Please do 19.2 and make sure its correct and clear.

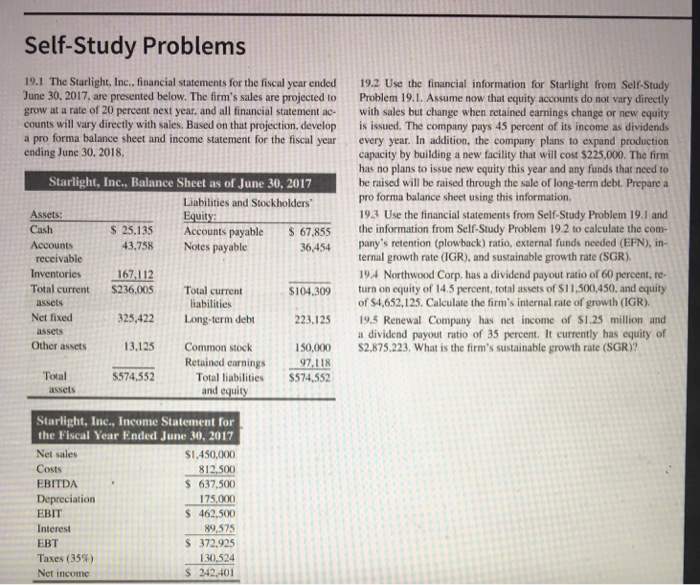

Self-Study Problems 19.1 The Starlight, Inc. financial statements for the fiscal year ended 19.2 Use the financial information for Starlight from Self-Study June 30. 2017, are presented below. The firm's sales are projected to Problem 19.1. Assume now that equity accounts do not vary directly grow at a rate of 20 percent next year. and all financial statement ac- with sales but change when retained earnings change or new equity counts will vary directly with sales. Based on that projection, develop is issued. The company pays 45 percent of its income as dividends a pro forma balance sheet and income statement for the fiscal year every year. In addition, the company plans to expand production capacity by building a new facility that will cost $225,000. The firm has no plans to issue new equity this year and any funds that need to be raised will be raised through the sale of long-term debt. Prepare a ending June 30. 2018 Starlight, Inc., Balance Sheet as of June 30, 2017 pro forma balance sheet using this information. Liabilities and Stockholders Assets: Cash Accounts 19.3 Use the financial statements from Self-Study Problem 19.1 and $ 67.855the information from Self-Study Problem 19.2 to calculate the com- 36.454 pany's retention (plowback) ratio, external funds needed (EFN). in- S 25.135 Accounts payable 43.758Notes payable receivable ternal growth rate (IGR), and sustainable growth rate (SGR). Inventories167.112 Total current $236.005 assets Net fixed 194 Northwood Corp, has a dividend payout ratio of 60 percent, re- turn on equity of 14.5 percent, total assets of $11,500,450. and equity Total current liabilities S104.309 223.125 150,000 $2.875,223, What is the firm's sustainable growth rate (SGR)? of $4,652,125. Calculate the firm's internal rate of growth (IGR) 25,422Long-term debt 19.5 Renewal Company has net income of S1.25 million and a dividend payout ratio of 35 percent. It currently has equity of assets Other assets 13,125Common stock Troal $7452$574552 Retained carnings 97.118 Total liabilities $574,552 assets and e Starlight, Inc., Income Statement for the Fiscal Year Ended June 30, 2017 Net sales Costs EBITDA Depreciation EBIT Interest EBT Taxes (35%) Net income $1,450,000 12.500 S 637,500 175,000 S 462,500 89,575 S 372.925 130,524 S 242,401