Please do A and B.

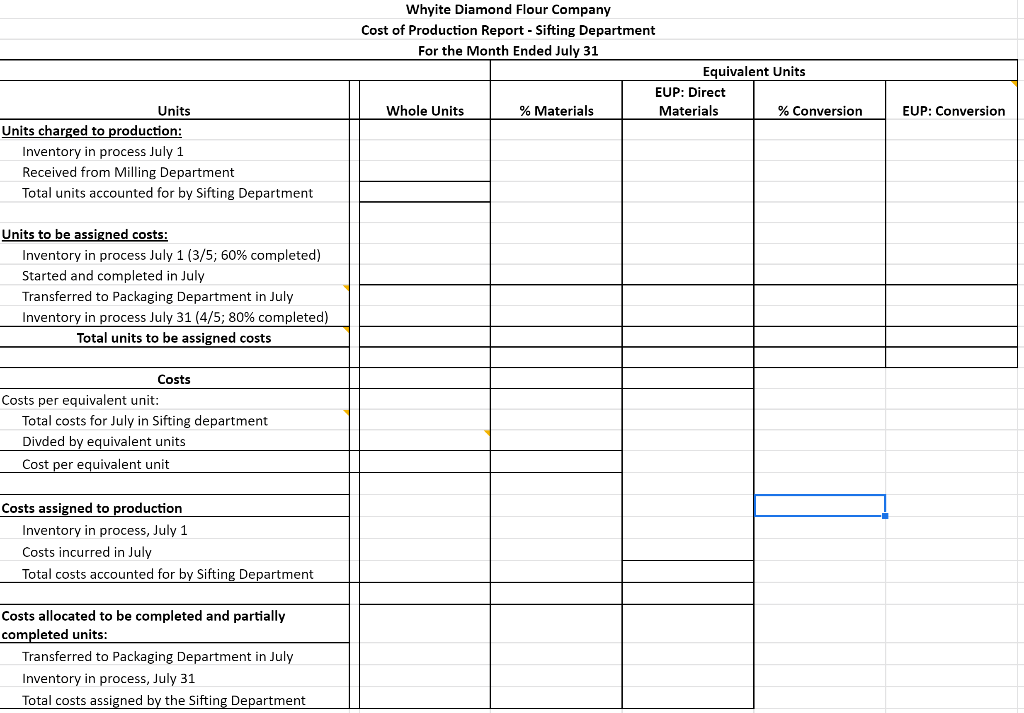

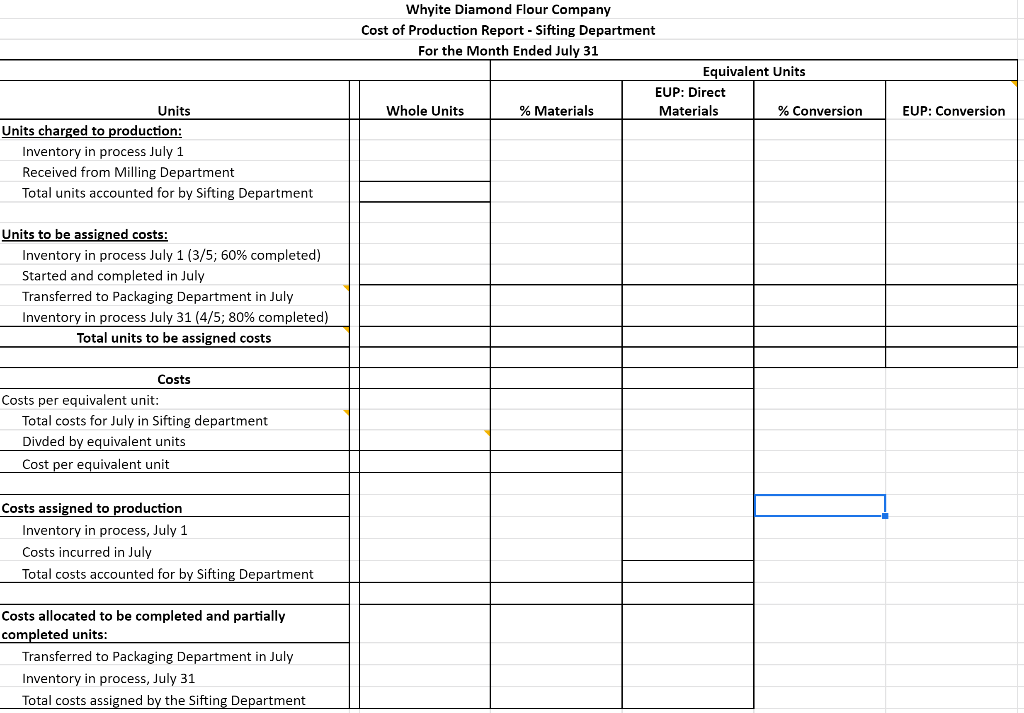

Here is what the spreadsheet should look like:

