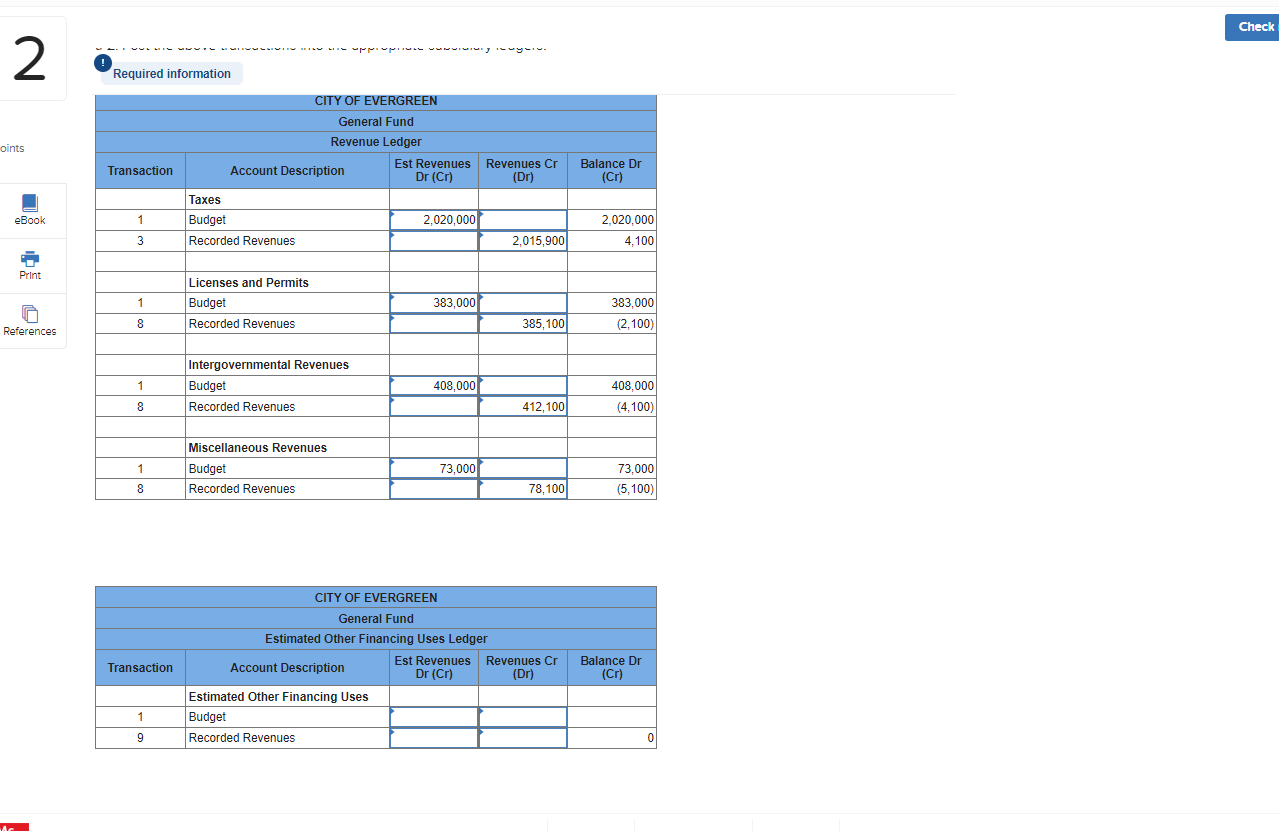

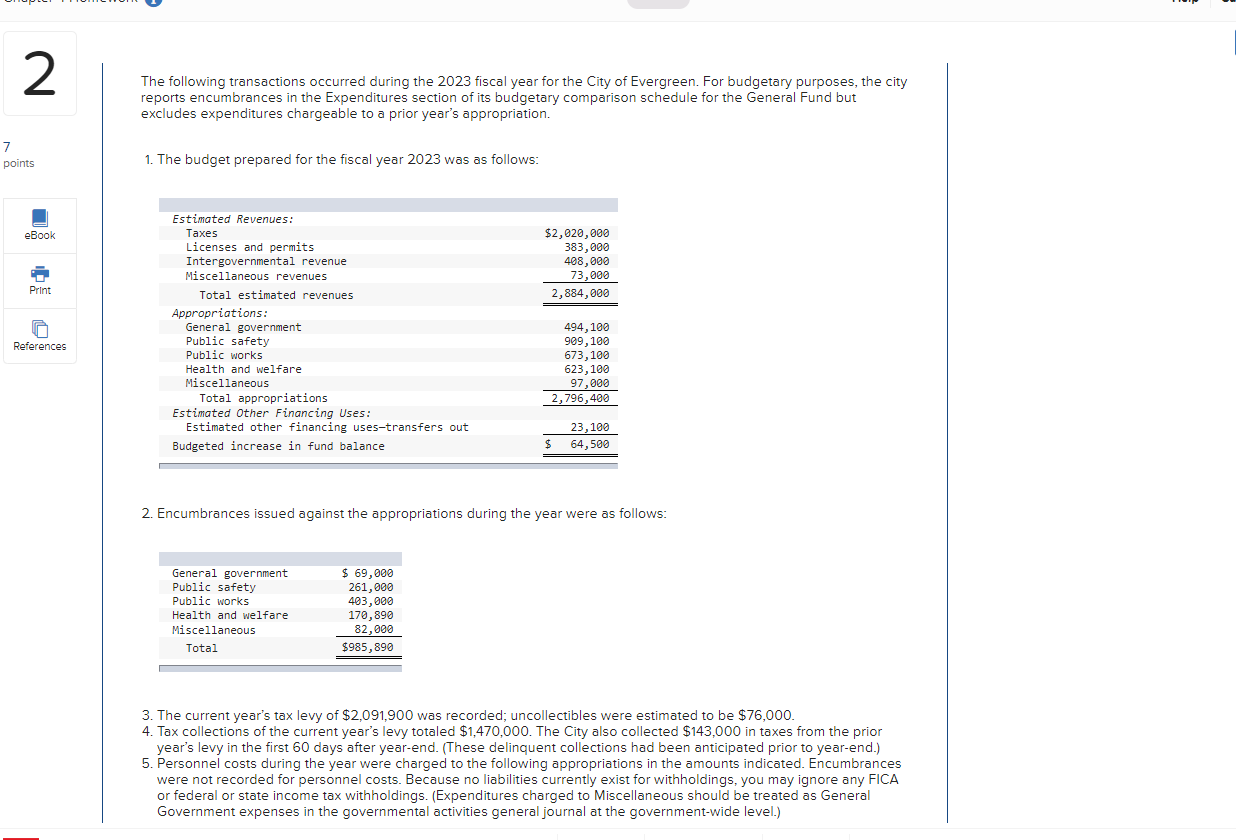

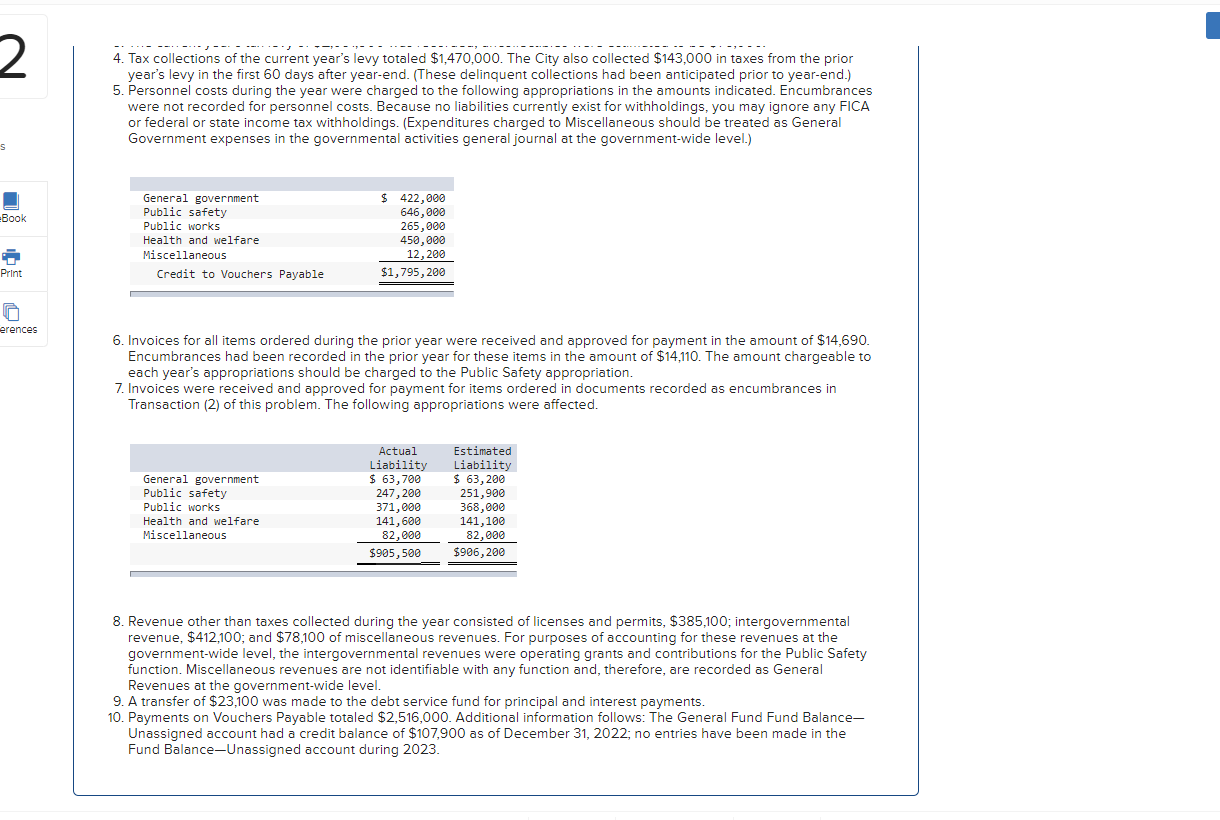

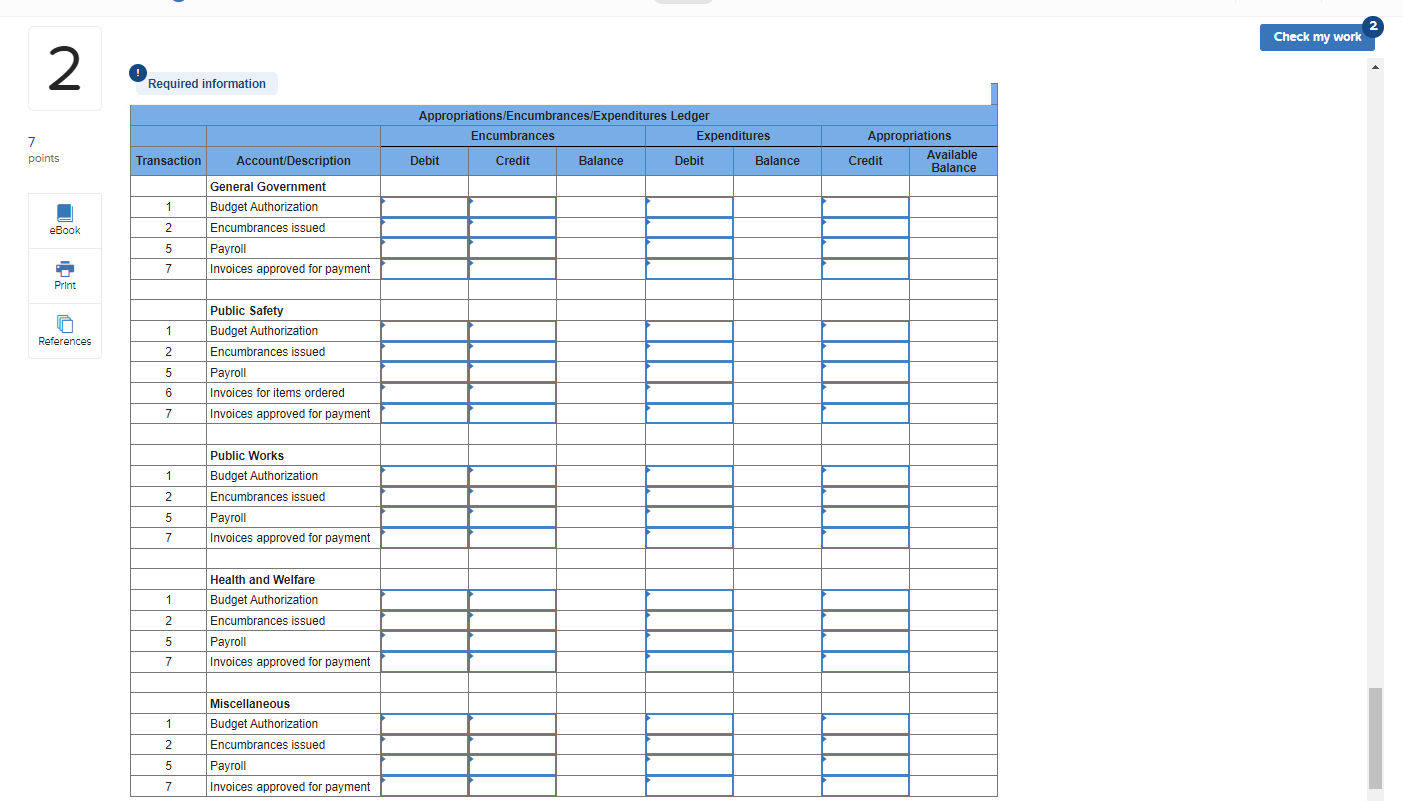

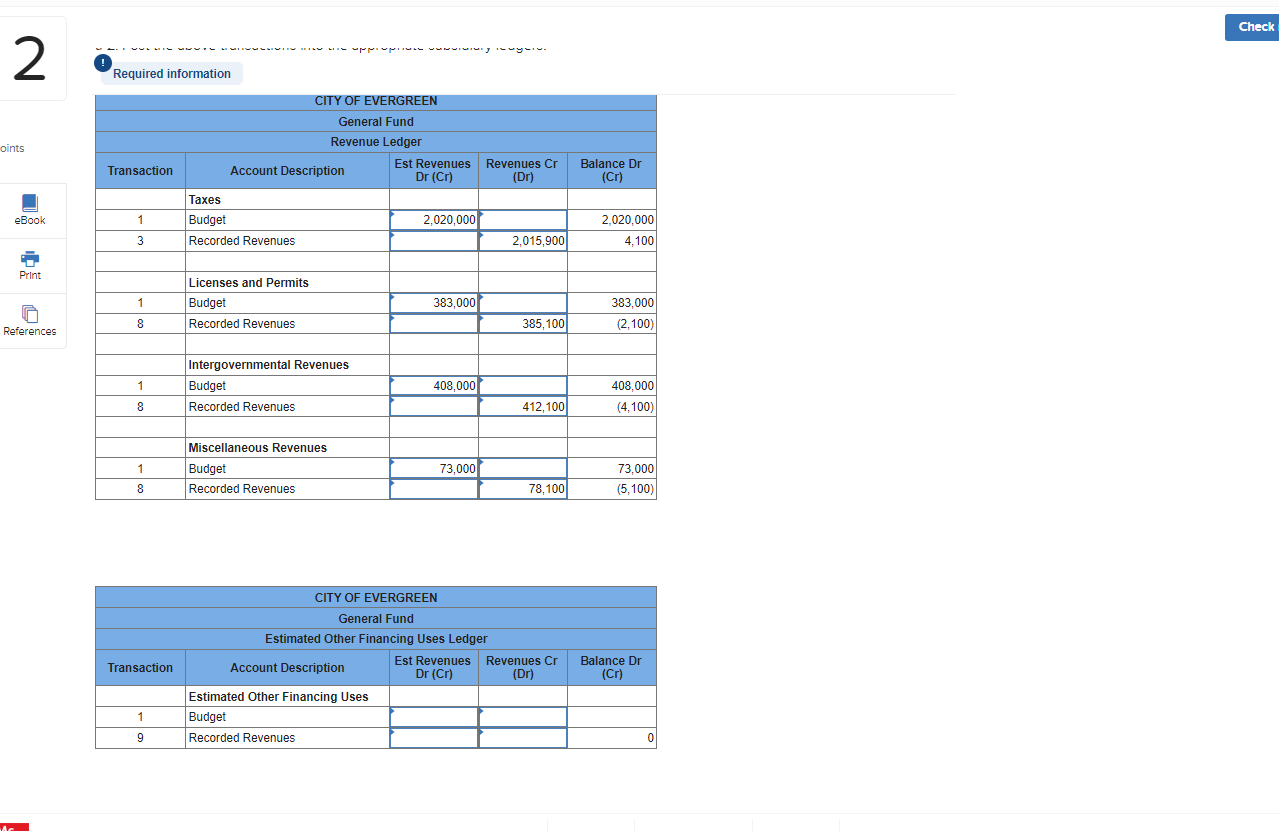

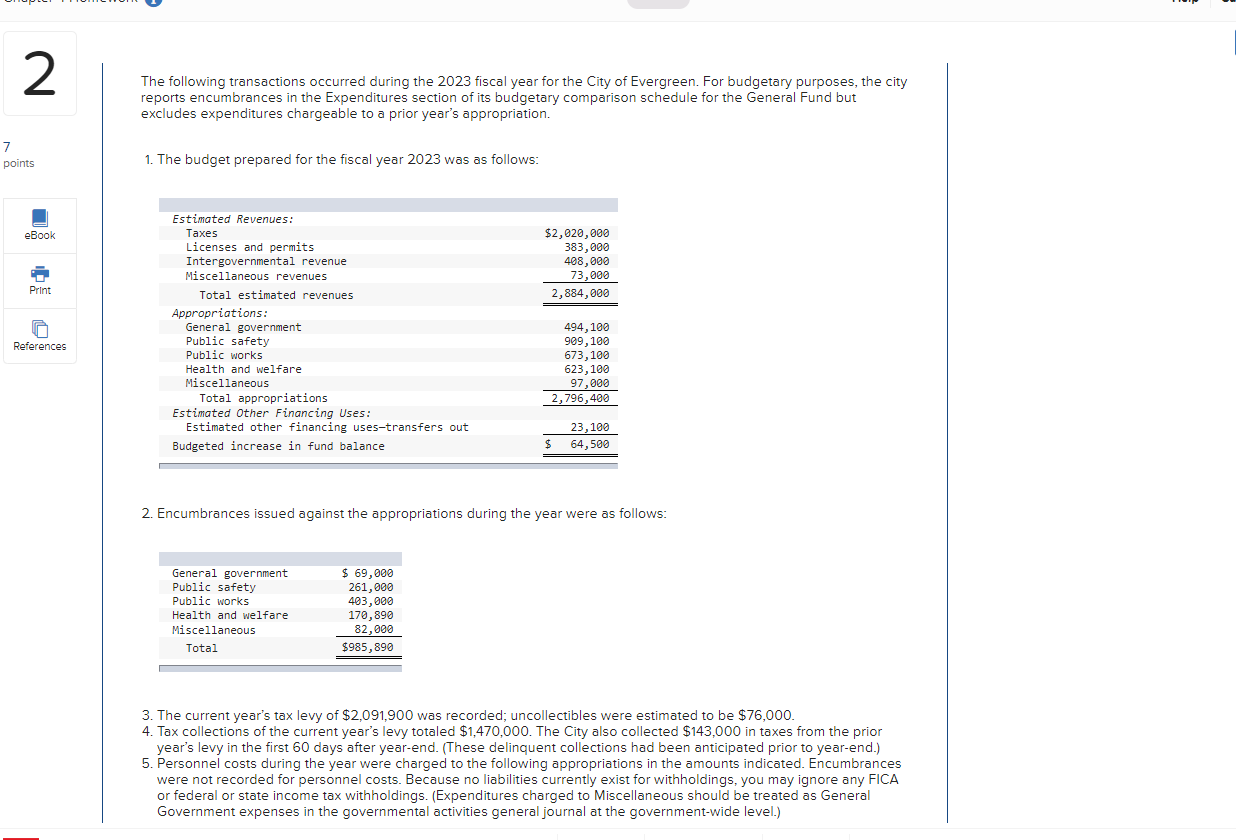

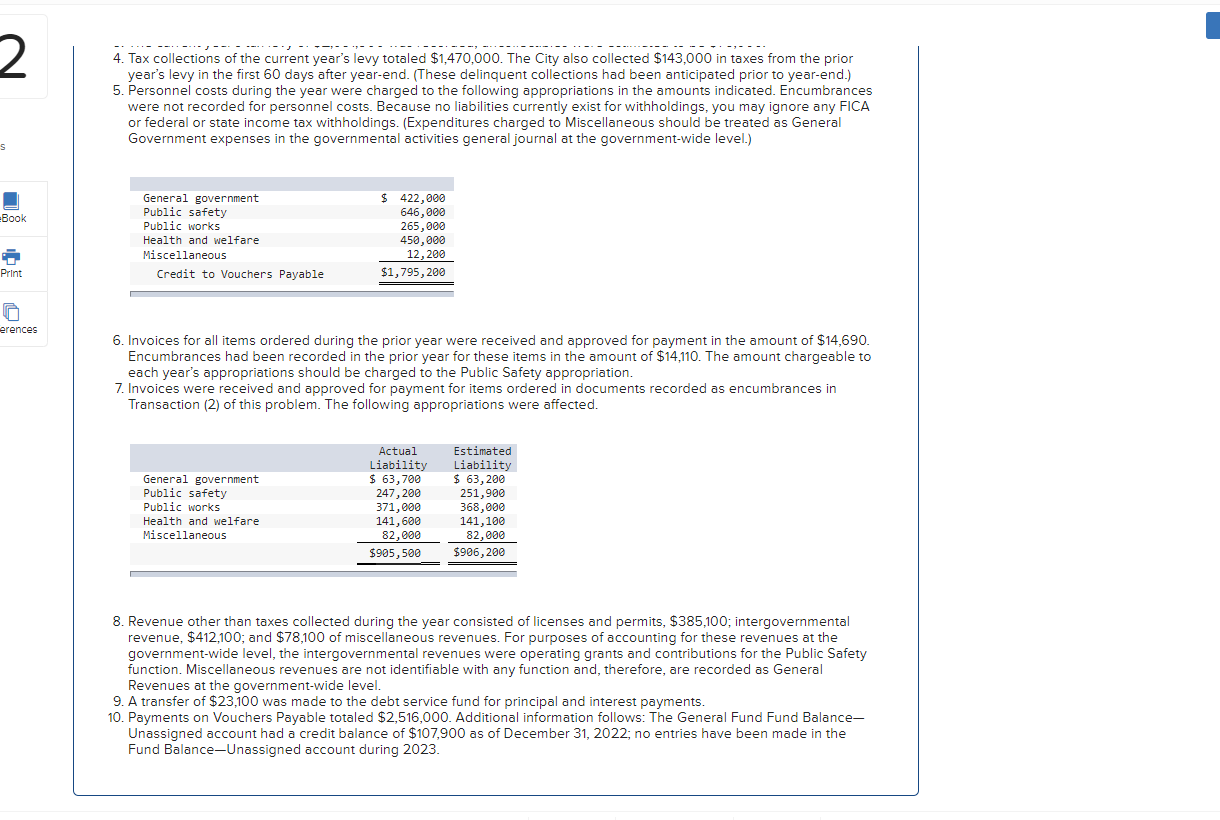

2. 2 The following transactions occurred during the 2023 fiscal year for the City of Evergreen. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but. excludes expenditures chargeable to a prior year's appropriation. 1. The budget prepared for the fiscal year 2023 was as follows: 2. Encumbrances issued against the appropriations during the year were as follows: 3. The current year's tax levy of $2,091,900 was recorded; uncollectibles were estimated to be $76,000. 4. Tax collections of the current year's levy totaled $1,470,000. The City also collected $143,000 in taxes from the prior year's levy in the first 60 days after year-end. (These