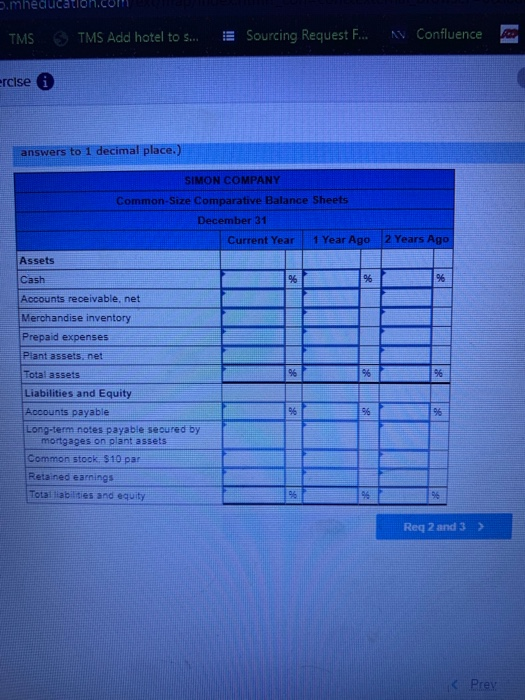

Please complete this question by enterinf answer in the tabs below .

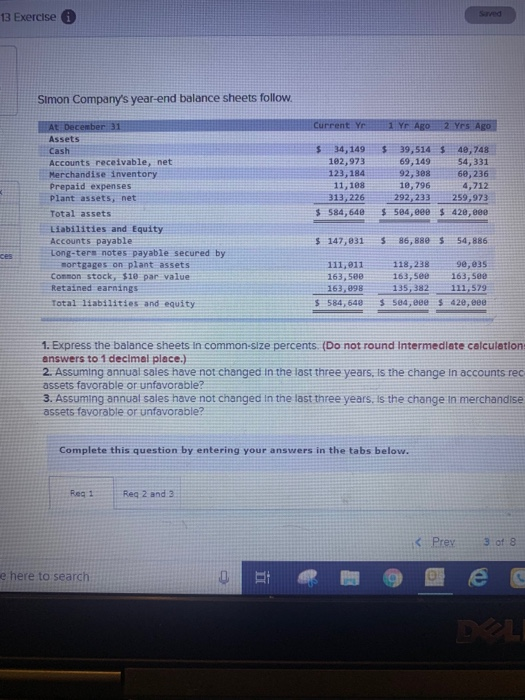

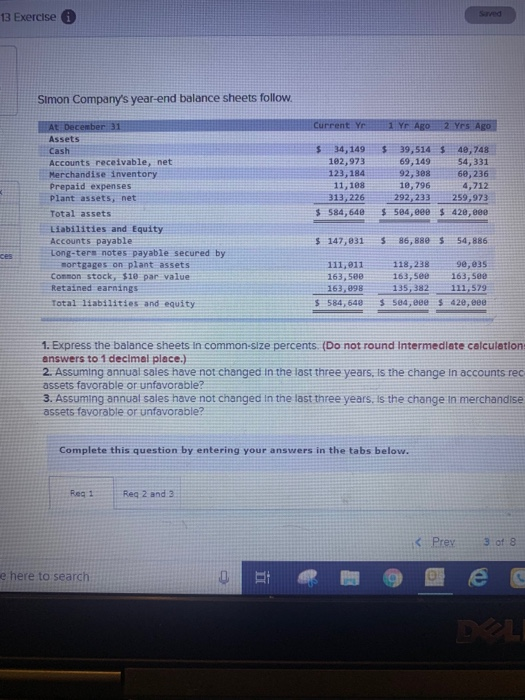

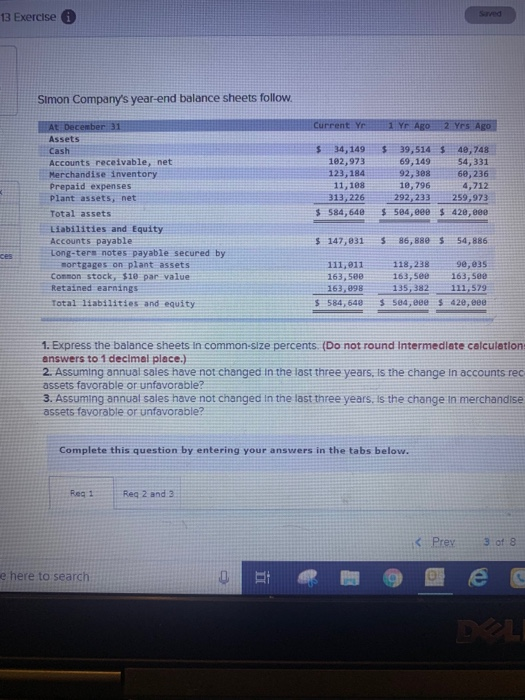

13 Exercise Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-ters notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 34,149 102,973 123, 184 11,108 313, 226 $ 584,640 $ 39,5145 40,748 69,149 54,331 92,388 68,236 10,796 4,712 292, 233 259,973 $ 584,000 $420,00 $ 147,831 $ 86,8805 54,886 ces 111,011 163,500 163,898 $ 584,640 118, 238 90,035 163,500 163,500 135, 382 111,579 $504, eee $ 420, eee 1. Express the balance sheets in common-size percents (Do not round Intermediate calculation answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts rec assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 2 Prey 13 Exercise Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-ters notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 34,149 102,973 123, 184 11,108 313, 226 $ 584,640 $ 39,5145 40,748 69,149 54,331 92,388 68,236 10,796 4,712 292, 233 259,973 $ 584,000 $420,00 $ 147,831 $ 86,8805 54,886 ces 111,011 163,500 163,898 $ 584,640 118, 238 90,035 163,500 163,500 135, 382 111,579 $504, eee $ 420, eee 1. Express the balance sheets in common-size percents (Do not round Intermediate calculation answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts rec assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 2 Prey