Please CREATE A INCOME STATEMENTS FOR ABPSORTION COSTING & VARIABLE-COSTING. All data is given in three pictures. Please add details for math operations. Thanks!

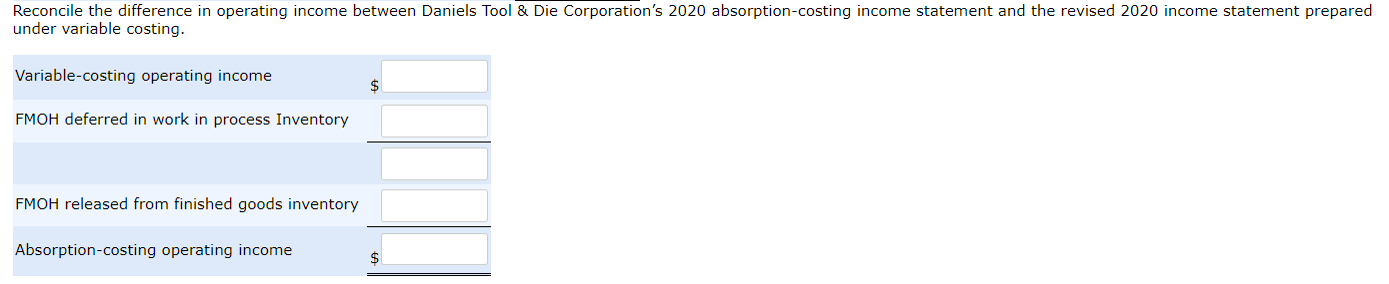

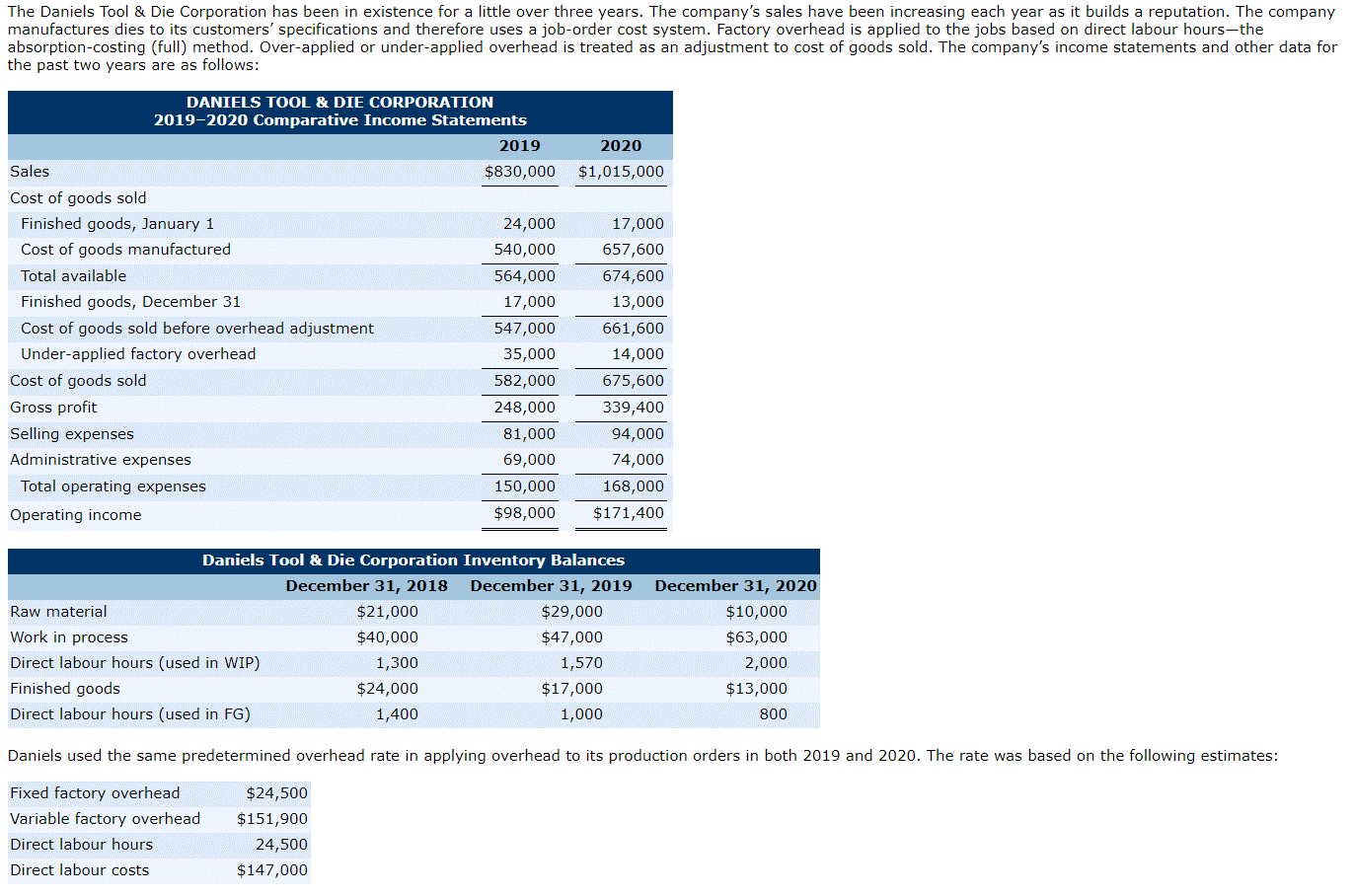

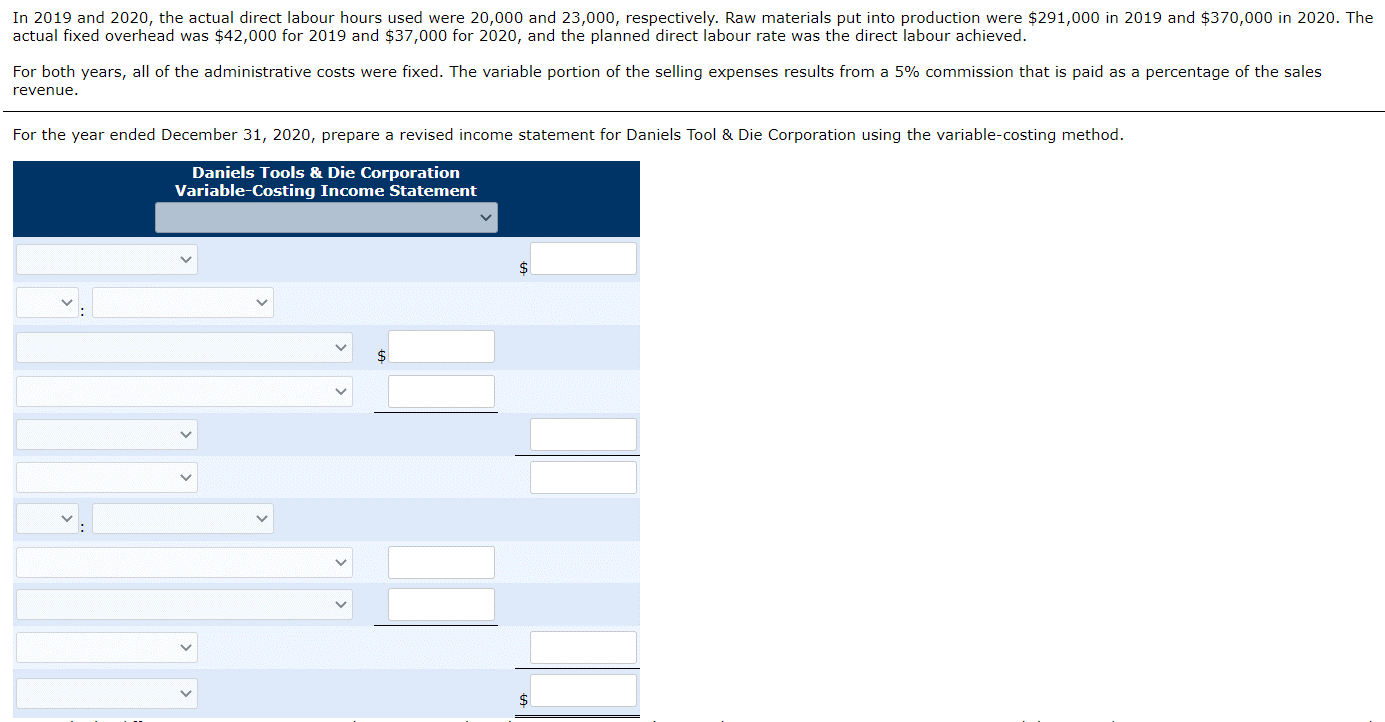

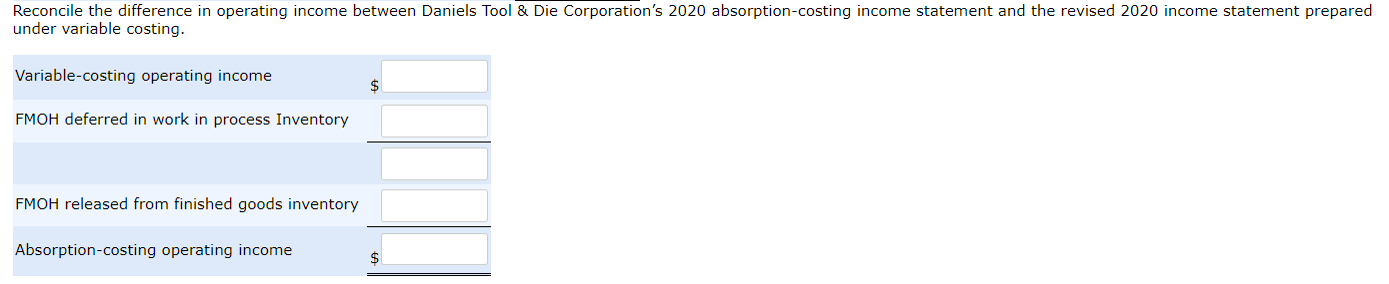

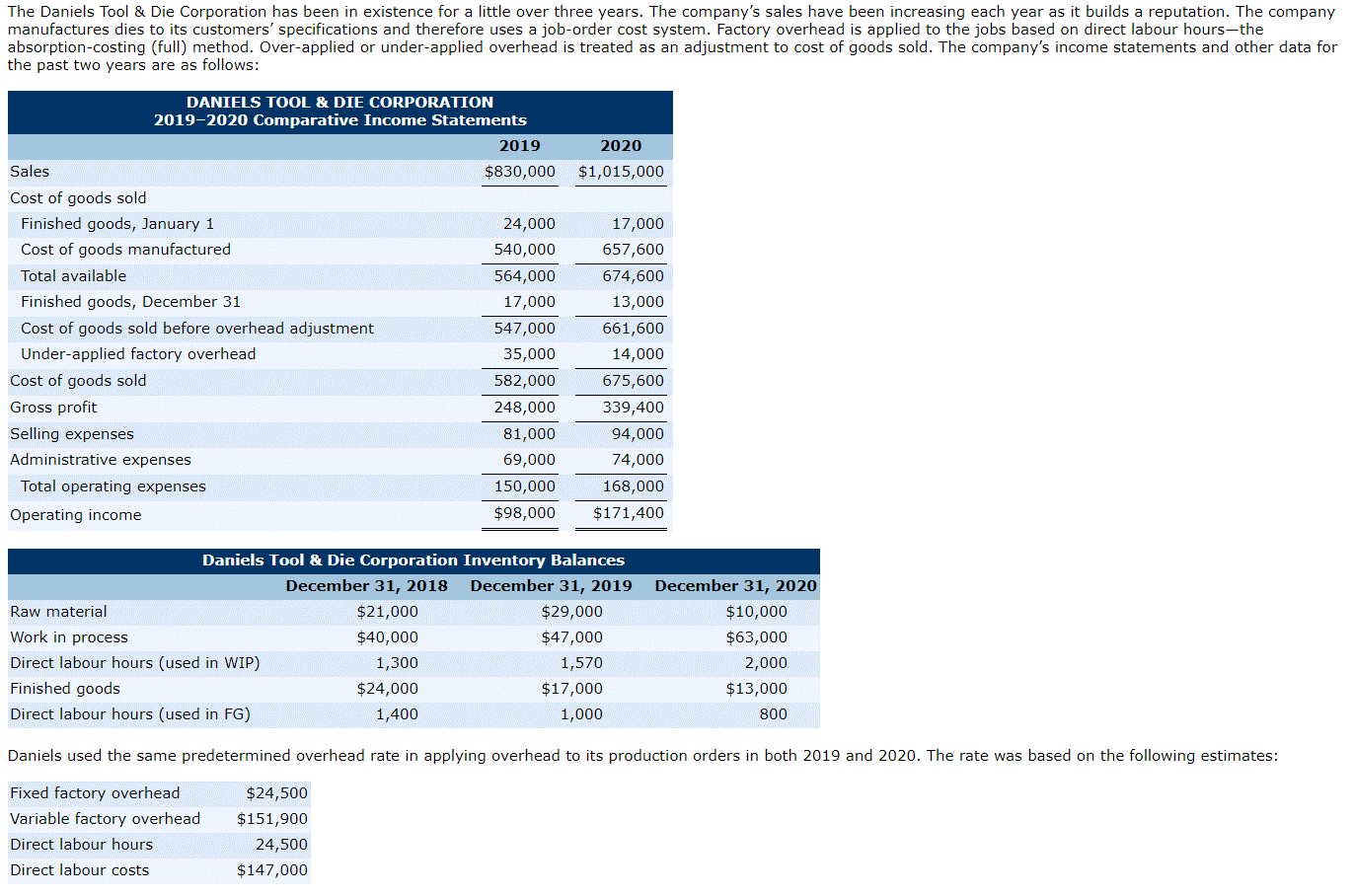

Reconcile the difference in operating income between Daniels Tool & Die Corporation's 2020 absorption-costing income statement and the revised 2020 income statement prepared under variable costing. Variable-costing operating income FMOH deferred in work in process Inventory FMOH released from finished goods inventory Absorption-costing operating income $ The Daniels Tool & Die Corporation has been in existence