Please discuss and summarize the statement above precisely. Thank you. The statement above is for reporting in school.

Please discuss and summarize the statement above precisely. Thank you. The statement above is for reporting in school.

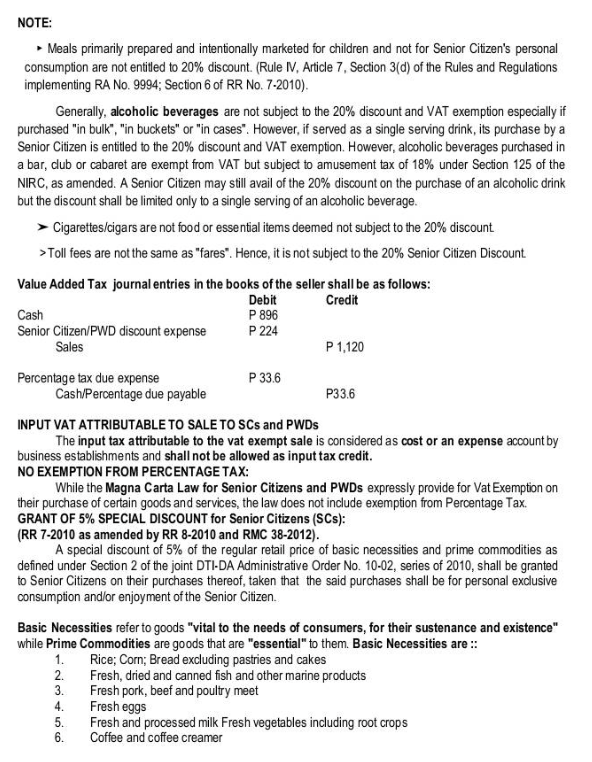

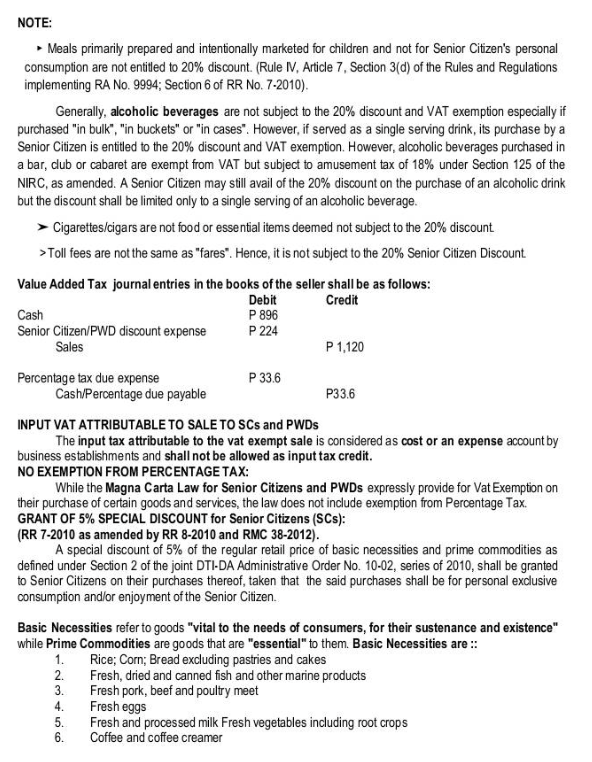

NOTE: - Meals primarity prepared and intentionally marketed for children and not for Senior Citizen's personal consumption are not entitled to 20% discount. (Rule N, Article 7. Section 3(d) of the Rules and Regulations implementing RA No. 9994; Section 6 of RR No. 7-2010). Generally, alcoholic beverages are not subject to the 20% discount and VAT exemption especially if purchased "in bulk", "in buckets" or "in cases". However, if served as a single serving drink, its purchase by a Senior Citizen is entitled to the 20% discount and VAT exemption. However, alcoholic beverages purchased in a bar, club or cabaret are exempt from VAT but subject to amusement tax of 18% under Section 125 of the NIRC, as amended. A Senior Citizen may still avail of the 20% discount on the purchase of an alcoholic drink but the discount shall be limited only to a single serving of an alcoholic beverage. > Cigarettes/cigars are not food or essential items deemed not subject to the 20% discount. > Toll fees are not the same as "fares". Hence, it is not subject to the 20% Senior Citizen Discount. Value Added Tax journal entries in the books of the seller shall be as follows: INPUT VAT ATTRIBUTABLE TO SALE TO SCs and PWDs The input tax attributable to the vat exempt sale is considered as cost or an expense account by business establishments and shall not be allowed as input tax credit. NO EXEMPTION FROM PERCENTAGE TAX: While the Magna Carta Law for Senior Citizens and PWDs expressly provide for Vat Exemption on their purchase of certain goods and services, the law does not include exemption from Percentage Tax. GRANT OF 5\% SPECIAL DISCOUNT for Senior Citizens (SCs): (RR 7-2010 as amended by RR 8-2010 and RMC 38-2012). A special discount of 5% of the regular retail price of basic necessities and prime commodities as defined under Section 2 of the joint DTI-DA Administrative Order No. 10-02, series of 2010, shall be granted to Senior Citizens on their purchases thereof, taken that the said purchases shall be for personal exclusive consumption and/or enjoyment of the Senior Citizen. Basic Necessities refer to goods "vital to the needs of consumers, for their sustenance and existence" while Prime Commodities are goods that are "essential" to them. Basic Necessities are :: 1. Rice; Corn; Bread excluding pastries and cakes 2. Fresh, dried and canned fish and other marine products 3. Fresh pork, beef and poultry meet 4. Fresh eggs 5. Fresh and processed milk Fresh vegetables including