Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please correct the ones in red exactly , is missing because is wrong . The first time someone aswered but some results are wrong in

please correct the ones in red

exactly , is missing because is wrong . The first time someone aswered but some results are wrong in red

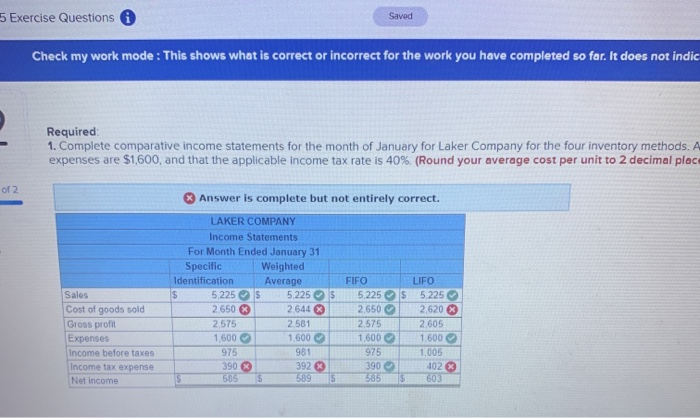

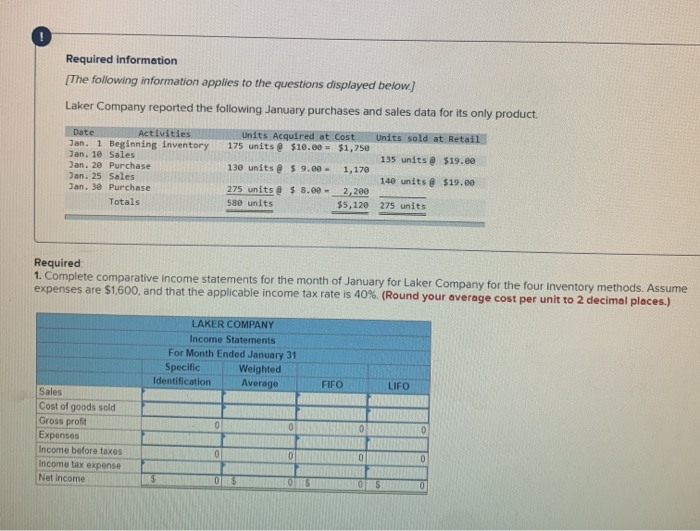

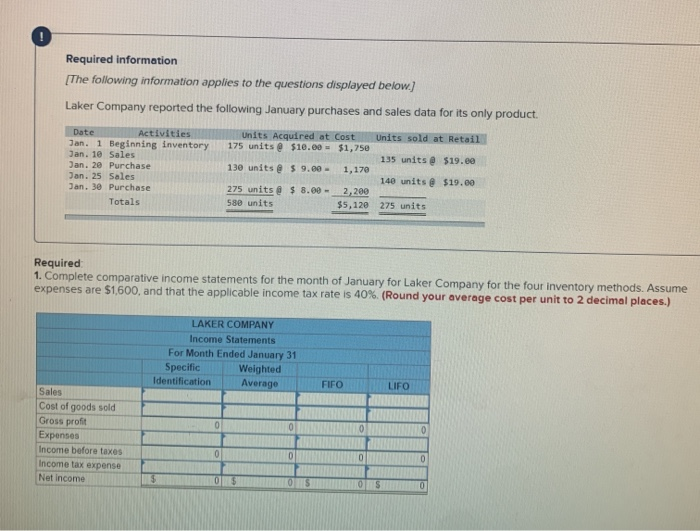

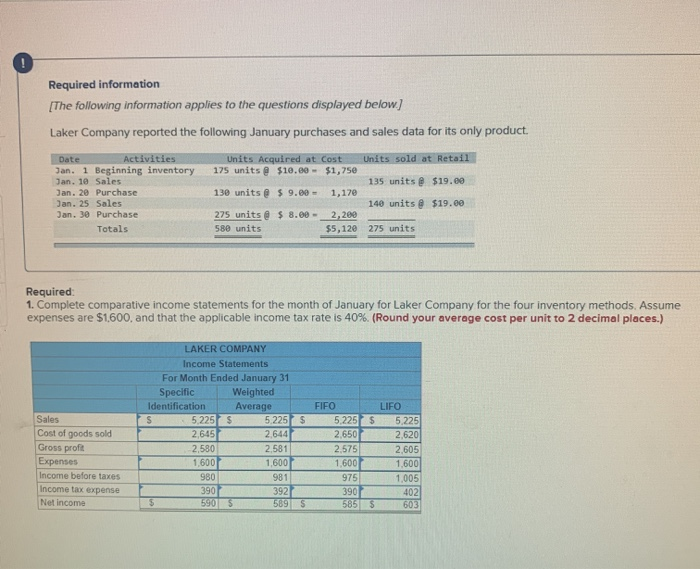

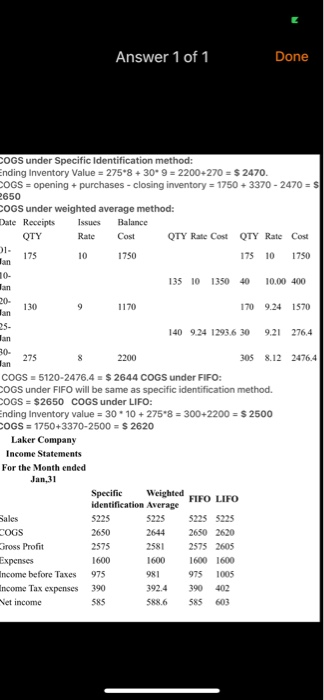

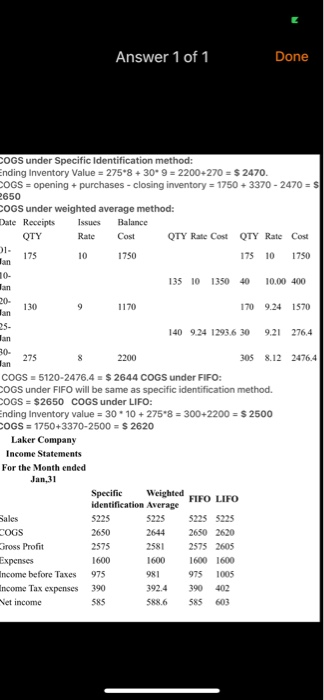

5 Exercise Questions Saved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indic Required 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. A expenses are $1,600, and that the applicable income tax rate is 40%. (Round your average cost per unit to 2 decimal plac of 2 Answer is complete but not entirely correct. Sales Cost of goods sold Gross profit Expenses Income before taxes Income tax expense Net income LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average S 5.225S 5.225$ 2.650 X 2644 2.575 2581 1.600 1,600 975 981 390 3923 S 585 S 589 S FIFO 5.225$ 2.650 2.575 1,600 975 390 586 $ LIFO 5.225 2,620 2,605 1,600 1,005 1023 603 S Required information [The following information applies to the questions displayed below.) Laker Company reported the following January purchases and sales data for its only product Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Jan. 30 Purchase Totals Units Acquired at Cost Units sold at Retail 175 units @ $10.00 = $1,750 135 units @ $19.00 130 units @ $ 9.00 - 1,170 140 units @ $19.00 275 units @ $ 8.00 - 2,200 580 units $5,120 275 units Required 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,600, and that the applicable income tax rate is 40%. (Round your average cost per unit to 2 decimal places.) LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average FIFO LIFO 0 0 Sales Cost of goods sold Gross profit Expenses Income before taxes Income tax expense Net Income 0 0 0 0 $ 0$ 0 LOS 0 Required information [The following information applies to the questions displayed below.) Laker Company reported the following January purchases and sales data for its only product Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Jan. 30 Purchase Totals Units Acquired at Cost Units sold at Retail 175 units @ $10.00 = $1,750 135 units @ $19.00 130 units @ $ 9.00 - 1,170 140 units @ $19.00 275 units @ $ 8.00 - 2,200 