Please consider the excerpts from Walgreens Boots Alliance (i.e., Walgreens) annual report for fiscal year 2020, and consider the following questions. Note that fiscal year 2020 ends on August 31, 2020.

1. Refer to 4.65% notes due 2046. Calculate the interest expense on this note for fiscal year 2025.

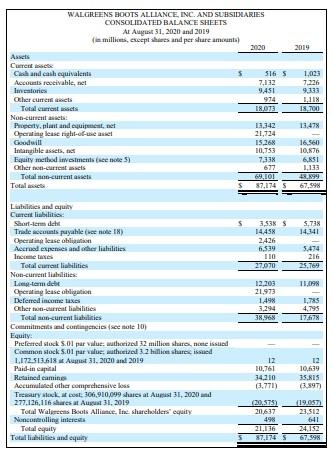

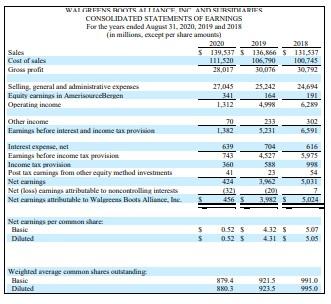

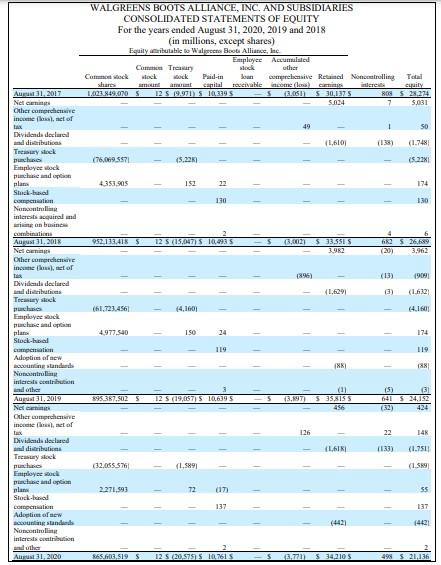

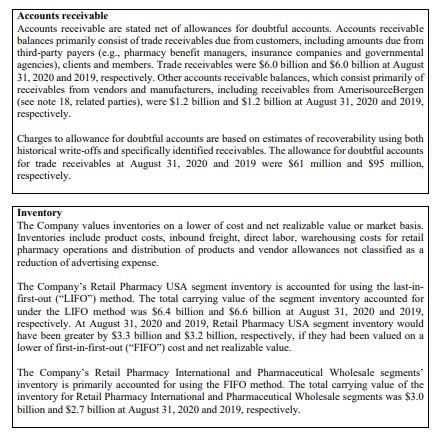

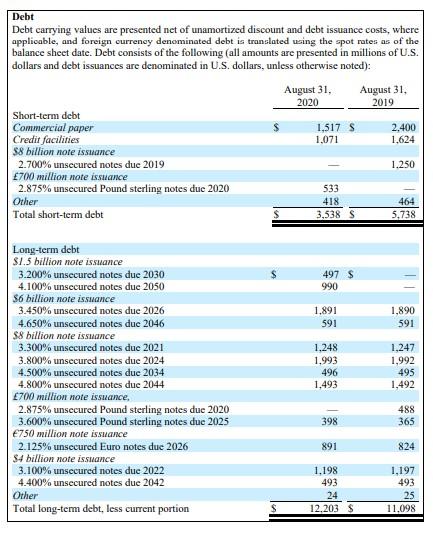

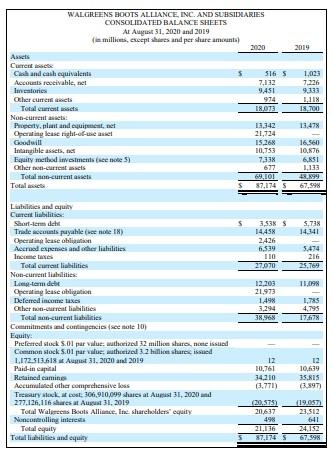

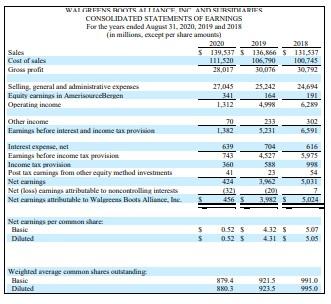

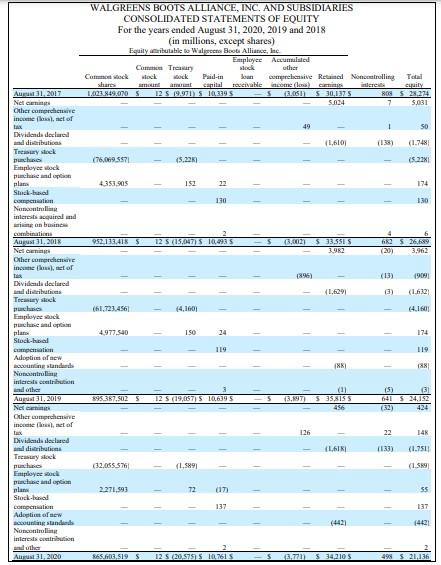

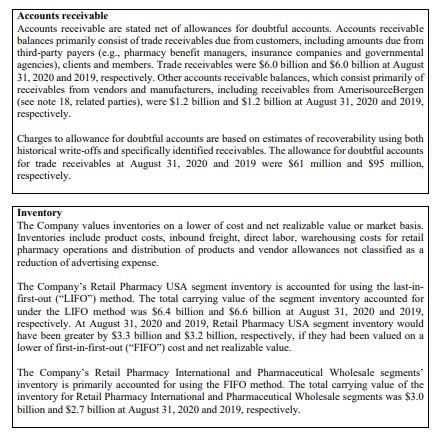

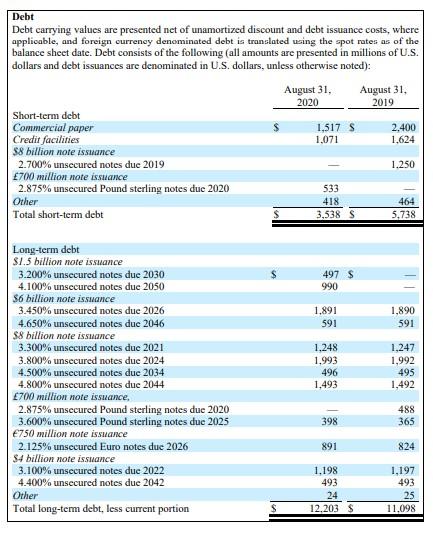

9451 WALGREENS BOOTS ALLIANCE, INC. AND SUBSIIMARIES CONSOLIDATED BALANCE SHEETS Al August 31, 2020 and 2019 millis, excepts and per share amount 2020 2019 Assets | Current at Cand cash equivalents 516 5 1,003 Accounts receivable, nel 7,132 7.226 Investories 9,333 Other current 974 Total wat 18.073 18,700 Non-currentes Property, plant and equipment net 13,342 13.478 Operating less right-of-sease 21,724 Goodwill 15.268 16.560 Intangible assets, et 10,753 10,876 Equity method investments see note 5 7,33 6,851 Other torrent 677 1.133 Total non-current assets 69.101 43.899 Total 87,1745 67.998 5,738 14.341 3,53% 14.45 2426 6.539 110 5.474 216 25.769 11.098 12.203 21,973 1498 3,294 38.968 1.785 4,795 17.678 abilities and any Curent liabilities Short-term delt Trale accents payable (se note 1) enie lene alient Accrued and other lialtilities le taxes Total current liabilities Non-current liabilities: L-term det Operating lease obligation Deferred income taxes Other current liabilities Total current liabilities Commitments al contingencies (see tole 10) Equity Preferred stock s.Ol par value theized 32 milli stare, neute issued Common stock 5.01 par value theiz 3.2 hillic share issued 1.172313.618 At 31, 2020 and 2019 Paid-in capital Retained camine Accumulated other comprehensive boss Treasury stock to: 306,980,099 shares at Amst 31, 2020 and 277.126.116 shares at August 31, 2019 Total Walen Boots Alliance. It shareholders' equity Nuncontrolling in Total equity Total abilities and culty IZ 10,761 34.210 (3.771) 12 10,639 35.815 3.897) (19.057) 23,512 20.575) 20.637 498 21,136 87.174 S 24,152 67.398 WALOREENS ROOTS ALLIANCE IN ANN SIRIARIES CONSOLIDATED STATEMENTS OF EARNINGS For the years ended August 31, 2020, 2019 and 2018 (in millions, except per share amount 2020 2019 2018 Sales 139.597 5 136,866 S 131,337 Cost of sales 111.520 106,790 100,745 Gross profit 28.017 30,076 30.797 Selling general and administrative expreca 27,045 25.242 24./94 |Ear anies in sareesaran 341 164 191 Operating in 1.312 4.99 6,289 Other income 70 302 