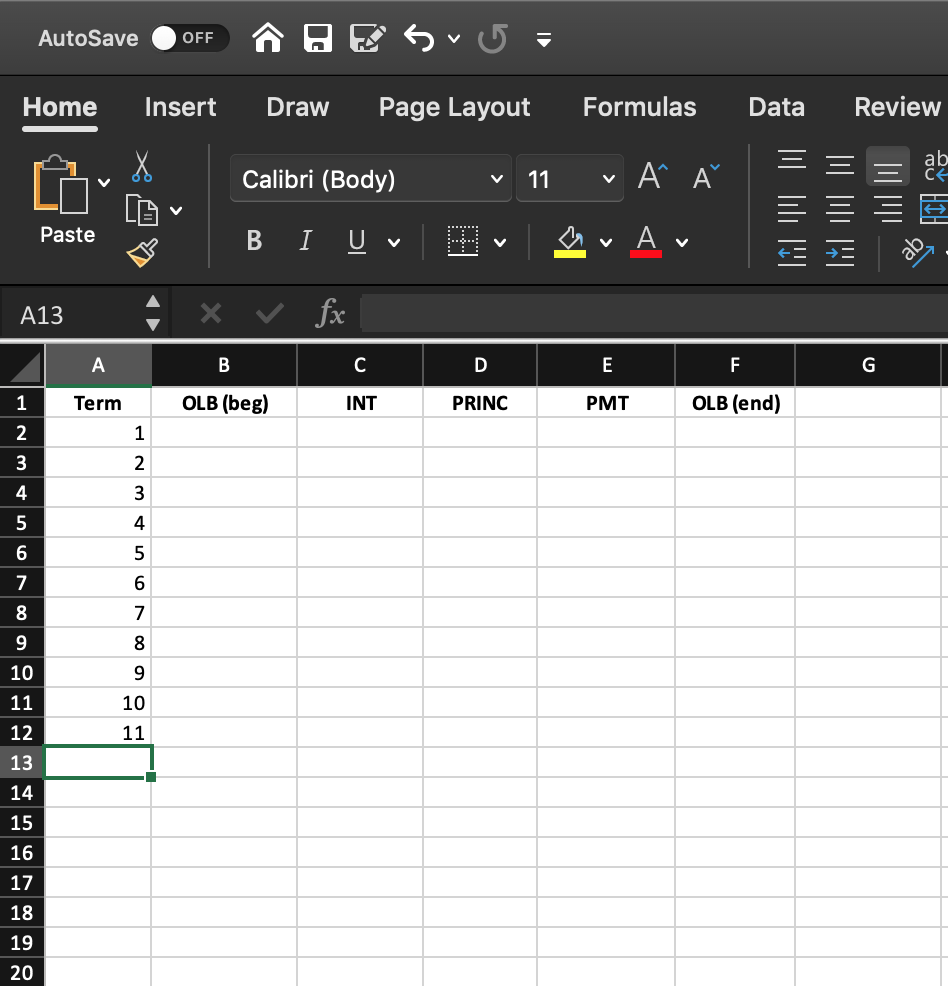

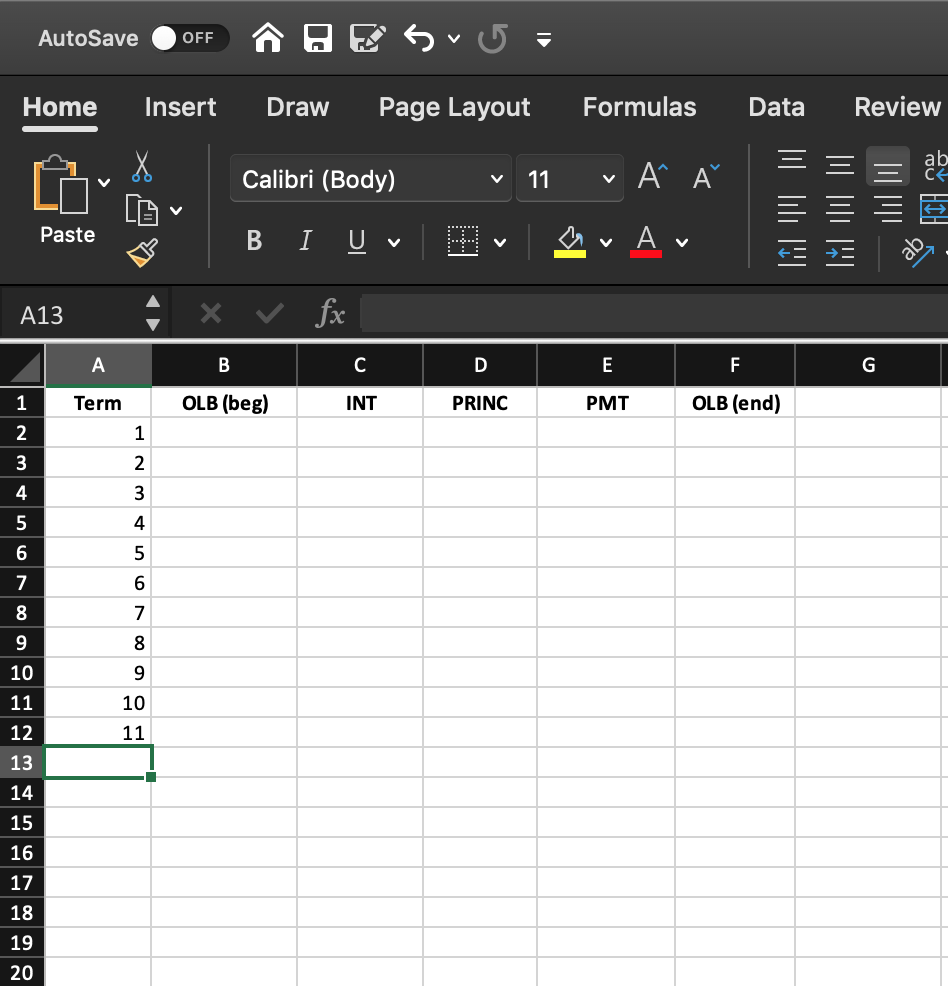

PLEASE CREATE DEBT AMORTIZATION TABLE

You and a developer have bought a site with equity for $200,000 on the last day of Year 0. You develop the project for an additional $750,000 that will be built in Year 1 which will be financed entirely by a construction loan including all interest. Upon completion, the project will be worth $1,000,000. At the completion of construction, you and the developer will obtain permanent financing in the amount of $750,000. A recap of the capital structure is outlined below. . First mortgage of $750,000 Construction financing of $750,000 Preferred equity of $180,000 Developer equity of $20,000 0 Cash flow assumptions are as follows: 1. We will assume or define the time period when the land is purchased is at the end of Year 0 or 12/31/00. 2. The project will be completed during Year 1 and the construction loan paid off at the end of Year 1. 3. Lease-up begins Year 2 or 1/1/02. We will ignore partial leasing during the year and assume all cash flows received will be at the END of the year. 4. Assume net operating cash flows start in Year 2 at $60,000/year and grow at 1%/year. 5. First mortgage of $750,000 has an interest rate of 5.5% on the outstanding balance. Also $2,000 of amortization is paid per year. 6. $50,000 of Cap Expenditures are required in years 4 and 9, thus reducing cash flow. NOTE: this will require additional equity contributions by the partners. 