please correct the balance sheet and add what is necessary

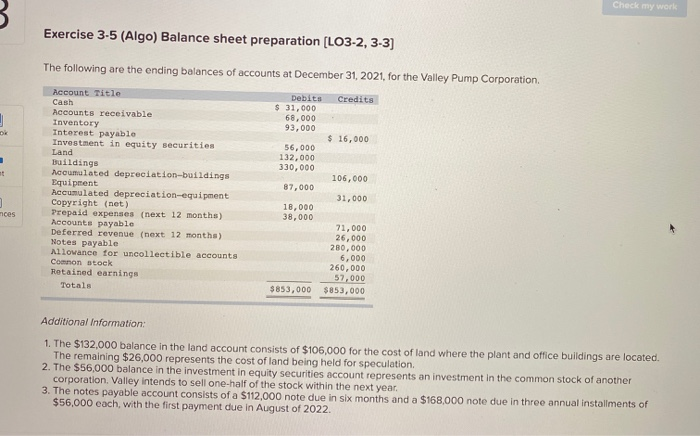

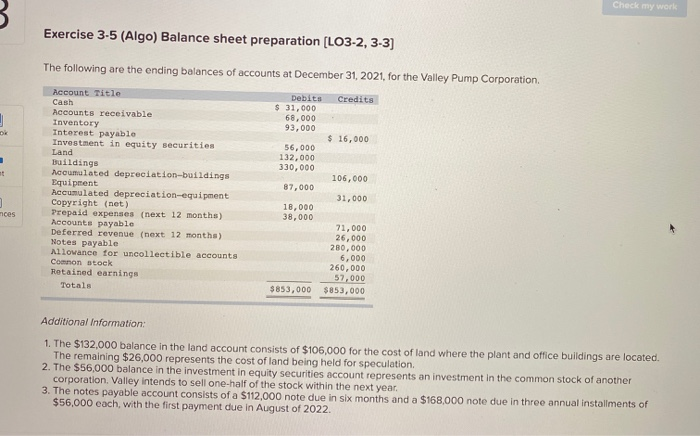

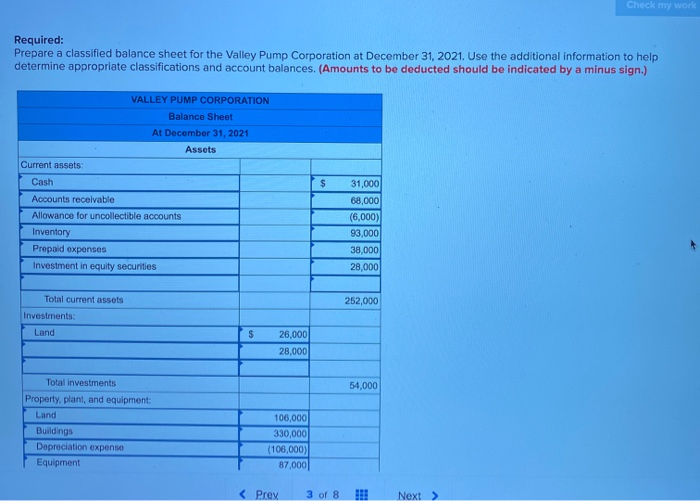

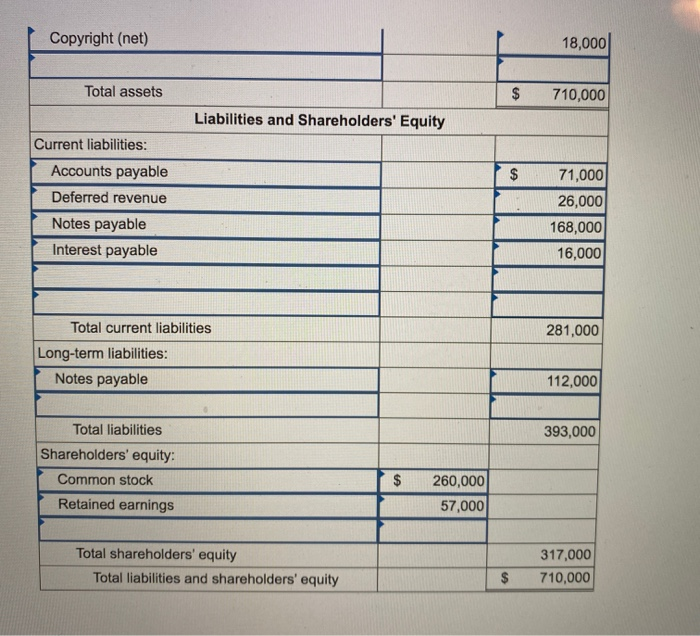

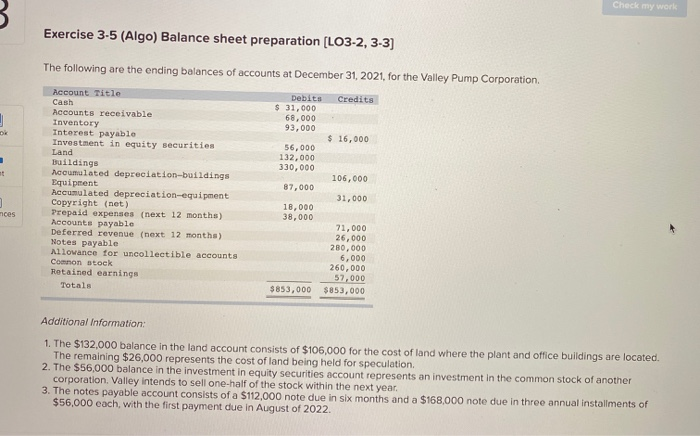

Exercise 3-5 (Algo) Balance sheet preparation (LO3-2, 3-3) The following are the ending balances of accounts at December 31, 2021, for the Valley Pump Corporation, Credits Debits $ 31,000 68,000 93,000 $ 16,000 56,000 132.000 330,000 106,000 87,000 Account Title Cash Accounts receivable Inventory Interest payable Investment in equity securities Land Buildings nccumulated depreciation-buildings Equipment Accumulated depreciation equipment Copyright (net) Prepaid expenses (next 12 months) Accounts payable Deferred revenue (next 12 months) Notes payable Allowance for uncollectible accounts Connon stock Retained earnings Totals 31,000 18,000 38,000 nces 71,000 26,000 280.000 6.000 260,000 57.000 $853,000 $853,000 Additional Information: 1. The $132,000 balance in the land account consists of $106,000 for the cost of land where the plant and office buildings are located. The remaining $26,000 represents the cost of land being held for speculation 2. The $56,000 balance in the investment in equity securities account represents an investment in the common stock of another corporation. Valley intends to sell one-half of the stock within the next year. 3. The notes payable account consists of a $112.000 note due in six months and a $168,000 note due in three annual installments of $56,000 each, with the first payment due in August of 2022 Check my work Required: Prepare a classified