Answered step by step

Verified Expert Solution

Question

1 Approved Answer

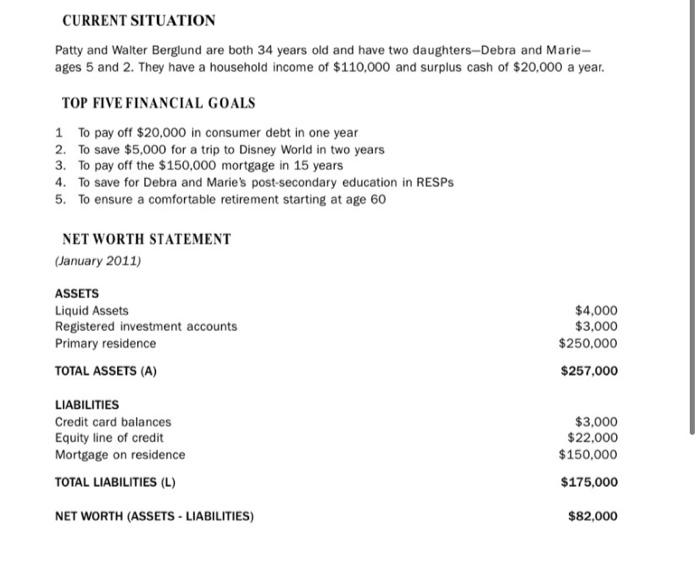

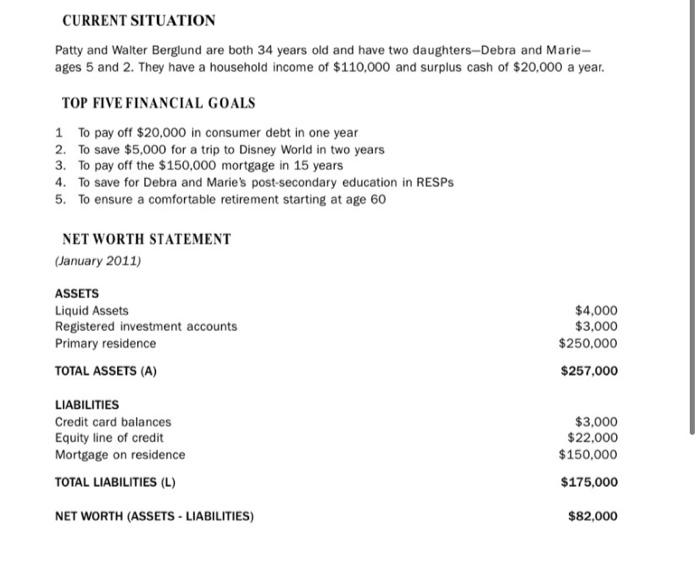

please CURRENT SITUATION Patty and Walter Berglund are both 34 years old and have two daughters-Debra and Marie- ages 5 and 2. They have a