delinquent collections had been anticipated prior to year-end.) 5. Personnel costs during the year were charged to the following appropriations in the amounts indicated. Encumbrances were not recorded for personnel costs. Because no liabilities currently exist for withholdings, you may ignore any FICA or federal or state income tax withholdings. (Expenditures charged to Miscellaneous should be treated as General Government expenses in the governmental activities general journal at the government-wide level.) 4. Tax collections of the current year's levy totaled $1,470,000. The City also collected $143,000 in taxes from the prior year's levy in the first 60 days after year-end. (These delinquent collections had been anticipated prior to year-end.) 5. Personnel costs during the year were charged to the following appropriations in the amounts indicated. Encumbrances were not recorded for personnel costs. Because no liabilities currently exist for withholdings, you may ignore any FICA or federal or state income tax withholdings. (Expenditures charged to Miscellaneous should be treated as General Government expenses in the governmental activities general journal at the government-wide level.) 6. Invoices for all items ordered during the prior year were received and approved for payment in the amount of $14,690. Encumbrances had been recorded in the prior year for these items in the amount of $14,110. The amount chargeable to each year's appropriations should be charged to the Public Safety appropriation. 7. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in Transaction (2) of this problem. The following appropriations were affected. 8. Revenue other than taxes collected during the year consisted of licenses and permits, $385,100; intergovernmental revenue, $412,100; and $78,100 of miscellaneous revenues. For purposes of accounting for these revenues at the government-wide