Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE DISREGARD THE QUESTIONS AT THE END OF THE TEXT. PLEASE ANSWER THE TABLE, THANK YOU! I. S. Hartman, sales manager of Angelina actual expenses

PLEASE DISREGARD THE QUESTIONS AT THE END OF THE TEXT. PLEASE ANSWER THE TABLE, THANK YOU!

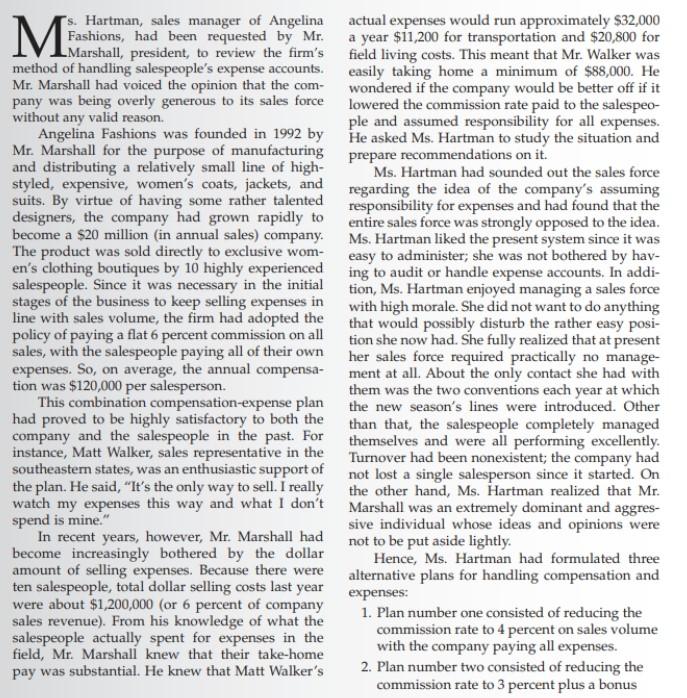

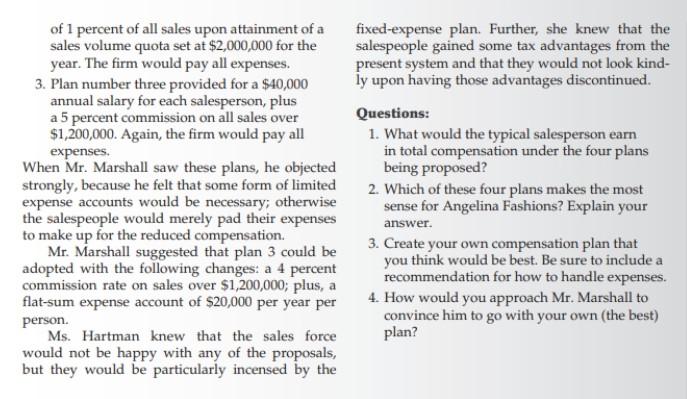

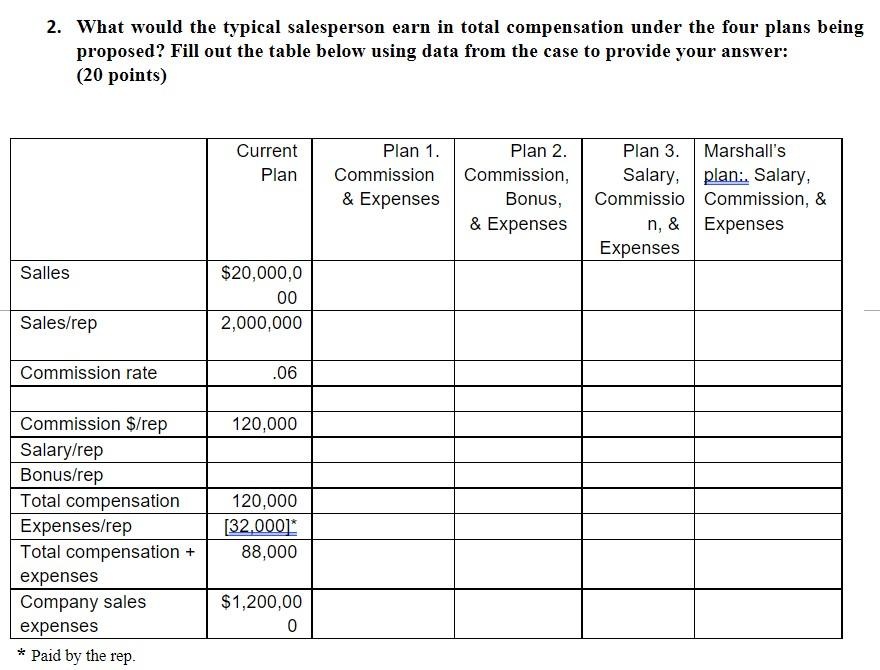

I. S. Hartman, sales manager of Angelina actual expenses would run approximately $32,000 Fashions, had been requested by Mr. a year $11,200 for transportation and $20,800 for 1 -Marshall, president, to review the firm's field living costs. This meant that Mr. Walker was method of handling salespeople's expense accounts. easily taking home a minimum of $88,000. He Mr. Marshall had voiced the opinion that the com- wondered if the company would be better off if it pany was being overly generous to its sales force lowered the commission rate paid to the salespeowithout any valid reason. Angelina Fashions was founded in 1992 by He and assumed responsibility for all expenses. Hartman to study the situation and Mr. Marshall for the purpose of manufacturing He asked Ms. Hartman to study the situation and and distributing a relatively small line of high- prepare recommendations on it. styled, expensive, women's coats, jackets, and regarding the idea of the company's assuming designers, the company had grown rapidly to responsibility for expenses and had found that the had proved to be highly satisfactory to both the than that, the salespeople completely managed company and the salespeople in the past. For themselves and were all performing excellently. instance, Matt Walker, sales representative in the Turnover had been nonexistent; the company had instance, Matt Walker, sales representative in the Turnover had been nonexistent; the company had the plan. He said, "It's the only way to sell. I really not lost a single salesperson since it started. On watch my expenses this way and what I don't Marshall was an extremely dominant and aggresspend is mine." In recent years, however, Mr. Marshall had not to be put aside lightly. become increasingly bothered by the dollar not to be put aside lightly. Hence, Ms. Hartman had formulated three amount of selling expenses. Because there were alternative plans for handling compensation and ten salespeople, total dollar selling costs last year expenses: sales revenue). From his knowledge of what the 1. Plan number one consisted of reducing the salespeople actually spent for expenses in the field, Mr. Marshall knew that their take-home commission rate to 4 percent on sales volume with the company paying all expenses. pay was substantial. He knew that Matt Walker's 2. Plan number two consisted of reducing the commission rate to 3 percent plus a bonus 2. What would the typical