please

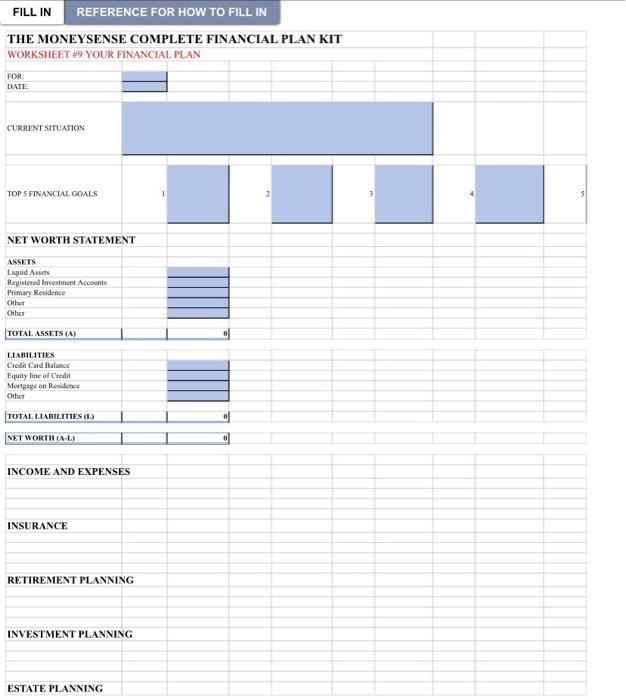

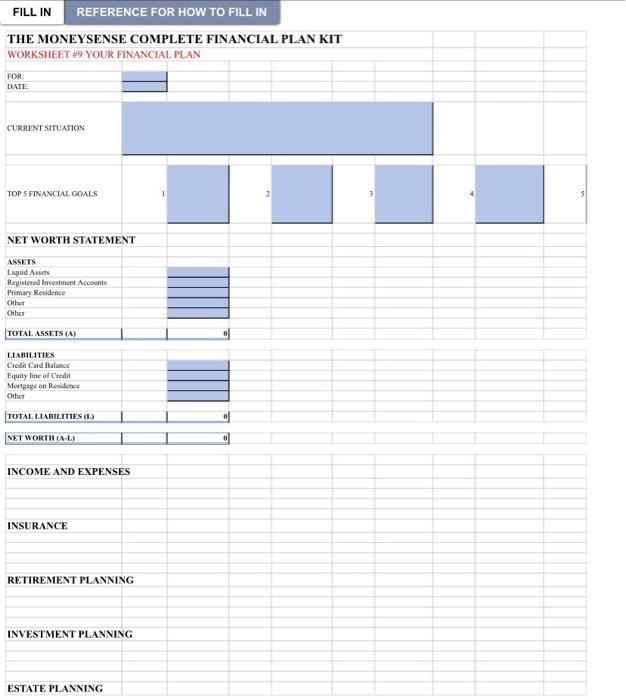

CURRENT SITUATION Patty and Walter Berglund are both 34 years old and have two daughters-Debra and Marie- ages 5 and 2. They have a household income of $110,000 and surplus cash of $20,000 a year. TOP FIVE FINANCIAL GOALS 1 To pay off $20,000 in consumer debt in one year 2. To save $5,000 for a trip to Disney World in two years 3. To pay off the $150,000 mortgage in 15 years 4. To save for Debra and Marie's post-secondary education in RESPS 5. To ensure a comfortable retirement starting at age 60 NET WORTH STATEMENT (January 2011) ASSETS Liquid Assets Registered investment accounts Primary residence TOTAL ASSETS (A) $4.000 $3,000 $250.000 $257,000 LIABILITIES Credit card balances Equity line of credit Mortgage on residence TOTAL LIABILITIES (L) $3.000 $22.000 $ 150.000 $175,000 NET WORTH (ASSETS - LIABILITIES) $82,000 FILL IN REFERENCE FOR HOW TO FILL IN THE MONEYSENSE COMPLETE FINANCIAL PLAN KIT WORKSHEET #9 YOUR FINANCIAL PLAN FOR DATE CURRENT SITUATION TOP 5 FINANCIAL GOALS NET WORTH STATEMENT ASSETS Liquid Assets Registered Investment Accounts Primary Residence Other Other TOTAL ASSETS (A) LIABILITIES Credit Card Balance Equity line of Credit Mortgage on Residence Other TOTAL LIABILITIES (L.) NET WORTILA-L) INCOME AND EXPENSES INSURANCE RETIREMENT PLANNING INVESTMENT PLANNING ESTATE PLANNING CURRENT SITUATION Patty and Walter Berglund are both 34 years old and have two daughters-Debra and Marie- ages 5 and 2. They have a household income of $110,000 and surplus cash of $20,000 a year. TOP FIVE FINANCIAL GOALS 1 To pay off $20,000 in consumer debt in one year 2. To save $5,000 for a trip to Disney World in two years 3. To pay off the $150,000 mortgage in 15 years 4. To save for Debra and Marie's post-secondary education in RESPS 5. To ensure a comfortable retirement starting at age 60 NET WORTH STATEMENT (January 2011) ASSETS Liquid Assets Registered investment accounts Primary residence TOTAL ASSETS (A) $4.000 $3,000 $250.000 $257,000 LIABILITIES Credit card balances Equity line of credit Mortgage on residence TOTAL LIABILITIES (L) $3.000 $22.000 $ 150.000 $175,000 NET WORTH (ASSETS - LIABILITIES) $82,000 FILL IN REFERENCE FOR HOW TO FILL IN THE MONEYSENSE COMPLETE FINANCIAL PLAN KIT WORKSHEET #9 YOUR FINANCIAL PLAN FOR DATE CURRENT SITUATION TOP 5 FINANCIAL GOALS NET WORTH STATEMENT ASSETS Liquid Assets Registered Investment Accounts Primary Residence Other Other TOTAL ASSETS (A) LIABILITIES Credit Card Balance Equity line of Credit Mortgage on Residence Other TOTAL LIABILITIES (L.) NET WORTILA-L) INCOME AND EXPENSES INSURANCE RETIREMENT PLANNING INVESTMENT PLANNING ESTATE PLANNING

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started