Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please compute wSP Y , wAGG, E(rP ), rP , and Sharpe Ratio of the optimal portfolio constructed using SPY and AGG. (Show your work)

Please compute wSP Y , wAGG, E(rP ), rP , and Sharpe Ratio of the optimal portfolio constructed using SPY and AGG. (Show your work)

If you require that your overall complete portfolio have an expected return of 4%, what are the allocation percentages to SPY, AGG, and t-bills for your complete portfolio. (Show your work and round your answer to 4 decimal places)

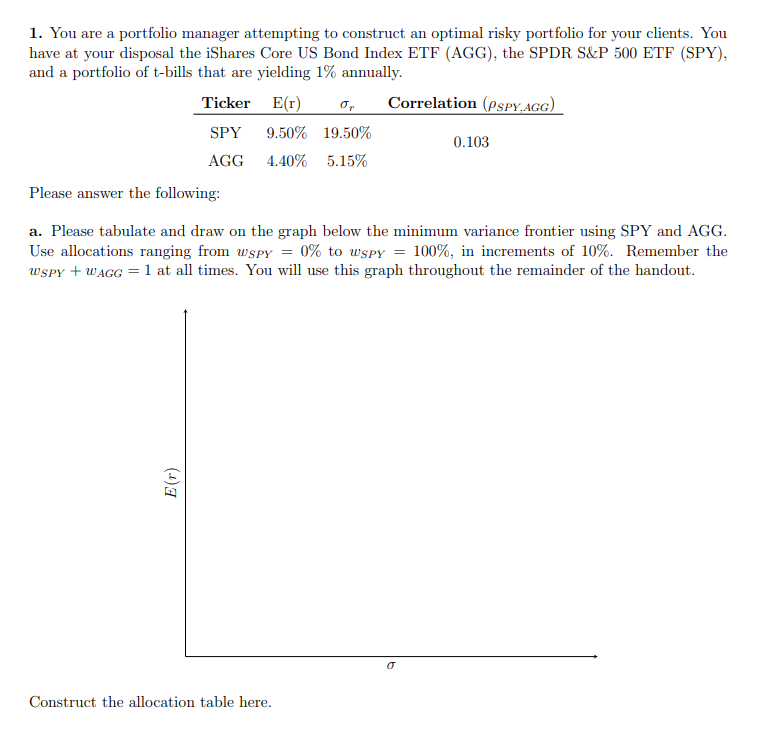

1. You are a portfolio manager attempting to construct an optimal risky portfolio for your clients. You have at your disposal the iShares Core US Bond Index ETF (AGG), the SPDR S\&P 500 ETF (SPY), and a portfolio of t-bills that are yielding 1% annually. Please answer the following: a. Please tabulate and draw on the graph below the minimum variance frontier using SPY and AGG. Use allocations ranging from wSPY=0% to wSPY=100%, in increments of 10%. Remember the wSPY+wAGG=1 at all times. You will use this graph throughout the remainder of the handout. Construct the allocation table here. 1. You are a portfolio manager attempting to construct an optimal risky portfolio for your clients. You have at your disposal the iShares Core US Bond Index ETF (AGG), the SPDR S\&P 500 ETF (SPY), and a portfolio of t-bills that are yielding 1% annually. Please answer the following: a. Please tabulate and draw on the graph below the minimum variance frontier using SPY and AGG. Use allocations ranging from wSPY=0% to wSPY=100%, in increments of 10%. Remember the wSPY+wAGG=1 at all times. You will use this graph throughout the remainder of the handout. Construct the allocation table hereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started