Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please develop a delta neutral strategy for the period 10/03/2020 to 25/03/2020 to speculate/arbitrage on volatility. Explain how the strategy will work, and detail all

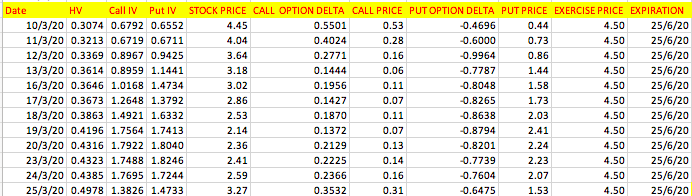

Please develop a delta neutral strategy for the period 10/03/2020 to 25/03/2020 to speculate/arbitrage on volatility. Explain how the strategy will work, and detail all transactions for undertaking the strategy. You can use as much capital as you like, but the cost of capital needs to be considered. Given that the strategy is theoretically risk free, you should not lose any money anyway! You are required to perform at least one re- balancing.

Date HV Call IV Put IV STOCK PRICE CALL OPTION DELTA CALL PRICE PUT OPTION DELTA PUT PRICE EXERCISE PRICE EXPIRATION 10/3/20 0.3074 0.6792 0.6552 4.45 0.5501 0.53 -0.4696 0.44 4.50 25/6/20 11/3/20 0.3213 0.6719 0.6711 4.04 0.4024 0.28 -0.6000 0.73 4.50 25/6/20 12/3/20 0.3369 0.8967 0.9425 3.64 0.2771 0.16 -0.9964 0.86 4.50 25/6/20 13/3/20 0.3614 0.8959 1.1441 3.18 0.1444 0.06 -0.7787 1.44 4.50 25/6/20 16/3/20 0.3646 1.0168 1.4734 3.02 0.1956 0.11 -0.8048 1.58 4.50 25/6/20 17/3/20 0.3673 1.2648 1.3792 2.86 0.1427 0.07 -0.8265 1.73 4.50 25/6/20 18/3/20 0.3863 1.4921 1.6332 2.53 0.1870 0.11 -0.8638 4.50 25/6/20 19/3/20 0.4196 1.7564 1.7413 2.14 0.1372 0.07 -0.8794 2.41 4.50 25/6/20 20/3/20 0.4316 1.7922 1.8040 2.36 0.2129 0.13 0.8201 2.24 4.50 25/6/20 23/3/20 0.4323 1.7488 1.8246 2.41 0.2225 0.14 -0.7739 2.23 4.50 25/6/20 24/3/20 0.4385 1.7695 1.7244 2.59 0.2366 0.16 -0.7604 2.07 4.50 25/6/20 25/3/20 0.4978 1.3826 1.4733 3.27 0.3532 0.31 -0.6475 1.53 4.50 25/6/20 2.03 Date HV Call IV Put IV STOCK PRICE CALL OPTION DELTA CALL PRICE PUT OPTION DELTA PUT PRICE EXERCISE PRICE EXPIRATION 10/3/20 0.3074 0.6792 0.6552 4.45 0.5501 0.53 -0.4696 0.44 4.50 25/6/20 11/3/20 0.3213 0.6719 0.6711 4.04 0.4024 0.28 -0.6000 0.73 4.50 25/6/20 12/3/20 0.3369 0.8967 0.9425 3.64 0.2771 0.16 -0.9964 0.86 4.50 25/6/20 13/3/20 0.3614 0.8959 1.1441 3.18 0.1444 0.06 -0.7787 1.44 4.50 25/6/20 16/3/20 0.3646 1.0168 1.4734 3.02 0.1956 0.11 -0.8048 1.58 4.50 25/6/20 17/3/20 0.3673 1.2648 1.3792 2.86 0.1427 0.07 -0.8265 1.73 4.50 25/6/20 18/3/20 0.3863 1.4921 1.6332 2.53 0.1870 0.11 -0.8638 4.50 25/6/20 19/3/20 0.4196 1.7564 1.7413 2.14 0.1372 0.07 -0.8794 2.41 4.50 25/6/20 20/3/20 0.4316 1.7922 1.8040 2.36 0.2129 0.13 0.8201 2.24 4.50 25/6/20 23/3/20 0.4323 1.7488 1.8246 2.41 0.2225 0.14 -0.7739 2.23 4.50 25/6/20 24/3/20 0.4385 1.7695 1.7244 2.59 0.2366 0.16 -0.7604 2.07 4.50 25/6/20 25/3/20 0.4978 1.3826 1.4733 3.27 0.3532 0.31 -0.6475 1.53 4.50 25/6/20 2.03Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started