Answered step by step

Verified Expert Solution

Question

1 Approved Answer

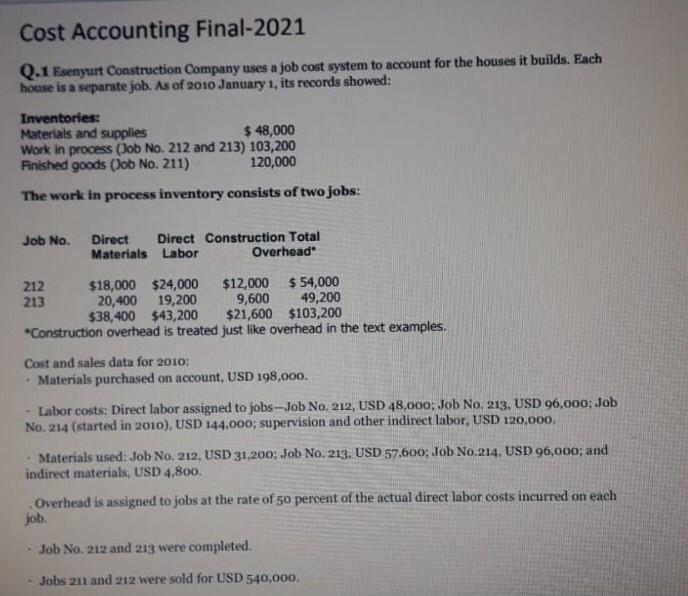

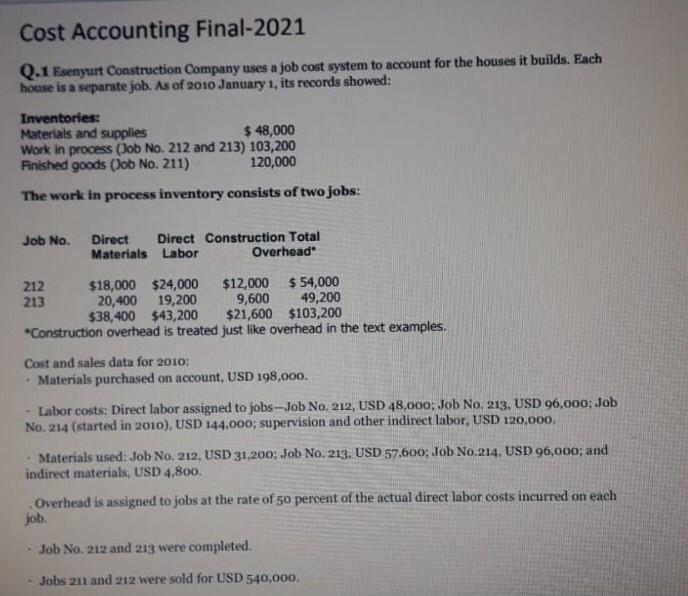

please could you solve it urgent Cost Accounting Final-2021 Q.1 Fsenyurt Construction Company uses a job cost system to account for the houses it builds.

please could you solve it urgent

Cost Accounting Final-2021 Q.1 Fsenyurt Construction Company uses a job cost system to account for the houses it builds. Each honse is a separate job. As of 2010 January 1 , its records showed: The work in process inventory consists of two jobs: "Construction overhead is treated just like overneac in me text examples. Cost and sales data for 2010: - Materials purchased on account, USD 198,000. - Labor costs: Direct labor assigned to jobsJob No. 212, USD 48,000; Job No, 213, USD 96,0oo; Job No. 214 (started in 2010), USD 144,000; supervision and other indirect labor, USD 120,000. - Materials used: Job No. 212, USD 31,200; Job No, 213, USD 57,600 ; Job No. 214, USD 96,000; and indirect materials, USD 4,800 . .Overhead is assigned to jobs at the rate of 50 percent of the actual direct labor costs incurred on each job. - Job No. 212 and 213 were completed. - Jobs 211 and 212 were sold for USD 540,000. Cost Accounting Final-2021 Q.1 Fsenyurt Construction Company uses a job cost system to account for the houses it builds. Each honse is a separate job. As of 2010 January 1 , its records showed: The work in process inventory consists of two jobs: "Construction overhead is treated just like overneac in me text examples. Cost and sales data for 2010: - Materials purchased on account, USD 198,000. - Labor costs: Direct labor assigned to jobsJob No. 212, USD 48,000; Job No, 213, USD 96,0oo; Job No. 214 (started in 2010), USD 144,000; supervision and other indirect labor, USD 120,000. - Materials used: Job No. 212, USD 31,200; Job No, 213, USD 57,600 ; Job No. 214, USD 96,000; and indirect materials, USD 4,800 . .Overhead is assigned to jobs at the rate of 50 percent of the actual direct labor costs incurred on each job. - Job No. 212 and 213 were completed. - Jobs 211 and 212 were sold for USD 540,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started