balance sheet for the Valley Pump Corporation at December 31, 2021. Use the additional information to help determine appropriate classifications and account balances. (Amounts to be deducted should be indicated by a minus sign.) VALLEY PUMP CORPORATION Balance Sheet At December 31, 2021 Assets Current assets: Cash Accounts receivable Allowance for uncollectible accounts Inventory Prepaid expenses Investment in equity securities 31,000 68,000 (6,000) 93.000 38,000 28.000 252.000 Total current assets Investments: Land 26.000 28.000 Total investments 54,000 Property, plant, and equipment: Land Buildings 106,000 330,000 (106,000) 87,000 Depreciation expense Equipment Buildings Depreciation expense Equipment TERET 330,000 (106,000) 87,000 417,000 (31,000) I 1 1 " 386,000 Net property, plant, and equipment Intangible assets: Copyright (net) PERFET 18,000 Total assets 710,000 Liabilities and Shareholders' Equity $ ces Current liabilities: Accounts payable yable Deferred revenue Notes payable Interest payable 71,000 26,000 168,000 16,000 281,000 Total current liabilities Long-term liabilities: Notes payable 112,000 393,000 Total liabilities Shareholders' equity: Common stock Retained earnings $ 260,000 57,000 Copyright (net) 18,000 Total assets $ 710,000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Deferred revenue Notes payable Interest payable : 71,000 26,000 168,000 16,000 281,000 Total current liabilities Long-term liabilities: Notes payable 112,000 393,000 Total liabilities Shareholders' equity: Common stock Retained earnings $ 260,000 57,000 | Total shareholders' equity Total liabilities and shareholders' equity 317,000 710,000