Answered step by step

Verified Expert Solution

Question

1 Approved Answer

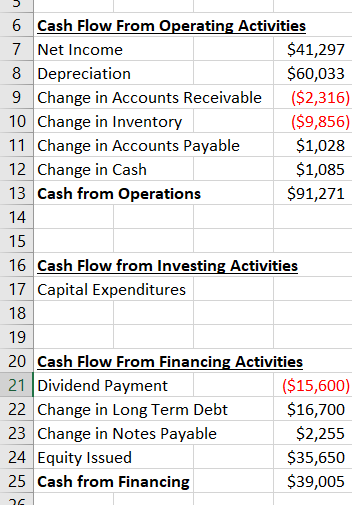

Please create a statement of cash flow using the income statement and balance sheet(first two images). The bottom image is what I had so far

Please create a statement of cash flow using the income statement and balance sheet(first two images). The bottom image is what I had so far except I don't think im doing it right. Please correct, either by changing numbers, adding, or removing as seen as necessary.

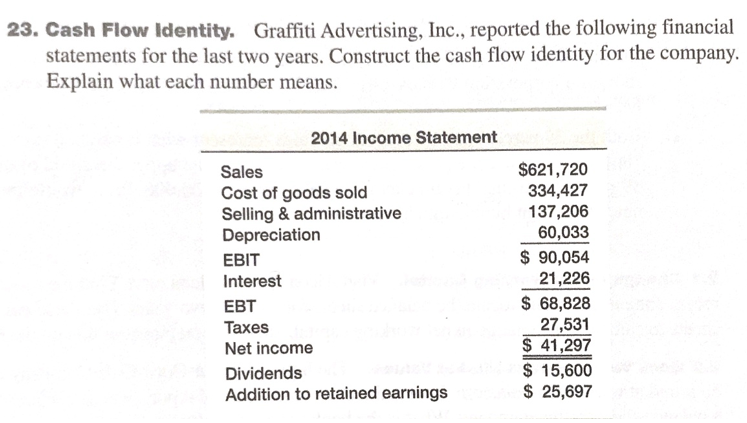

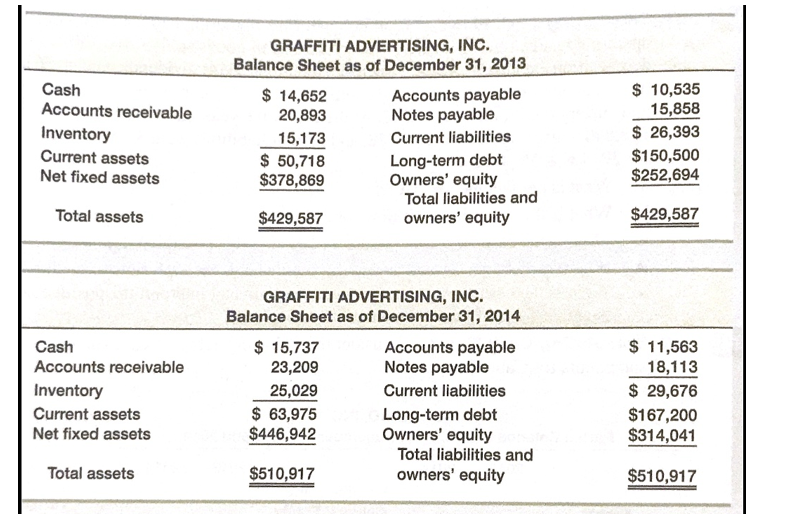

23. Cash Flow Identity. Graffiti Advertising, Inc., reported the following financial statements for the last two years. Construct the cash flow identity for the company. Explain what each number means. 2014 Income Statement Sales Cost of goods sold Selling & administrative Depreciation EBIT Interest EBT Taxes Net income Dividends Addition to retained earnings $621,720 334,427 137,206 60,033 $ 90,054 21,226 68,828 27,531 $ 41,297 $15,600 $ 25,697 GRAFFITI ADVERTISING, INC. Balance Sheet as of December 31, 2013 Cash Accounts receivable Inventory Current assets Net fixed assets 14,652 20,893 15,173 Accounts payable Notes payable Current liabilities Long-term debt Owners' equity $ 10,535 15,858 26,393 $150,500 $252,694 $50,718 $378,869 Total liabilities and owners' equity Total assets $429,587 $429,587 GRAFFITI ADVERTISING, INC. Balance Sheet as of December 31, 2014 Cash Accounts receivable Inventory Current assets Net fixed assets 15,737 23,209 25,029 $ 63,975 $446,942 Accounts payable Notes payable Current liabilities Long-term debt Owners' equity $11,563 18,113 $ 29,676 $167,200 $314,041 Total liabilities and owners' equity Total assets $510,917 $510,917 6 Cash Flow From Operating Activities 7 Net Income 8 Depreciation 9 Change in Accounts Receivable ($2,316) 10 Change in Inventory 11 Change in Accounts Payable 12 Change in Cash 13 Cash from Operations 14 15 16 Cash Flow from Investing Activities 17 Capital Expenditures 18 19 20 Cash Flow From Financing Activities 21 Dividend Payment 22 Change in Long Term Debt 23 Change in Notes Payable 24 Equity Issued 25 Cash from Financing $41,297 $60,033 ($9,856) $1,028 $1,085 $91,271 ($15,600) $16,700 $2,255 $35,650 $39,005Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started