Please do #2 without using excel

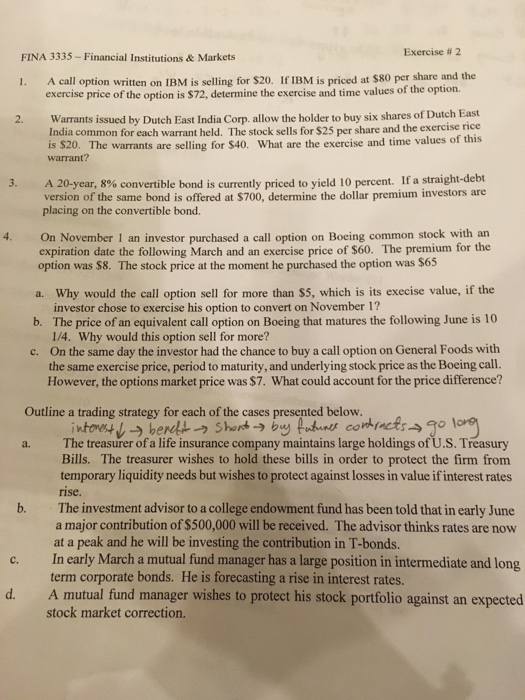

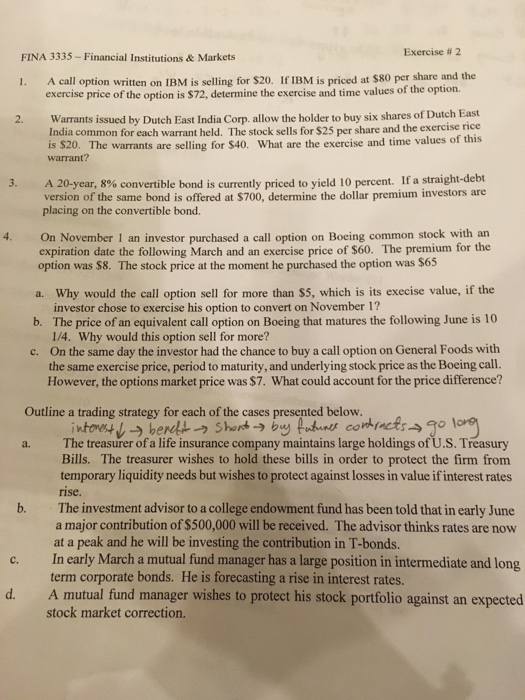

A call option written on IBM is selling for $20. If IBM is priced at $80 per share and the exercise price of the option is $72, determine the exercise and time values of the option. Warrants issued by Dutch Hast India Corp. allow the holder to buy six shares of Dutch East India common for each warrant held. The stock sells for $25 per share and the exercise is $20. The warrants are selling for $40. What arc the exercise and time values of this warrant? A 20-year, 8% convertible bond is currently priced to yield 10 percent. If a straight-debt version of the same bond is offered at $700, determine the dollar premium investors are placing on the convertible bond. On November 1 an investor purchased a call option on Boeing common stock with an expiration date the following March and an exercise price of $60. The premium for the option was $8. The stock price at the moment he purchased the option was $65 Why would the call option sell for more titan $5, which is its exercise value, if the investor chose to exercise his option to convert on November 1 ? The price of an equivalent call option on Boeing that matures the following June is 10 1/4. Why would this option sell for more? On the same day the investor had the chance to buy a call option on General Foods with the same exercise price, period to maturity, and underlying stock price as the Boeing call. However, the options market price was $7. What could account for the price difference? Outline a trading strategy for each of the cases presented below. The treasurer of a life insurance company maintains large holdings of U.S. Treasury Bills. The treasurer wishes to hold these bills in order to protect the firm from temporary liquidity needs but wishes to protect against losses in value if interest rates rise. The investment advisor to a college endowment fund has been told that in early June a major contribution of $500,000 will be received. The advisor thinks rates are now at a peak and he will be investing the contribution in T-bonds. In early March a mutual fund manager has a large position in intermediate and long term corporate bonds. He is forecasting a rise in interest rates. A mutual fund manager wishes to protect his stock portfolio against an expected stock market correction