Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do 7-23b and 7-44 Tables. Please do both questions and show all formulas. Thanks 7-23b You have just been elected into the Society of

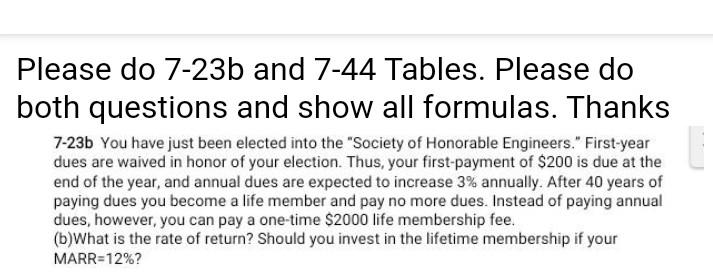

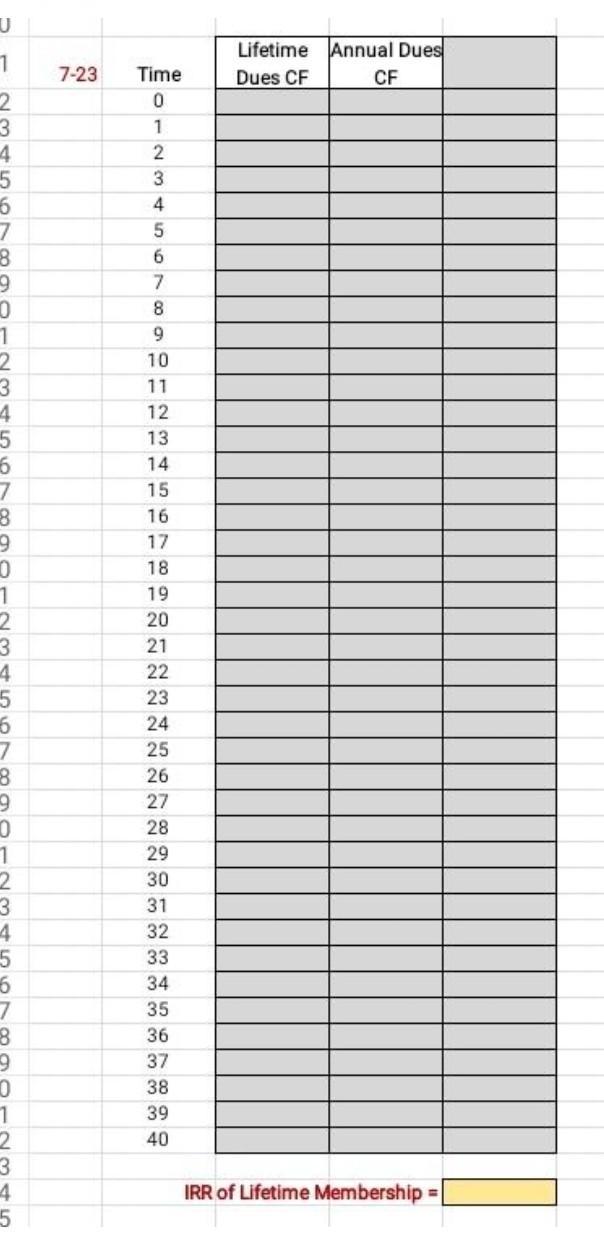

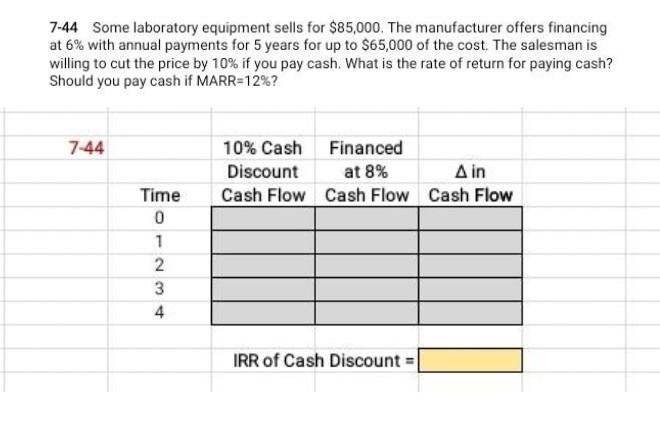

Please do 7-23b and 7-44 Tables. Please do both questions and show all formulas. Thanks 7-23b You have just been elected into the "Society of Honorable Engineers." First-year dues are waived in honor of your election. Thus, your first-payment of $200 is due at the end of the year, and annual dues are expected to increase 3% annually. After 40 years of paying dues you become a life member and pay no more dues. Instead of paying annual dues, however, you can pay a one-time $2000 life membership fee. (b)What is the rate of return? Should you invest in the lifetime membership if your MARR=12%? U 7 Lifetime Dues CF Annual Dues CF 7-23 Time 0 1 2 3 4 5 6 2 3 4 5 6 7 8 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 D 1 2 3 4 5 6 7 8 9 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 2 3 4. 5 IRR of Lifetime Membership = 7-44 Some laboratory equipment sells for $85,000. The manufacturer offers financing at 6% with annual payments for 5 years for up to $65,000 of the cost. The salesman is willing to cut the price by 10% if you pay cash. What is the rate of return for paying cash? Should you pay cash if MARR=12%? 7-44 10% Cash Financed Discount at 8% in Cash Flow Cash Flow Cash Flow Time 0 1 2 3 4 IRR of Cash Discount =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started