for a little over three years. The company's sales have been increasing each year as it builds a reputation. The company manufactures dies to its customers' specifications and therefore uses a job-order cost system. Factory overhead is applied to the jobs based on direct labour hours-the absorption-costing (full) method. Over-applied or under-applied overhead is treated as an adjustment to cost of goods sold. The company's income statements and other data for the past two years are as follows: a DANIELS TOOL & DIE CORPORATION 2019-2020 Comparative Income Statements 2019 2020 $830,000 $1,015,000 Sales Cost of goods sold Finished goods, January 1 Cost of goods manufactured Total available Finished goods, December 31 Cost of goods sold before overhead adjustment Under-applied factory overhead Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Operating income 24,000 540,000 564,000 17,000 547,000 35,000 582,000 248,000 81,000 69,000 150,000 $98,000 17,000 657,600 674,600 13,000 661,600 14,000 675,600 339,400 94,000 74,000 168,000 $171,400 Daniels Tool & Die Corporation Inventory Balances December 31, 2018 December 31, 2019 Raw material $21,000 $29,000 Work in process $40,000 $47,000 Direct labour hours (used in WIP) 1,300 1,570 Finished goods $24,000 $17,000 Direct labour hours (used in FG) 1,400 1,000 December 31, 2020 $10,000 $63,000 2,000 $13,000 800 Daniels used the same predetermined overhead rate in applying overhead to its production orders in both 2019 and 2020. The rate was based on the following estimates: Fixed factory overhead Variable factory overhead Direct labour hours Direct labour costs $24,500 $151,900 24,500 $147,000 In 2019 and 2020, the actual direct labour hours used were 20,000 and 23,000, respectively. Raw materials put into production were $291,000 in 2019 and $370,000 in 2020. The actual fixed overhead was $42,000 for 2019 and $37,000 for 2020, and the planned direct labour rate was the direct labour achieved. For both years, all of the administrative costs were fixed. The variable portion of the selling expenses results from a 5% commission that is paid as a percentage of the sales revenue. For the year ended December 31, 2020, prepare a revised income statement for Daniels Tool & Die Corporation using the variable-costing method. Daniels Tools & Die Corporation Variable-Costing Income Statement $