Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please determine the sensitivity of the following bond to very small changes in the yields (e.g. for the case of duration neutral hedging)! We have

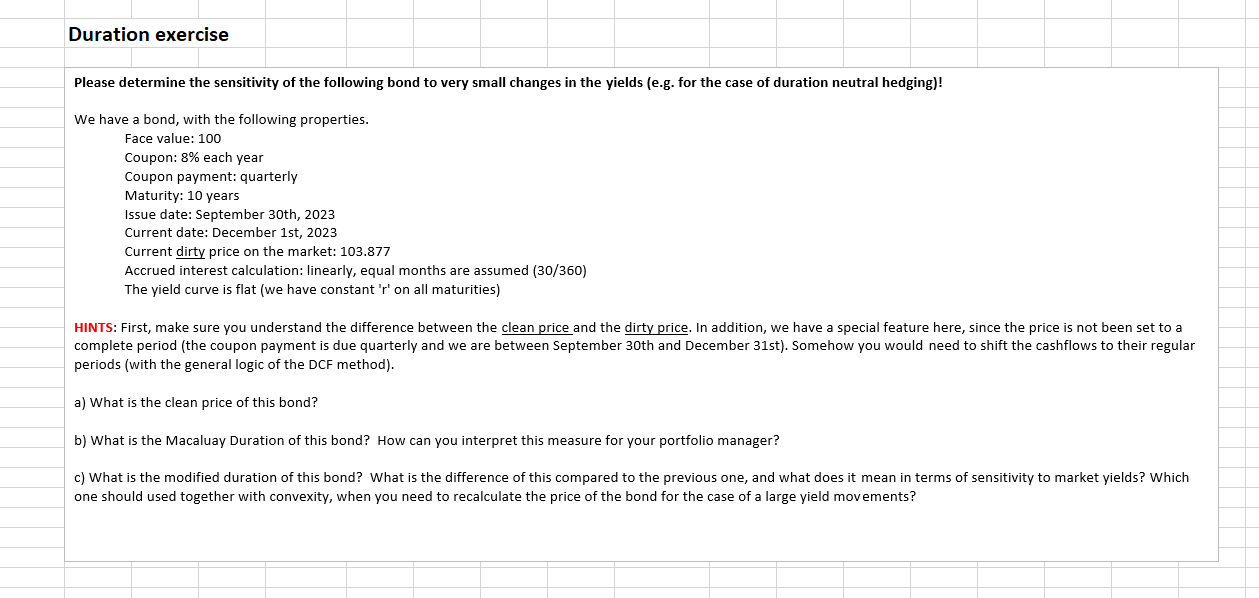

Please determine the sensitivity of the following bond to very small changes in the yields (e.g. for the case of duration neutral hedging)! We have a bond, with the following properties. Face value: 100 Coupon: 8% each year Coupon payment: quarterly Maturity: 10 years Issue date: September 30th, 2023 Current date: December 1st, 2023 Current dirty price on the market: 103.877 Accrued interest calculation: linearly, equal months are assumed (30/360) The yield curve is flat (we have constant ' r ' on all maturities) HINTS: First, make sure you understand the difference between the clean price and the dirty price. In addition, we have a special feature here, since the price is not been set to a complete period (the coupon payment is due quarterly and we are between September 30th and December 31st). Somehow you would need to shift the cashflows to their regular periods (with the general logic of the DCF method). a) What is the clean price of this bond? b) What is the Macaluay Duration of this bond? How can you interpret this measure for your portfolio manager? c) What is the modified duration of this bond? What is the difference of this compared to the previous one, and what does it mean in terms of sensitivity to market yields? Which one should used together with convexity, when you need to recalculate the price of the bond for the case of a large yield movements

Please determine the sensitivity of the following bond to very small changes in the yields (e.g. for the case of duration neutral hedging)! We have a bond, with the following properties. Face value: 100 Coupon: 8% each year Coupon payment: quarterly Maturity: 10 years Issue date: September 30th, 2023 Current date: December 1st, 2023 Current dirty price on the market: 103.877 Accrued interest calculation: linearly, equal months are assumed (30/360) The yield curve is flat (we have constant ' r ' on all maturities) HINTS: First, make sure you understand the difference between the clean price and the dirty price. In addition, we have a special feature here, since the price is not been set to a complete period (the coupon payment is due quarterly and we are between September 30th and December 31st). Somehow you would need to shift the cashflows to their regular periods (with the general logic of the DCF method). a) What is the clean price of this bond? b) What is the Macaluay Duration of this bond? How can you interpret this measure for your portfolio manager? c) What is the modified duration of this bond? What is the difference of this compared to the previous one, and what does it mean in terms of sensitivity to market yields? Which one should used together with convexity, when you need to recalculate the price of the bond for the case of a large yield movements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started