Emme before interest and income tax pro 1.382 5.231 6,591 Interest expense, et 639 704 616 Emiga efore income tax provit 743 4,527 5.975 Incomie gov 360 588 998 Pust tax corning liom der equity method investments 41 23 54 Nettings 424 3.962 3,031 Netscamins attributable to control interes 1221 (20) Net cuites attentable na Walens Bats Alliance. Ite 4565 3.2 S 5.024 | Net eatits per cuttisatire Basic Diluted s 0.525 0:52 4325 4315 5.07 3.05 Weighted average communsure outstatuling Hasic Diluted 879.4 80.3 9215 923.5 991.0 995.0 $ . WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EQUITY For the years ended August 31, 2020, 2019 and 2018 (in millions, except shares) Equily ributable to Wale Bo Alliance, he Employee Accumulated Come Treury weck other Cock Week ock prehensive Retaimed Nontrolling Total capital receivable come a interesse city Am 31. 2017 1.0023.849.070 S 12 S 19.971) S 10.210 S 3.058 530,1375 808 S 28,224 Net 5024 7 5.031 Cther angrdiatime incument of x Dkvidonda del al dialluties | (1.6101 (138) (1.748 Try soek (76,069.5971 (5.22 SON Etaployee wock punch and plam 4355,505 153 174 Stuck-bud 130 130 Nemli interests acquired ines combination Aurust 31, 2018 952.133.4153 12 S 15.0471 T (3.00) S 33.55ES 2 S 26,69 Ner 3,982 (2003 3. Other com intent of 1895) (13) 1909 Divide declared mildirib 1.6291 (3) (1.6327 Tee stock (61.723.4561 14.1601 64.16 Employeeck purchae nil plan 4.977.540 150 14 174 Stockhol Curnparai 119 119 Adopt of new con stand XK 188 Ng interesselribution and other 15) 30 August 31, 2019 895387.SOZ 5 12 S (19,657 10S 3.897) 355155 641 5 24.152 Nel (32) 424 Other cumprch incestor Lux 126 22 14K Dividends clared tariation (133) Treystek (1.751 punch (32.055.76 (1.5891 (1.59 Employee c. prince and 2.271,593 72 017 55 Studio 137 137 Adaptiudies og standard (4421 14421 No control interest dhe At 31, 2020 65.603,519 12 S (20,791 S 10,761 5 34,210 5 499 S 21,136 ch 19 11 L611 Accounts receivable Accounts receivable are stated net of allowances for doubtful accounts. Accounts receivable balances primarily consist of trade receivables due from customers, including amounts due from third-party payers (eg, pharmacy benefit managers, insurance companies and governmental agencies), clients and members. Trade receivables were $6.0 billion and $6.0 billion at August 31, 2020 and 2019, respectively. Other accounts receivable balances, which consist primarily of receivables from vendors and manufacturers, including receivables from AmerisourceBergen (see note 18, related parties), were $1.2 billion and $1.2 billion at August 31, 2020 and 2019, respectively. Charges to allowance for doubtful accounts are based on estimates of recoverability using both historical write-offs and specifically identified receivables. The