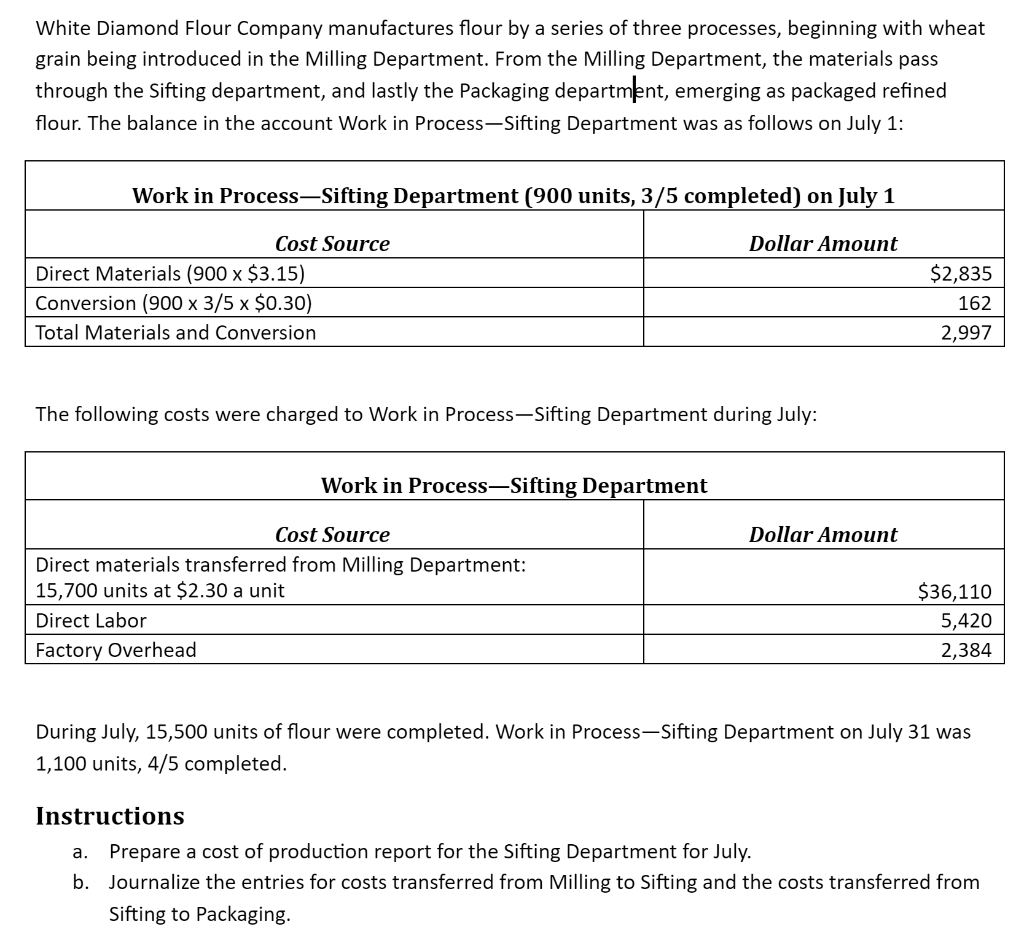

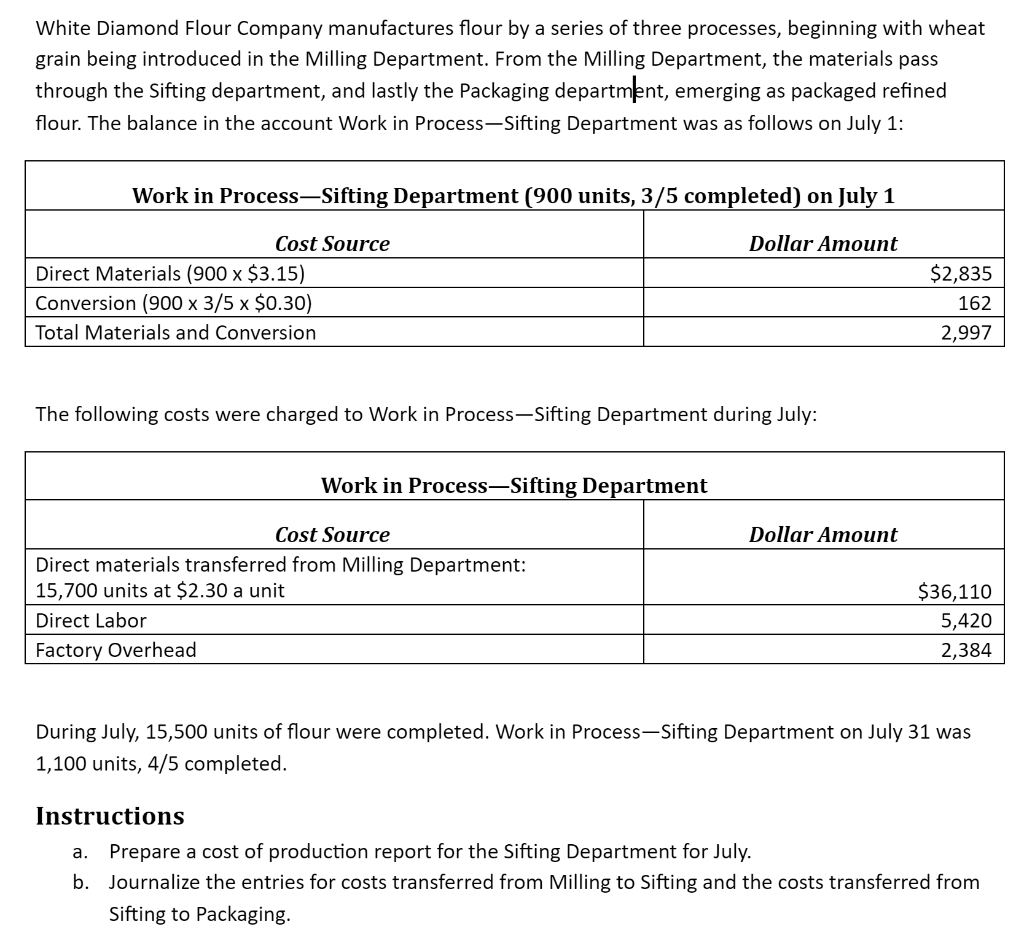

White Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat grain being introduced in the Milling Department. From the Milling Department, the materials pass through the Sifting department, and lastly the Packaging department, emerging as packaged refined flour. The balance in the account Work in ProcessSifting Department was as follows on July 1: Work in ProcessSifting Department (900 units, 3/5 completed) on July 1 Dollar Amount Cost Source Direct Materials (900 x $3.15) Conversion (900 x 3/5 x $0.30) Total Materials and Conversion $2,835 162 2,997 The following costs were charged to Work in Process-Sifting Department during July: Work in Process-Sifting Department Dollar Amount Cost Source Direct materials transferred from Milling Department: 15,700 units at $2.30 a unit Direct Labor Factory Overhead $36,110 5,420 2,384 During July, 15,500 units of flour were completed. Work in Process-Sifting Department on July 31 was 1,100 units, 4/5 completed. Instructions a. Prepare a cost of production report for the Sifting Department for July. b. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. Whyite Diamond Flour Company Cost of Production Report - Sifting Department For the Month Ended July 31 Equivalent Units EUP: Direct Whole Units % Materials Materials % Conversion EUP: Conversion Units Units charged to production: Inventory in process July 1 Received from Milling Department Total units accounted for by Sifting Department Units to be assigned costs: Inventory in process July 1 (3/5; 60% completed) Started and completed in July Transferred to Packaging Department in July Inventory in process July 31 (4/5; 80% completed) Total units to be assigned costs Costs Costs per equivalent unit: Total costs for July in Sifting department Divded by equivalent units Cost per equivalent unit Costs assigned to production Inventory in process, July 1 Costs incurred in July Total costs accounted for by Sifting Department Costs allocated to be completed and partially completed units: Transferred to Packaging Department in July Inventory in process, July 31 Total