Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE CORRECT NUMBERS FOR LAST JOURNAL ENTRY On December 31 of Year 1, Drew Company leased equipment under a lease for a period of five

PLEASE CORRECT NUMBERS FOR LAST JOURNAL ENTRY

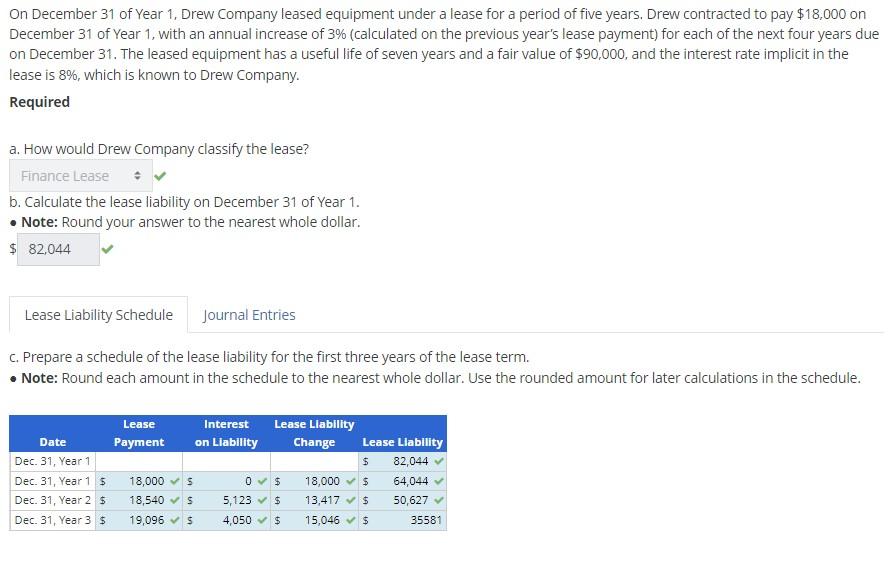

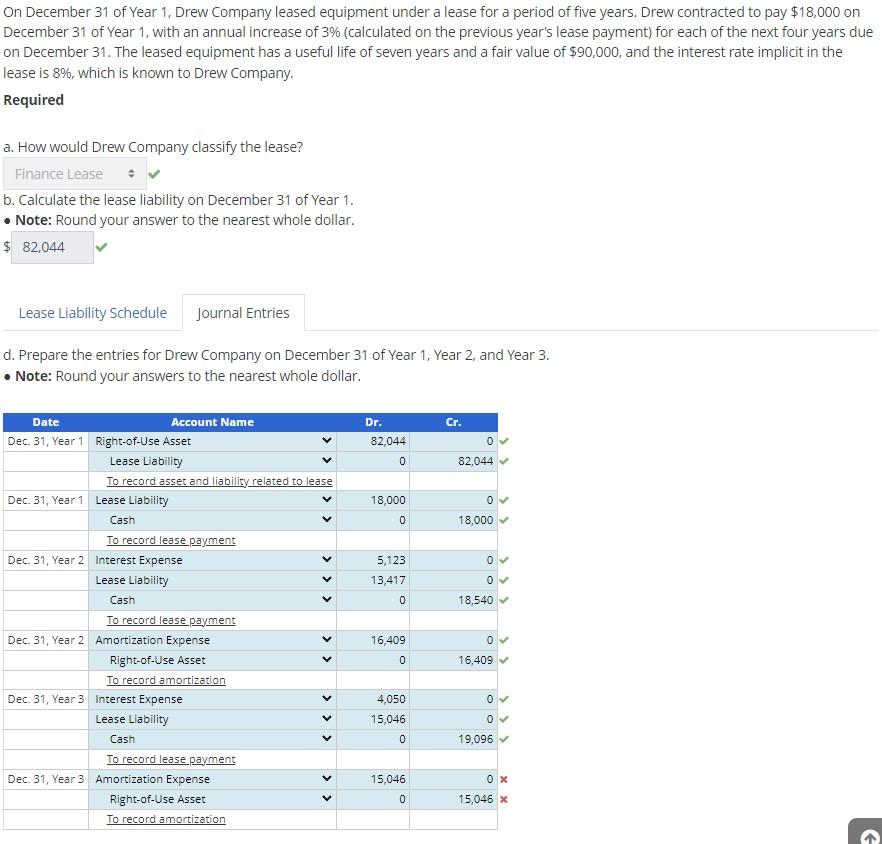

On December 31 of Year 1, Drew Company leased equipment under a lease for a period of five years. Drew contracted to pay $18,000 on December 31 of Year 1, with an annual increase of 3% (calculated on the previous year's lease payment) for each of the next four years due on December 31. The leased equipment has a useful life of seven years and a fair value of $90,000, and the interest rate implicit in the lease is 8%, which is known to Drew Company. Required a. How would Drew Company classify the lease? b. Calculate the lease liability on December 31 of Year 1. - Note: Round your answer to the nearest whole dollar. $ c. Prepare a schedule of the lease liability for the first three years of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. On December 31 of Year 1, Drew Company leased equipment under a lease for a period of five years. Drew contracted to pay $18,000 on December 31 of Year 1, with an annual increase of 3% (calculated on the previous year's lease payment) for each of the next four years due on December 31. The leased equipment has a useful life of seven years and a fair value of $90,000, and the interest rate implicit in the lease is 8%, which is known to Drew Company. Required a. How would Drew Company classify the lease? b. Calculate the lease liability on December 31 of Year 1. - Note: Round your answer to the nearest whole dollar. $ d. Prepare the entries for Drew Company on December 31 of Year 1, Year 2, and Year 3. - Note: Round your answers to the nearest whole dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started