salesperson earn in total compensation under the four plans being proposed? Fill out the table below using data from the case to provide your answer: (20 points) raiu uy we 10. I. S. Hartman, sales manager of Angelina actual expenses would run approximately $32,000 Fashions, had been requested by Mr. a year $11,200 for transportation and $20,800 for 1 -Marshall, president, to review the firm's field living costs. This meant that Mr. Walker was method of handling salespeople's expense accounts. easily taking home a minimum of $88,000. He Mr. Marshall had voiced the opinion that the com- wondered if the company would be better off if it pany was being overly generous to its sales force lowered the commission rate paid to the salespeowithout any valid reason. Angelina Fashions was founded in 1992 by He and assumed responsibility for all expenses. Hartman to study the situation and Mr. Marshall for the purpose of manufacturing He asked Ms. Hartman to study the situation and and distributing a relatively small line of high- prepare recommendations on it. styled, expensive, women's coats, jackets, and regarding the idea of the company's assuming designers, the company had grown rapidly to responsibility for expenses and had found that the had proved to be highly satisfactory to both the than that, the salespeople completely managed company and the salespeople in the past. For themselves and were all performing excellently. instance, Matt Walker, sales representative in the Turnover had been nonexistent; the company had instance, Matt Walker, sales representative in the Turnover had been nonexistent; the company had the plan. He said, "It's the only way to sell. I really not lost a single salesperson since it started. On watch my expenses this way and what I don't Marshall was an extremely dominant and aggresspend is mine." In recent years, however, Mr. Marshall had not to be put aside lightly. become increasingly bothered by the dollar not to be put aside lightly. Hence, Ms. Hartman had formulated three amount of selling expenses. Because there were alternative plans for handling compensation and ten salespeople, total dollar selling costs last year expenses: sales revenue). From his knowledge of what the 1. Plan number one consisted of reducing the salespeople actually spent for expenses in the field, Mr. Marshall knew that their take-home commission rate to 4 percent on sales volume with the company paying all expenses. pay was substantial. He knew that Matt Walker's 2. Plan number two consisted of reducing the commission rate to 3 percent plus a bonus 2. What would the typical salesperson earn in total compensation under the four plans being proposed? Fill out the table below using data from the case to provide your answer: (20 points) raiu uy we 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started