7. At the end of Year 11, the project is sold based on Year 12's NOI capped at 6%. The financial commitments and assumptions are as follows: 1. You as the Preferred Equity or Money Partner will cover 90% of the land cost while the operational partner will contribute 10% and retain operational control. Both partners are responsible for their proportionate shares of additional capital contributions. 2. You as the Money Partner will receive a 6% cumulative preferred return on your investment AFTER debt service has been paid on the senior loan. 3. Any cash flow remaining after all preferred return arrearages and preferred return are paid will be split 50/50. 4. The waterfall while operating the property is as follows: I. Total preferred return earned; II. Payment of previous earned but not paid; III. Any cash flow remaining is split 50/50. 5. The waterfall upon sale is as follows: I. Repayment of debt II. Total preferred return earned; III. Payment of previous earned but not paid; IV. Return of equity V. Any cash flow remaining is split 50/50. NOTE: Any equity investments made by the partners are NOT recovered until a final disposition of the property Compute the following: 1. Prepare a cash flow statement from Year 0 to Year 12. 2. Prepare an permanent debt amortization table. 3. Prepare a Preferred Equity Capital account for the Money Partner. 4. What is the IRR to the developer? 5. What is the IRR to the money partner? AutoSave OFF E sv 5 = Home Insert Draw Page Layout Formulas Data Review Calibri (Body) 11 V ' ' V ||||||| Paste B I U V V A13 fx A B C D E F G Term OLB (beg) INT PRINC PMT OLB (end) 1 2 1 3 Nm 4 5 4 6 5 7 6 8 7 9 8 9 10 11 12 13 10 11 14 15 16 17 18 19 20