Question

Please count this for 2 or 3 questions or whatever you need to to solve this. I really need help with this please (2) What

Please count this for 2 or 3 questions or whatever you need to to solve this. I really need help with this please

(2) What does this example illustrate concerning the impact of financial leverage on expected rate of return and risk?

d. With the preceding points in mind, now consider the optimal capital structure for SDSS.

(1) To begin, define the term optimal capital structure.

(2) Describe briefly, without using numbers, the sequence of events that would occur if SDSS decided to change its capital structure to include more debt.

(3) Assume that shares could be repurchased at the current market price of $20 per share. Calculate SDSSs expected EPS and TIE at debt levels of $0, $250,000, $500,000, $750,000, and $1,000,000. How many shares would remain after recapitalization under each scenario? [EPS = (Net income)/(outstanding shares)]

(4) What would be the new stock price if SDSS recapitalizes with $250,000 of debt? $500,000? $750,000? $1,000,000? Recall that the SDSS pays out all earnings as dividends, so g = 0.

(5) Considering only the levels of debt discussed, what is SDSSs optimal capital structure?

(6) Is EPS maximized at the debt level that maximizes share price? Why?

(7) What is the WACC at the optimal capital structure?

e. Suppose you discovered that SDSS had more business risk than you originally estimated. Describe how this would affect the analysis. What if the firm had less business risk than originally estimated?

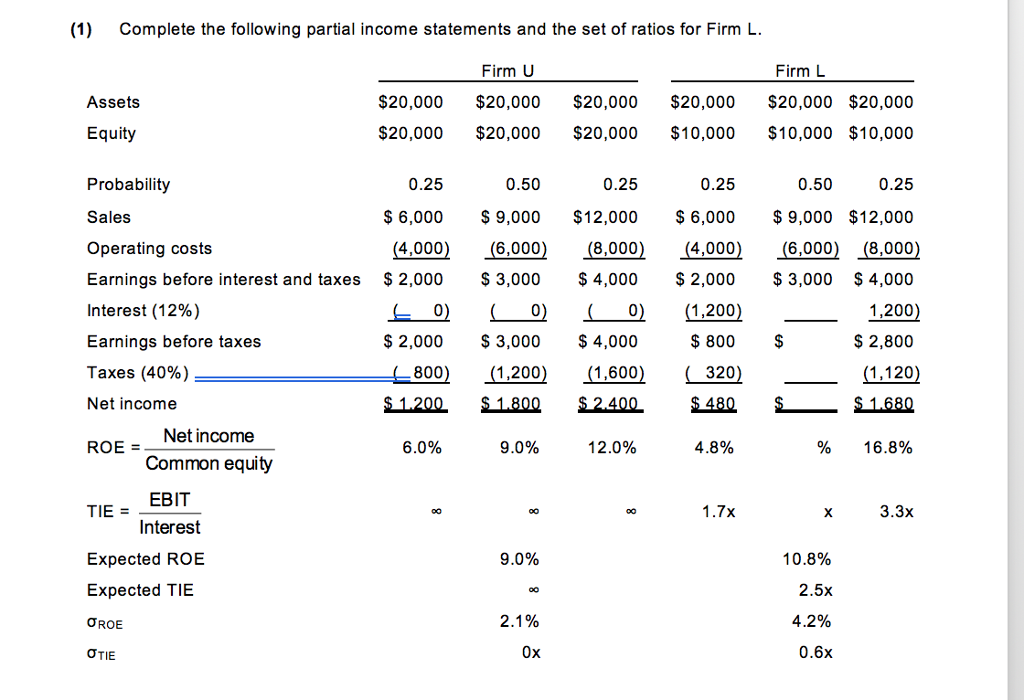

(1) Complete the following partial income statements and the set of ratios for Firm L. Firm U Firm L Assets $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 Equity $20,000 $20,000 $20,000 $10,000 $10,000 $10,000 0.25 0.50 0.25 0.25 0.50 0.25 Probability Sales Operating costs Earnings before interest and taxes $ 2,000 S 3,000 4,000 2,000 $3,000 $ 4,000 Interest (12%) Earnings before taxes Taxes (40%) ( 800) (1,200) (1,600) 320) Net income $ 6,000 $9,000 $12,000 $ 6,000 $9,000 $12,000 (4,000 6,000 (8,000) (4,000 (6,000) (8,000) 0) 0) 0) (1,200) 1,200 $ 2,800 1,120 $ 2,000 $3,000 4,000 $ 800 $ () ROENet income 6.0% 9.0% 12.0% 4.8% % 16.8% Common equity EBIT TIE = 1.7x 3.3x Interest Expected ROE Expected TIE 9.0% 10.8% 2.5x 42% 0.6x 2.1%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started