Answered step by step

Verified Expert Solution

Question

1 Approved Answer

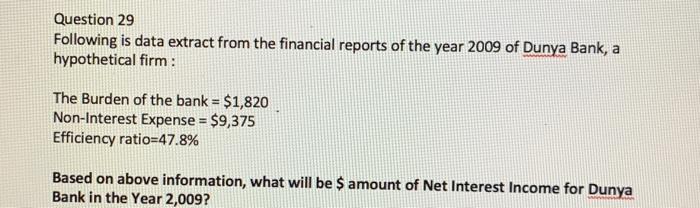

Please could I have anwsers with steps Question 29 Following is data extract from the financial reports of the year 2009 of Dunya Bank, a

Please could I have anwsers with steps

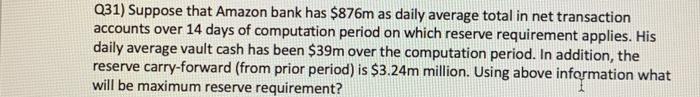

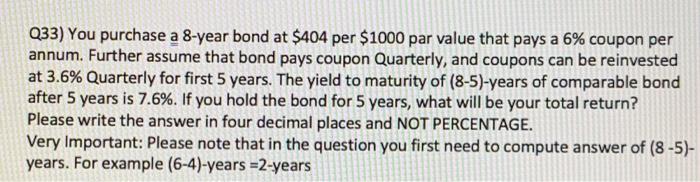

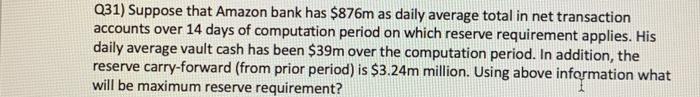

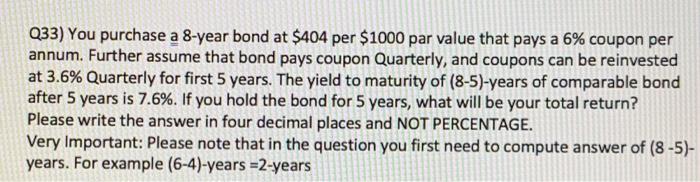

Question 29 Following is data extract from the financial reports of the year 2009 of Dunya Bank, a hypothetical firm: The Burden of the bank = $1,820 Non-Interest Expense = $9,375 Efficiency ratio=47.8% Based on above information, what will be $ amount of Net Interest Income for Dunya Bank in the Year 2,009? 031) Suppose that Amazon bank has $876m as daily average total in net transaction accounts over 14 days of computation period on which reserve requirement applies. His daily average vault cash has been $39m over the computation period. In addition, the reserve carry-forward (from prior period) is $3.24m million. Using above information what will be maximum reserve requirement? Q33) You purchase a 8-year bond at $404 per $1000 par value that pays a 6% coupon per annum. Further assume that bond pays coupon Quarterly, and coupons can be reinvested at 3.6% Quarterly for first 5 years. The yield to maturity of (8-5)-years of comparable bond after 5 years is 7.6%. If you hold the bond for 5 years, what will be your total return? Please write the answer in four decimal places and NOT PERCENTAGE. Very Important: Please note that in the question you first need to compute answer of (8-5)- years. For example (6-4)-years =2-years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started