please do A and B . thank you

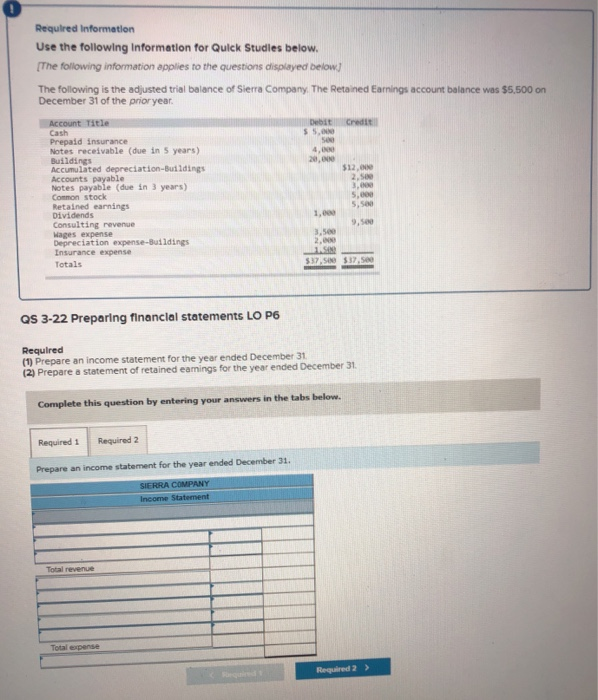

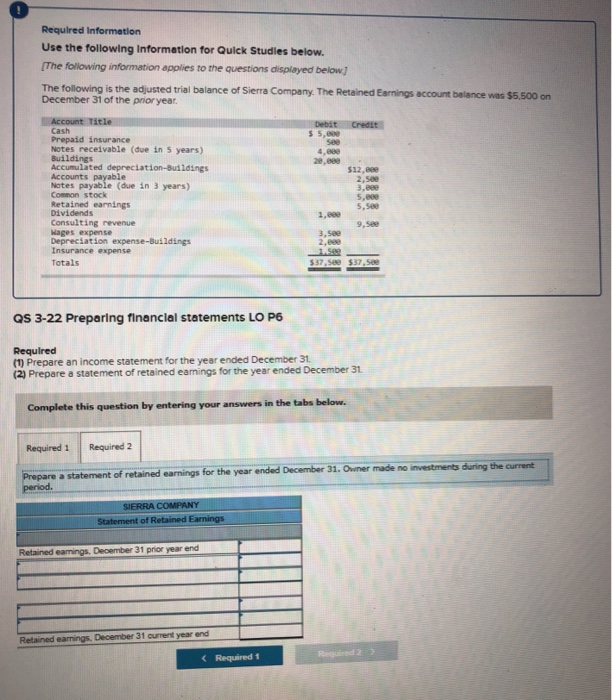

Required Information Use the following Information for Qulck Studles below. The following information applies to the questions displayed below The following is the adjusted trial balance of Sierra Company The Retained Earnings account balance was $5,500 on December 31 of the prior year Account Title Debit S 5.000 Credit Cash Prepaid insurance Notes receivable (due in 5 years) Buildings Accumulated depreciation-Buildings Accounts payable Notes payable (due in 3 years) Common stock Retained earnings Dividends Consulting revenue 4,000 28,000 $12,0e 2.500 3,000 s,00 5,se 1,000 9,s00 Mages expense Depreciation expense-Buildings Insurance expense 3,50e 2,000 1,500 $37,500 $37,50 Totals QS 3-22 Preparing financial statements LO P6 Required (1) Prepare an income statement for the year ended December 31 (2) Prepare a statement of retained eanings for the year ended December 31. Complete this question by entering your answers in the tabs below. Required 2 Required 1 Prepare an income statement for the year ended December 31 SIERRA COMPANY Income Statement Total revenue Total expense Required 2 Required Information Use the following Information for Quick Studles below. (The following information applies to the questions displayed below] The following is the adjusted trial balance December 31 of the prior year of Sierra Company. The Retained Earnings account balance was $5,500 on Account Title Debit S5,000 see Credit Cash Prepaid insurance Notes receivable (due in 5 years) Buildings Accumulated depreciation-Buildings Accounts payable Notes payable (due in 3 years) 4,eee 28,ee0 $12,88e 2,500 3,eee 5,00e 5,see Common stock Retained earnings Dividends Consulting revenue Hages expense Depreciation expense-Buildings Insurance expense 1,000 9,see 3,see 2,eee 1.5e $37,see $37,see Totals QS 3-22 Preparing financlal statements LO P6 Required (1) Prepare an income statement for the year ended December 31 (2) Prepare a statement of retained eamings for the year ended December 31 Complete this question by entering your answers in the tabs below. Required 2 Required 1 Prepare a statement of retained earnings for the year ended December 31. Ovner made no investments during the current period. SIERRA COMPANY Statement of Retained Earnings Retained eamings, December 31 prior year end Retained eamings, December 31 current year end Required 2 Required 1