Please could you assist me with the attached question and how to calculate the accumulated funds.

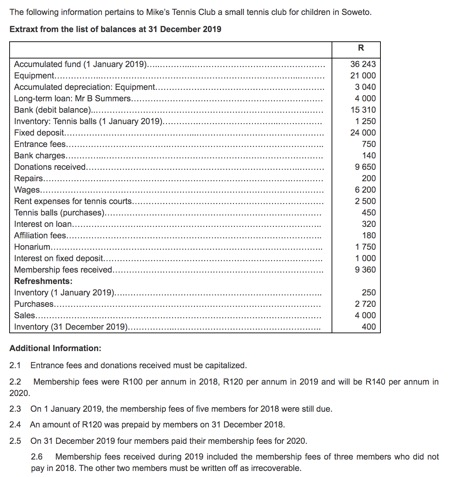

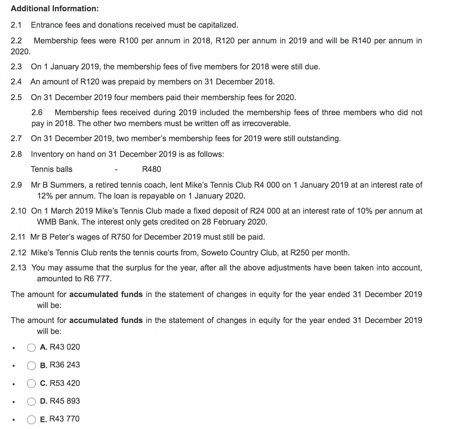

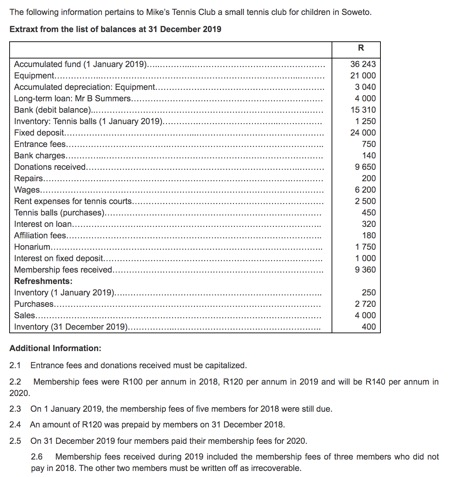

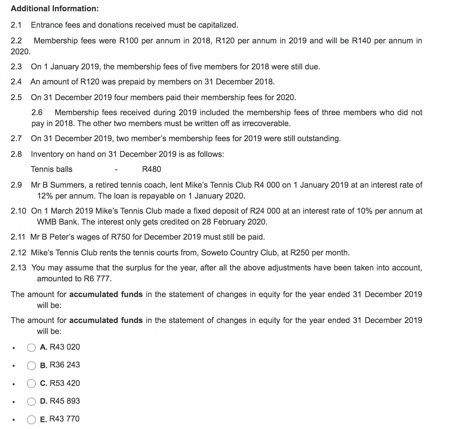

The following information pertains to Mike's Tennis Club a small tennis club for children in Soweto. Extraxt from the list of balances at 31 December 2019 R Accumulated fund (1 January 2019). Equipment........... Accumulated depreciation: Equipment. Long-term loan: Mr B Summers... Bank (debit balance)......... Inventory: Tennis balls (1 January 2019). Fixed deposit........ Entrance fees..... Bank charges..... Donations received.......... Repairs......... Wages........ Rent expenses for tennis courts. Tennis balls (purchases).......... Interest on loan..... Affiliation fees..... Honarium...... Interest on foxed deposit..... Membership fees received Refreshments: Inventory (1 January 2019). Purchases.... Sales..... Inventory (31 December 2019). 36 243 21 000 3040 4000 15 310 1 250 24 000 750 140 9 650 200 6200 2 500 450 320 180 1750 1 000 9 360 250 2720 4000 400 Additional Information: 2.1 Entrance fees and donations received must be capitalized. 2.2 Membership fees were R100 per annum in 2018, R120 per annum in 2019 and will be R140 per annum in 2020 2.3 On 1 January 2019, the membership fees of five members for 2018 were still due. 24 An amount of R120 was prepaid by members on 31 December 2018 2.5 On 31 December 2019 four members paid their membership fees for 2020. 2.6 Membership fees received during 2019 included the membership fees of three members who did not pay in 2018. The other two members must be written off as irrecoverable. Additional Information: 2.1 Entrance fees and donations received must be capitalized. 2.2 Membership fees were R100 per annum in 2018, R120 per annum in 2019 and will be R140 per annum in 2020 2.3 On 1 January 2019, the membership fees of five members for 2018 were stil due. 24 An amount of R120 was prepaid by members on 31 December 2018 2.5 On 31 December 2019 four members paid their membership fees for 2020. 26 Membership fees received during 2019 included the membership fees of three members who did not pay in 2018. The other two members must be written off as irrecoverable. 2.7 On 31 December 2019, two member's membership fees for 2019 were still outstanding 2.8 Inventory on hand on 31 December 2019 is as follows: Tennis balls R480 2.9 Mr B Summers, a retired tennis coach, lent Mike's Tennis Club R4 000 on 1 January 2019 at an interest rate of 12% per annum. The loan is repayable on 1 January 2020. 2.10 On 1 March 2019 Mike's Tennis Club made a fixed deposit of R24 000 at an interest rate of 10% per annum at WMB Bank. The interest only gets credited on 28 February 2020. 2.11 Mr B Peter's wages of R750 for December 2019 must still be paid. 2.12 Mike's Tennis Club rents the tennis courts from, Soweto Country Club, at R250 per month 2.13 You may assume that the surplus for the year, after all the above adjustments have been taken into account amounted to R6 777 The amount for accumulated funds in the statement of changes in equity for the year ended 31 December 2019 will be: The amount for accumulated funds in the statement of changes in equity for the year ended 31 December 2019 will be A. R43020 B. R36 243 C. R53 420 D. R45 893 E. R43 770