root crops 6. Coffee and coffee creamer NOTE: - Meals primarity prepared and intentionally marketed for children and not for Senior Citizen's personal consumption are not entitled to 20% discount. (Rule N, Article 7. Section 3(d) of the Rules and Regulations implementing RA No. 9994; Section 6 of RR No. 7-2010). Generally, alcoholic beverages are not subject to the 20% discount and VAT exemption especially if purchased "in bulk", "in buckets" or "in cases". However, if served as a single serving drink, its purchase by a Senior Citizen is entitled to the 20% discount and VAT exemption. However, alcoholic beverages purchased in a bar, club or cabaret are exempt from VAT but subject to amusement tax of 18% under Section 125 of the NIRC, as amended. A Senior Citizen may still avail of the 20% discount on the purchase of an alcoholic drink but the discount shall be limited only to a single serving of an alcoholic beverage. > Cigarettes/cigars are not food or essential items deemed not subject to the 20% discount. > Toll fees are not the same as "fares". Hence, it is not subject to the 20% Senior Citizen Discount. Value Added Tax journal entries in the books of the seller shall be as follows: INPUT VAT ATTRIBUTABLE TO SALE TO SCs and PWDs The input tax attributable to the vat exempt sale is considered as cost or an expense account by business establishments and shall not be allowed as input tax credit. NO EXEMPTION FROM PERCENTAGE TAX: While the Magna Carta Law for Senior Citizens and PWDs expressly provide for Vat Exemption on their purchase of certain goods and services, the law does not include exemption from Percentage Tax. GRANT OF 5\% SPECIAL DISCOUNT for Senior Citizens (SCs): (RR 7-2010 as amended by RR 8-2010 and RMC 38-2012). A special discount of 5% of the regular retail price of basic necessities and prime commodities as defined under Section 2 of the joint DTI-DA Administrative Order No. 10-02, series of 2010, shall be granted to Senior Citizens on their purchases thereof, taken that the said purchases shall be for personal exclusive consumption and/or enjoyment of the Senior Citizen. Basic Necessities refer to goods "vital to the needs of consumers, for their sustenance and existence" while Prime Commodities are goods that are "essential" to them. Basic Necessities are :: 1. Rice; Corn; Bread excluding pastries and cakes 2. Fresh, dried and canned fish and other marine products 3. Fresh pork, beef and poultry meet 4. Fresh eggs 5. Fresh and processed milk Fresh vegetables including root crops 6. Coffee and coffee creamer

Please discuss and summarize the statement above precisely. Thank you. The statement above is for reporting in school.

Please discuss and summarize the statement above precisely. Thank you. The statement above is for reporting in school.