Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do A B and C Problem 1 At some point in 2016, you purchased a 26-week T-Bill maturing on March 2, 2017 (see the

Please do A B and C

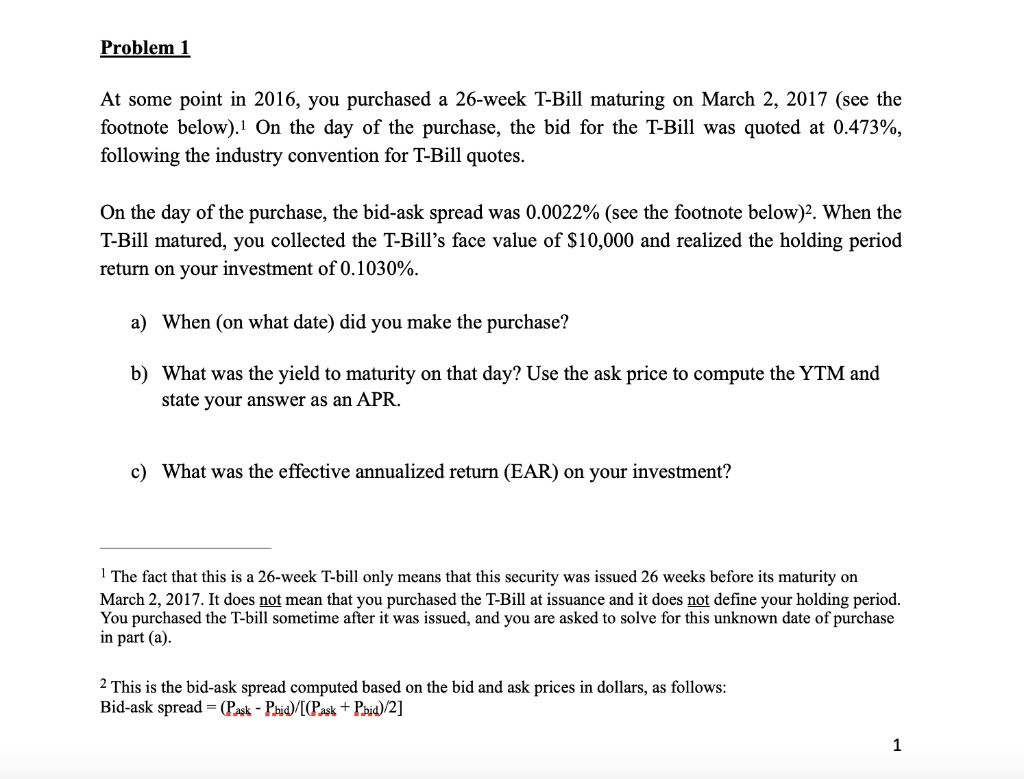

Problem 1 At some point in 2016, you purchased a 26-week T-Bill maturing on March 2, 2017 (see the footnote below). On the day of the purchase, the bid for the T-Bill was quoted at 0.473%, following the industry convention for T-Bill quotes. On the day of the purchase, the bid-ask spread was 0.0022% (see the footnote below)2. When the T-Bill matured, you collected the T-Bill's face value of $10,000 and realized the holding period return on your investment of 0.1030%. a) When (on what date) did you make the purchase? b) What was the yield to maturity on that day? Use the ask price to compute the YTM and state your answer as an APR. c) What was the effective annualized return (EAR) on your investment? 1 The fact that this is a 26-week T-bill only means that this security was issued 26 weeks before its maturity on March 2, 2017. It does not mean that you purchased the T-Bill at issuance and it does not define your holding period. You purchased the T-bill sometime after it was issued, and you are asked to solve for this unknown date of purchase in part (a). 2 This is the bid-ask spread computed based on the bid and ask prices in dollars, as follows: Bid-ask spread = (Pask - Phid) [Pask + Pbid)/2] 1 Problem 1 At some point in 2016, you purchased a 26-week T-Bill maturing on March 2, 2017 (see the footnote below). On the day of the purchase, the bid for the T-Bill was quoted at 0.473%, following the industry convention for T-Bill quotes. On the day of the purchase, the bid-ask spread was 0.0022% (see the footnote below)2. When the T-Bill matured, you collected the T-Bill's face value of $10,000 and realized the holding period return on your investment of 0.1030%. a) When (on what date) did you make the purchase? b) What was the yield to maturity on that day? Use the ask price to compute the YTM and state your answer as an APR. c) What was the effective annualized return (EAR) on your investment? 1 The fact that this is a 26-week T-bill only means that this security was issued 26 weeks before its maturity on March 2, 2017. It does not mean that you purchased the T-Bill at issuance and it does not define your holding period. You purchased the T-bill sometime after it was issued, and you are asked to solve for this unknown date of purchase in part (a). 2 This is the bid-ask spread computed based on the bid and ask prices in dollars, as follows: Bid-ask spread = (Pask - Phid) [Pask + Pbid)/2] 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started