Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( Please , desperately need help with this ) Sandra Martin owns and operates Acme Solutions Co . , a first - year service business.

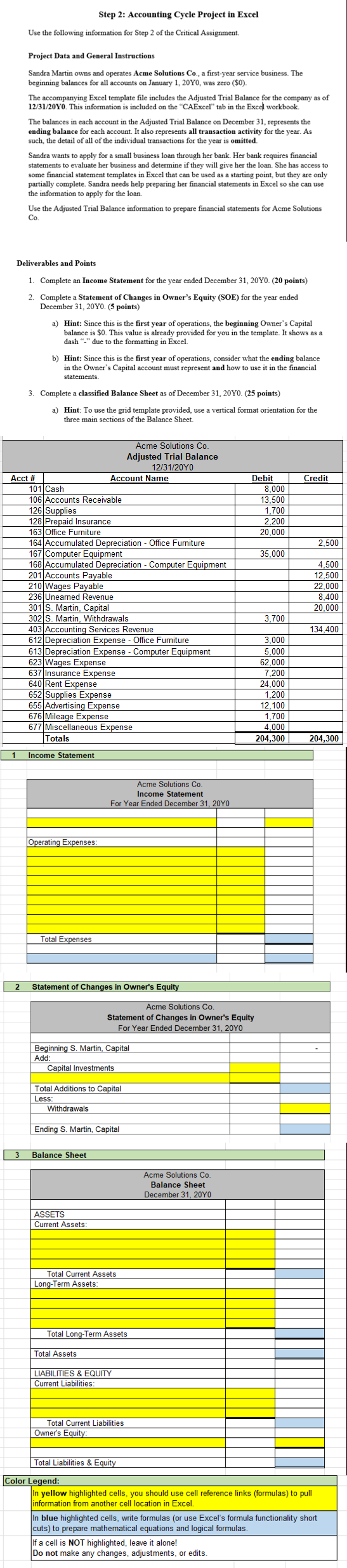

Please desperately need help with this Sandra Martin owns and operates Acme Solutions Co a firstyear service business. The beginning balances for all accounts on January Y was zero $

The accompanying Excel template file includes the Adjusted Trial Balance for the company as of Y This information is included on the CAExcel tab in the Excel workbook.

The balances in each account in the Adjusted Trial Balance on December represents the ending balance for each account. It also represents all transaction activity for the year. As such, the detail of all of the individual transactions for the year is omitted.

Sandra wants to apply for a small business loan through her bank. Her bank requires financial statements to evaluate her business and determine if they will give her the loan. She has access to some financial statement templates in Excel that can be used as a starting point, but they are only partially complete. Sandra needs help preparing her financial statements in Excel so she can use the information to apply for the loan.

Use the Adjusted Trial Balance information to prepare financial statements for Acme Solutions CoStep : Accounting Cycle Project in Excel

Use the following information for Step of the Critical Assignment.

Project Data and General Instructions

Sandra Martin owns and operates Acme Solutions Co a firstyear service business. The

The accompanying Excel template file includes the Adjusted Trial Balance for the company as of Y This information is included on the "CAExcel" tab in the Excel workbook.

The balances in each account in the Adjusted Trial Balance on December represents the

Sandra wants to apply for a small business loan through her bank. Her bank requires financi

some financial statement templates in Excel that can be used as a starting point, but they are only partially complete. Sandra needs help preparing her financial statements in Excel so she can use

Use the Adjusted Trial Balance information to prepare financial statements for Acme Solutions Co

Deliverables and Points

Complete an Income Statement for the year ended December Y points

Complete a Statement of Changes in Owner's Equity SOE for the year ended December points

a Hint: Since this is the first year of operations, the beginning Owner's Capital balance is $ This value is already provided for you in the template. It shows a

balance is $ This value is already pro dash due to the formatting in Excel.

b Hint: Since this is the first year of operations, consider what the ending balance in the Owner's Capital account must represent and how to use it in the financial

in the Own

Complete a classified Balance Sheet as of December Y points

a Hint: To use the grid template provided, use a vertical format orientation for the three main sections of the Balance Sheet.

Income Statement

Statement of Changes in Owner's Equity

Color Legend:

In yellow highlighted cells, you should use cell reference links formulas to pull

information from another cell location in Excel.

In blue highlighted cells, write formulas or use Excel's formula functionality short cuts to prepare mathematical

cuts to prepare mathematical equations and logical formulas.

If a cell is NOT highlighted, leave it alone! Do not make any changes, adjustments, or edits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started