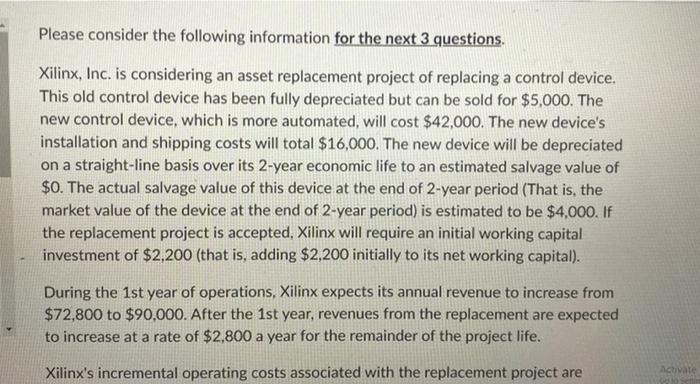

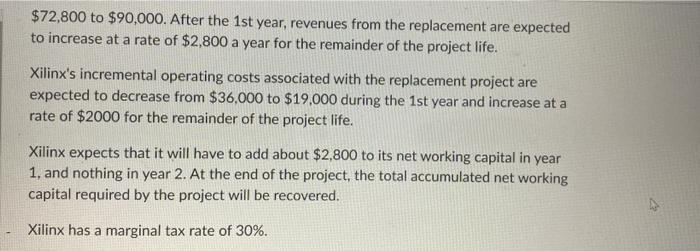

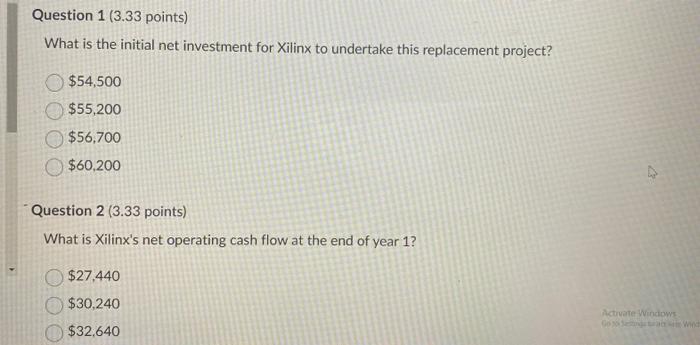

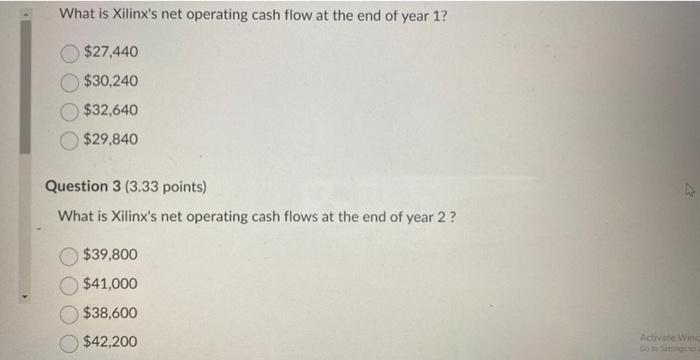

Please consider the following information for the next 3 questions. Xilinx, Inc. is considering an asset replacement project of replacing a control device. This old control device has been fully depreciated but can be sold for $5,000. The new control device, which is more automated, will cost $42,000. The new device's installation and shipping costs will total $16,000. The new device will be depreciated on a straight-line basis over its 2 -year economic life to an estimated salvage value of $0. The actual salvage value of this device at the end of 2 -year period (That is, the market value of the device at the end of 2 -year period) is estimated to be $4,000. If the replacement project is accepted, Xilinx will require an initial working capital investment of $2,200 (that is, adding $2,200 initially to its net working capital). During the 1st year of operations, Xilinx expects its annual revenue to increase from $72,800 to $90,000. After the 1st year, revenues from the replacement are expected to increase at a rate of $2,800 a year for the remainder of the project life. Xilinx's incremental operating costs associated with the replacement project are $72,800 to $90,000. After the 1 st year, revenues from the replacement are expected to increase at a rate of $2,800 a year for the remainder of the project life. Xilinx's incremental operating costs associated with the replacement project are expected to decrease from $36,000 to $19,000 during the 1 st year and increase at a rate of $2000 for the remainder of the project life. Xilinx expects that it will have to add about $2,800 to its net working capital in year 1 , and nothing in year 2 . At the end of the project, the total accumulated net working capital required by the project will be recovered. Xilinx has a marginal tax rate of 30%. What is the initial net investment for Xilinx to undertake this replacement project? $54,500$55,200$56,700$60,200 Question 2 ( 3.33 points) What is Xilinx's net operating cash flow at the end of year 1 ? $27,440$30,240$32,640 What is Xilinx's net operating cash flow at the end of year 1 ? $27,440$30,240$32,640$29,840 Question 3 (3.33 points) What is Xilinx's net operating cash flows at the end of year 2 ? $39,800$41,000$38,600$42,200