level, the intergovernmental revenues were operating grants and contributions for the Public Safety function. Miscellaneous revenues are not identifiable with any function and, therefore, are recorded as General Revenues at the government-wide level. 9. A transfer of $23,100 was made to the debt service fund for principal and interest payments. 10. Payments on Vouchers Payable totaled $2,516,000. Additional information follows: The General Fund Fund BalanceUnassigned account had a credit balance of $107,900 as of December 31,2022 ; no entries have been made in the Fund Balance-Unassigned account during 2023. 2. 2 The following transactions occurred during the 2023 fiscal year for the City of Evergreen. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but. excludes expenditures chargeable to a prior year's appropriation. 1. The budget prepared for the fiscal year 2023 was as follows: 2. Encumbrances issued against the appropriations during the year were as follows: 3. The current year's tax levy of $2,091,900 was recorded; uncollectibles were estimated to be $76,000. 4. Tax collections of the current year's levy totaled $1,470,000. The City also collected $143,000 in taxes from the prior year's levy in the first 60 days after year-end. (These delinquent collections had been anticipated prior to year-end.) 5. Personnel costs during the year were charged to the following appropriations in the amounts indicated. Encumbrances were not recorded for personnel costs. Because no liabilities currently exist for withholdings, you may ignore any FICA or federal or state income tax withholdings. (Expenditures charged to Miscellaneous should be treated as General Government expenses in the governmental activities general journal at the government-wide level.) 