costs assigned by the Sifting Department White Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat grain being introduced in the Milling Department. From the Milling Department, the materials pass through the Sifting department, and lastly the Packaging department, emerging as packaged refined flour. The balance in the account Work in ProcessSifting Department was as follows on July 1: Work in ProcessSifting Department (900 units, 3/5 completed) on July 1 Dollar Amount Cost Source Direct Materials (900 x $3.15) Conversion (900 x 3/5 x $0.30) Total Materials and Conversion $2,835 162 2,997 The following costs were charged to Work in Process-Sifting Department during July: Work in Process-Sifting Department Dollar Amount Cost Source Direct materials transferred from Milling Department: 15,700 units at $2.30 a unit Direct Labor Factory Overhead $36,110 5,420 2,384 During July, 15,500 units of flour were completed. Work in Process-Sifting Department on July 31 was 1,100 units, 4/5 completed. Instructions a. Prepare a cost of production report for the Sifting Department for July. b. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. Whyite Diamond Flour Company Cost of Production Report - Sifting Department For the Month Ended July 31 Equivalent Units EUP: Direct Whole Units % Materials Materials % Conversion EUP: Conversion Units Units charged to production: Inventory in process July 1 Received from Milling Department Total units accounted for by Sifting Department Units to be assigned costs: Inventory in process July 1 (3/5; 60% completed) Started and completed in July Transferred to Packaging Department in July Inventory in process July 31 (4/5; 80% completed) Total units to be assigned costs Costs Costs per equivalent unit: Total costs for July in Sifting department Divded by equivalent units Cost per equivalent unit Costs assigned to production Inventory in process, July 1 Costs incurred in July Total costs accounted for by Sifting Department Costs allocated to be completed and partially completed units: Transferred to Packaging Department in July Inventory in process, July 31 Total costs assigned by the Sifting Department