Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE CORRECT ME WITH CORRECT ANSWER Do not say You can use a linear programming solver or software to find the optimal solution I need

PLEASE CORRECT ME WITH CORRECT ANSWER

Do not say You can use a linear programming solver or software to find the optimal solution

I need to compare my answers! GIVE ME RIGHT ANSWER THANK YOU!

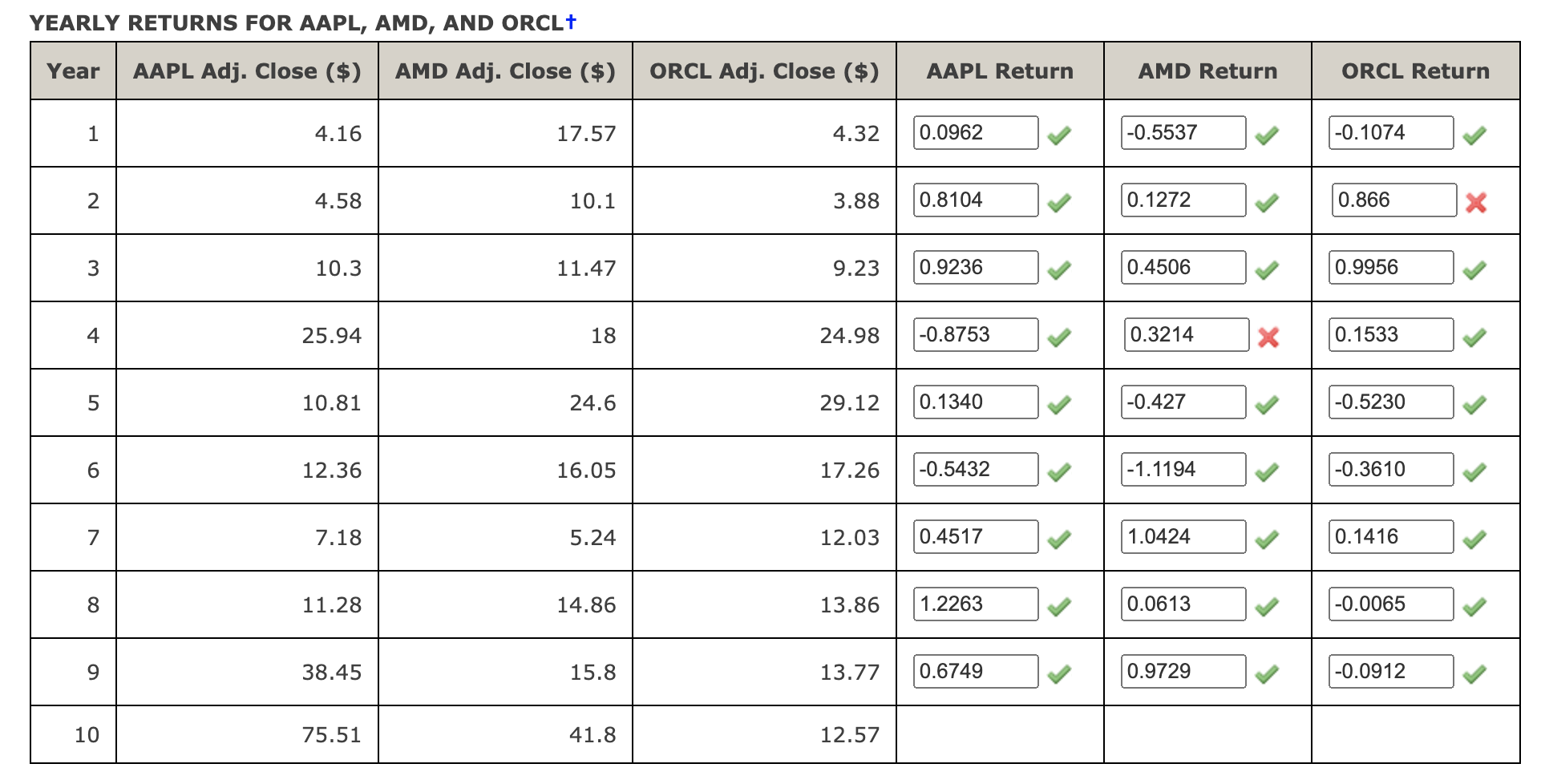

adjusted for splits and stock dividends, then the price of stock i in period t+1,p(i,t+1), is given by p(i,t+1)=pi,teeri,t and Oracle Corporation for the years included here. Solving the equation p(i,t+1)=pi,teri,t for the return on stock i in period t gives ri,t=ln(pi,tpi,t+1). Year 10 is ln(38.4575.51)=0.6749. for AAPL, AMD, and ORCL using ri,t=ln(pi,tpi,t+1). (Round your answers to four decimal places.) YEARLY RETURNS FOR AAPL. AMD. AND ORCL

adjusted for splits and stock dividends, then the price of stock i in period t+1,p(i,t+1), is given by p(i,t+1)=pi,teeri,t and Oracle Corporation for the years included here. Solving the equation p(i,t+1)=pi,teri,t for the return on stock i in period t gives ri,t=ln(pi,tpi,t+1). Year 10 is ln(38.4575.51)=0.6749. for AAPL, AMD, and ORCL using ri,t=ln(pi,tpi,t+1). (Round your answers to four decimal places.) YEARLY RETURNS FOR AAPL. AMD. AND ORCL Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started