Please correct my answer if I'm wrong and give explanation.

Please correct my answer if I'm wrong and give explanation.

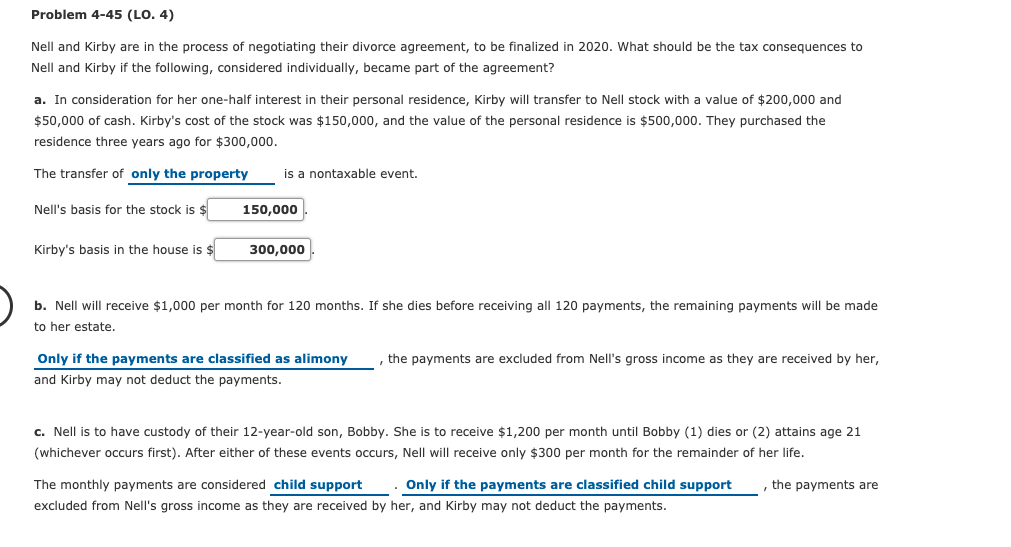

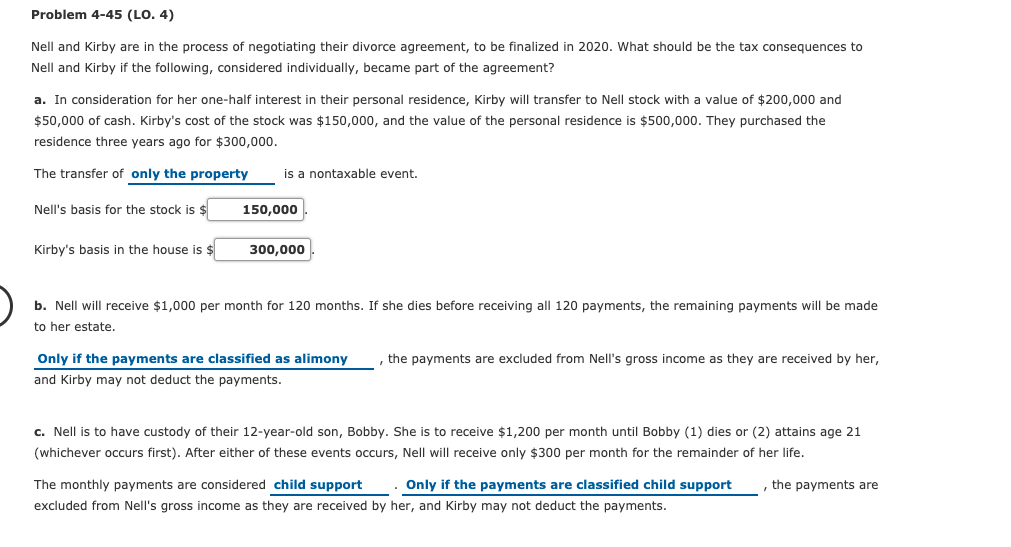

Problem 4-45 (LO. 4) Nell and Kirby are in the process of negotiating their divorce agreement, to be finalized in 2020. What should be the tax consequences to Nell and Kirby if the following, considered individually, became part of the agreement? a. In consideration for her one-half interest in their personal residence, Kirby will transfer to Nell stock with a value of $200,000 and $50,000 of cash. Kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. They purchased the residence three years ago for $300,000. The transfer of only the property is a nontaxable event. Nell's basis for the stock is $ 150,000 Kirby's basis in the house is $ 300,000 b. Nell will receive $1,000 per month for 120 months. If she dies before receiving all 120 payments, the remaining payments will be made to her estate. Only if the payments are classified as alimony and Kirby may not deduct the payments. the payments are excluded from Nell's gross income as they are received by her, C. Nell is to have custody of their 12-year-old son, Bobby. She is to receive $1,200 per month until Bobby (1) dies or (2) attains age 21 (whichever occurs first). After either of these events occurs, Nell will receive only $300 per month for the remainder of her life. , the payments are The monthly payments are considered child support Only if the payments are classified child support excluded from Nell's gross income as they are received by her, and Kirby may not deduct the payments. Problem 4-45 (LO. 4) Nell and Kirby are in the process of negotiating their divorce agreement, to be finalized in 2020. What should be the tax consequences to Nell and Kirby if the following, considered individually, became part of the agreement? a. In consideration for her one-half interest in their personal residence, Kirby will transfer to Nell stock with a value of $200,000 and $50,000 of cash. Kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. They purchased the residence three years ago for $300,000. The transfer of only the property is a nontaxable event. Nell's basis for the stock is $ 150,000 Kirby's basis in the house is $ 300,000 b. Nell will receive $1,000 per month for 120 months. If she dies before receiving all 120 payments, the remaining payments will be made to her estate. Only if the payments are classified as alimony and Kirby may not deduct the payments. the payments are excluded from Nell's gross income as they are received by her, C. Nell is to have custody of their 12-year-old son, Bobby. She is to receive $1,200 per month until Bobby (1) dies or (2) attains age 21 (whichever occurs first). After either of these events occurs, Nell will receive only $300 per month for the remainder of her life. , the payments are The monthly payments are considered child support Only if the payments are classified child support excluded from Nell's gross income as they are received by her, and Kirby may not deduct the payments

Please correct my answer if I'm wrong and give explanation.

Please correct my answer if I'm wrong and give explanation.