Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do A and B preferably in excel Problem 3 On June 25, 2016 you purchased a 5-year TIPS security, which has a par value

Please do A and B preferably in excel

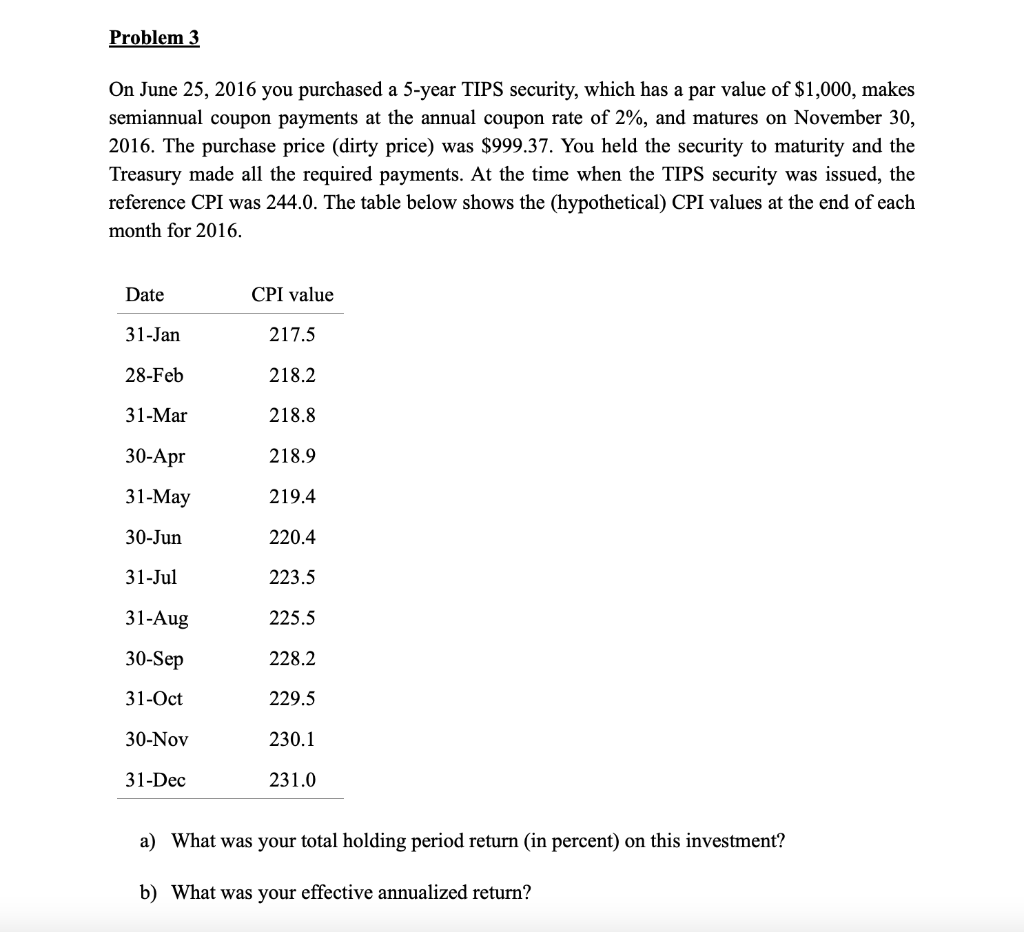

Problem 3 On June 25, 2016 you purchased a 5-year TIPS security, which has a par value of $1,000, makes semiannual coupon payments at the annual coupon rate of 2%, and matures on November 30, 2016. The purchase price (dirty price) was $999.37. You held the security to maturity and the Treasury made all the required payments. At the time when the TIPS security was issued, the reference CPI was 244.0. The table below shows the (hypothetical) CPI values at the end of each month for 2016. Date CPI value 31-Jan 217.5 28-Feb 218.2 31-Mar 218.8 30-Apr 218.9 31-May 219.4 30-Jun 220.4 31-Jul 223.5 31-Aug 225.5 30-Sep 228.2 31-Oct 229.5 30-Nov 230.1 31-Dec 231.0 a) What was your total holding period return (in percent) on this investment? b) What was your effective annualized return? Problem 3 On June 25, 2016 you purchased a 5-year TIPS security, which has a par value of $1,000, makes semiannual coupon payments at the annual coupon rate of 2%, and matures on November 30, 2016. The purchase price (dirty price) was $999.37. You held the security to maturity and the Treasury made all the required payments. At the time when the TIPS security was issued, the reference CPI was 244.0. The table below shows the (hypothetical) CPI values at the end of each month for 2016. Date CPI value 31-Jan 217.5 28-Feb 218.2 31-Mar 218.8 30-Apr 218.9 31-May 219.4 30-Jun 220.4 31-Jul 223.5 31-Aug 225.5 30-Sep 228.2 31-Oct 229.5 30-Nov 230.1 31-Dec 231.0 a) What was your total holding period return (in percent) on this investment? b) What was your effective annualized returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started