allowance for doubtful accounts for trade receivables at August 31, 2020 and 2019 were $61 million and $95 million, respectively. Inventory The Company values inventories on a lower of cost and net realizable value or market basis. Inventories include product costs, inbound freight, direct labor, warehousing costs for retail pharmacy operations and distribution of products and vendor allowances not classified as a reduction of advertising expense. The Company's Retail Pharmacy USA segment inventory is accounted for using the last-in- first-out ("LIFO") method. The total carrying value of the segment inventory accounted for under the LIFO method was $6.4 billion and $6.6 billion at August 31, 2020 and 2019, respectively. At August 31, 2020 and 2019, Retail Pharmacy USA segment inventory would have been greater by $3.3 billion and $3.2 billion, respectively, if they had been valued on a lower of first-in-first-out ("FIFO") cost and net realizable value. The Company's Retail Pharmacy International and Pharmaceutical Wholesale segments" inventory is primarily accounted for using the FIFO method. The total carrying value of the inventory for Retail Pharmacy International and Pharmaceutical Wholesale segments was $3.0 billion and $2.7 billion at August 31, 2020 and 2019, respectively. Debt Debt carrying values are presented net of unamortized discount and debt issuance costs, where applicable, and foreign currency denominated debt is translated using the spot rates as of the balance sheet date. Debt consists of the following (all amounts are presented in millions of U.S. dollars and debt issuances are denominated in U.S. dollars, unless otherwise noted): August 31, August 31, 2020 2019 Short-term debt Commercial paper $ 1,517 S 2.400 Credit facilities 1.071 1,624 $8 billion note issuance 2.700% unsecured notes due 2019 1.250 700 million note issuance 2.875% unsecured Pound sterling notes due 2020 533 Other 418 464 Total short-term debt 3,538 S 5,738 497 s 990 1.891 591 1,890 591 Long-term debt $1.5 billion note issuance 3.200% unsecured notes due 2030 4.100% unsecured notes due 2050 $6 billion note issuance 3.450% unsecured notes due 2026 4.650% unsecured notes duc 2046 $8 billion note issuance 3.300% unsecured notes due 2021 3.800% unsecured notes due 2024 4.500% unsecured notes due 2034 4.800% unsecured notes due 2044 700 million note issuance, 2.875% unsecured Pound sterling notes due 2020 3.600% unsecured Pound sterling notes due 2025 750 million note issuance 2.125% unsecured Euro notes due 2026 $4 billion note issuance 3.100% unsecured notes due 2022 4.400% unsecured notes due 2042 Other Total long-term debt, less current portion 1.248 1,993 496 1.493 1.247 1,992 495 1,492 488 365 398 891 824 1.198 493 24 12,203 $ 1.197 493 25 11.098