580 units $5,120 275 units Required 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,600, and that the applicable income tax rate is 40%. (Round your average cost per unit to 2 decimal places.) LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average FIFO LIFO 0 0 Sales Cost of goods sold Gross profit Expenses Income before taxes Income tax expense Net Income 0 0 0 0 $ 0$ 0 LOS 0 Required information [The following information applies to the questions displayed below) Laker Company reported the following January purchases and sales data for its only product. Date Activities Units Acquired at Cost Units sold at Retail Jan. 1 Beginning inventory 175 units @ $10.00 - $1,750 Jan. 10 Sales 135 units @ $19.00 Jan. 20 Purchase 130 units @ $ 9.00 - Jan. 25 Sales 140 units @ $19.00 Jan. 30 Purchase 275 units @ $ 8.00 - 2,200 Totals 580 units $5,120 275 units 1,170 Required 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1.600, and that the applicable income tax rate is 40%. (Round your average cost per unit to 2 decimal places.) Sales Cost of goods sold Gross proft Expenses Income before taxes Income tax expense Net Income LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average S 5,225$ 5.225 $ 2,645 2.644 2,580 2.581 1,600 1,600 980 981 390 392 590 S 589S FIFO 5.225 s 2,650 2.575 1,600 975 390 585 $ LIFO 5.225 2,620 2,605 1,600 1,005 402 603 Answer 1 of 1 Done COGS under Specific Identification method: Ending Inventory Value = 275*8 + 309 9 = 2200-270 = $ 2470. COGS = opening + purchases - closing inventory = 1750 + 3370 - 2470 = 8 2650 COGS under weighted average method: Date Receipts Issues Balance Rate QTY Rate Cost QTY Rate Cost 01. 1750 Jan 135 10 1350 40 QTY Cost 175 10 175 10 1750 10.00 400 Jan 130 9 1170 170 9.24 1570 20- Tan 25- lan 30- Jan 140 9:24 1293.6 30 9.21 276.4 275 & 2200 305 8.12 2476.4 COGS = 5120-2476,4$ 2644 COGS under FIFO: COGS under FIFO will be same as specific identification method. COGS = $2650 COGS under LIFO: nding Inventory value = 30 * 10 + 275*8 = 300+2200 = $ 2500 COGS = 1750+3370-2500 = $ 2620 Laker Company Income Statements For the Month ended Jan 31 Sales COGS Gross Profit Expenses Income before Taxes Income Tax expenses Vet income Specific Weighted identification Average 5225 5225 2650 2644 2575 2581 1600 1600 975 981 390 392.4 SRS 588.6 FIFO LIFO 5225 5225 2650 2620 2575 2605 1600 1600 975 1005 390 402 585 603

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started