4. Tax collections of the current year's levy totaled $1,470,000. The City also collected $143,000 in taxes from the prior year's levy in the first 60 days after year-end. (These delinquent collections had been anticipated prior to year-end.) 5. Personnel costs during the year were charged to the following appropriations in the amounts indicated. Encumbrances were not recorded for personnel costs. Because no liabilities currently exist for withholdings, you may ignore any FICA or federal or state income tax withholdings. (Expenditures charged to Miscellaneous should be treated as General Government expenses in the governmental activities general journal at the government-wide level.) 6. Invoices for all items ordered during the prior year were received and approved for payment in the amount of $14,690. Encumbrances had been recorded in the prior year for these items in the amount of $14,110. The amount chargeable to each year's appropriations should be charged to the Public Safety appropriation. 7. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in Transaction (2) of this problem. The following appropriations were affected. 8. Revenue other than taxes collected during the year consisted of licenses and permits, $385,100; intergovernmental revenue, $412,100; and $78,100 of miscellaneous revenues. For purposes of accounting for these revenues at the government-wide level, the intergovernmental revenues were operating grants and contributions for the Public Safety function. Miscellaneous revenues are not identifiable with any function and, therefore, are recorded as General Revenues at the government-wide level. 9. A transfer of $23,100 was made to the debt service fund for principal and interest payments. 10. Payments on Vouchers Payable totaled $2,516,000. Additional information follows: The General Fund Fund BalanceUnassigned account had a credit balance of $107,900 as of December 31,2022 ; no entries have been made in the Fund Balance-Unassigned account during 2023