Please do a balance sheet analysis covering exposure and identify impact to leverage and repayment, major changes in assets/liabilities, Significant trends in liquidity, working capital and balance sheet ratios and analysis by business segment. Thank you!

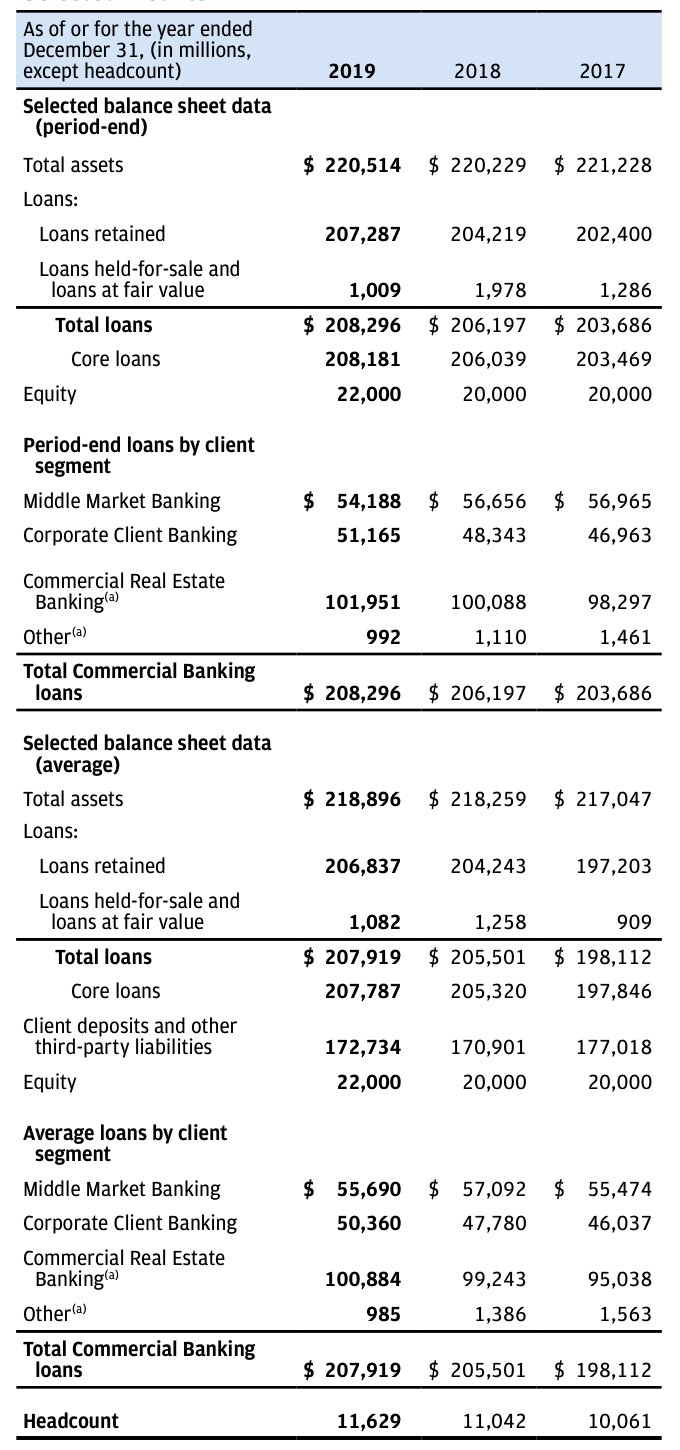

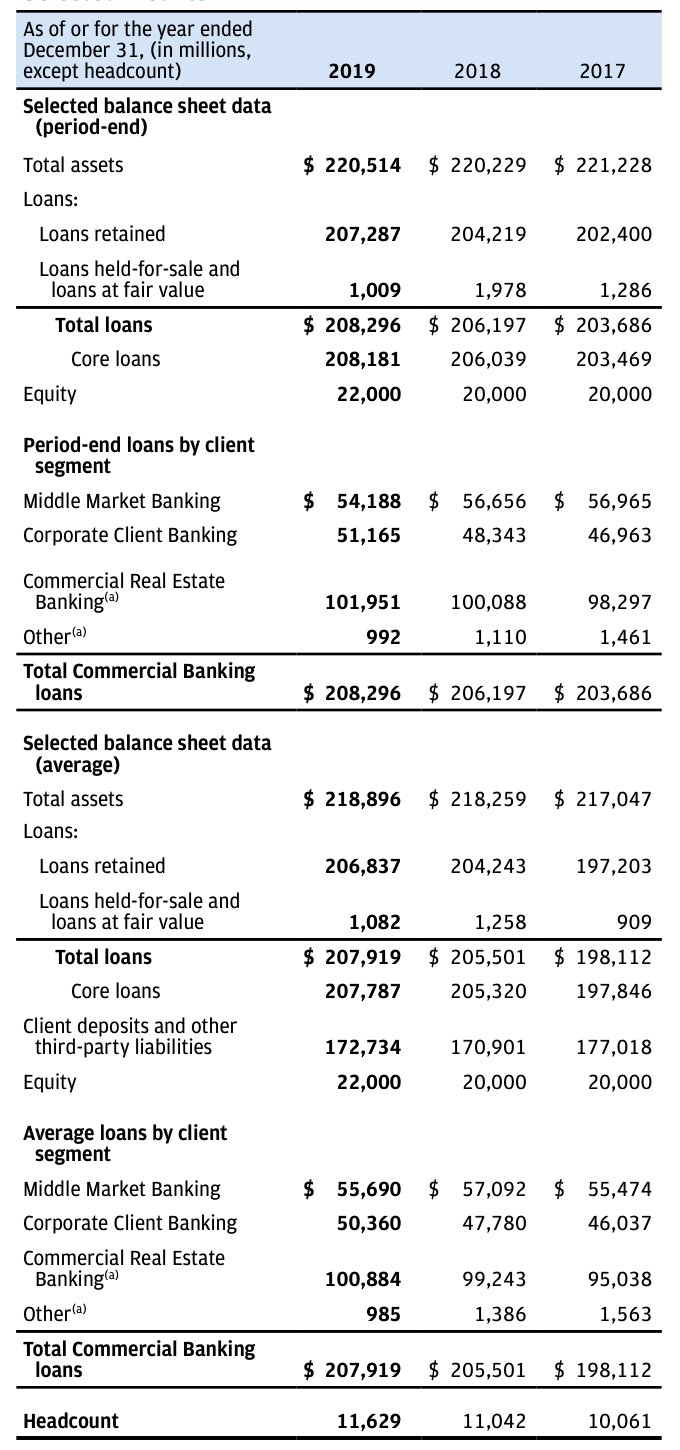

As of or for the year ended December 31, (in millions, except headcount) Selected balance sheet data (period-end) 2019 2018 2017 Total assets $ 220,514 $ 220,229 $ 221,228 Loans: Loans retained 207,287 204,219 202,400 Loans held-for-sale and loans at fair value Total loans 1,009 $ 208,296 208,181 22,000 1,978 $ 206,197 206,039 20,000 1,286 $ 203,686 203,469 20,000 Core loans Equity Period-end loans by client segment Middle Market Banking Corporate Client Banking $ 54,188 51,165 $ 56,656 48,343 $ 56,965 46,963 98,297 Commercial Real Estate Banking(a) Other(a) Total Commercial Banking loans 101,951 992 100,088 1,110 1,461 $ 208,296 $ 206,197 $ 203,686 Selected balance sheet data (average) Total assets $ 218,896 $ 218,259 $ 217,047 Loans: Loans retained 206,837 204,243 197,203 Loans held-for-sale and loans at fair value 909 1,082 $ 207,919 Total loans 1,258 $ 205,501 205,320 $ 198,112 207,787 197,846 Core loans Client deposits and other third-party liabilities Equity 170,901 177,018 172,734 22,000 20,000 20,000 Average loans by client segment Middle Market Banking Corporate Client Banking Commercial Real Estate Banking(a) Other(a) $ 55,690 50,360 $ 57,092 47,780 $ 55,474 46,037 100,884 99,243 95,038 1,563 985 1,386 Total Commercial Banking loans $ 207,919 $ 205,501 $ 198,112 Headcount 11,629 11,042 10,061 As of or for the year ended December 31, (in millions, except headcount) Selected balance sheet data (period-end) 2019 2018 2017 Total assets $ 220,514 $ 220,229 $ 221,228 Loans: Loans retained 207,287 204,219 202,400 Loans held-for-sale and loans at fair value Total loans 1,009 $ 208,296 208,181 22,000 1,978 $ 206,197 206,039 20,000 1,286 $ 203,686 203,469 20,000 Core loans Equity Period-end loans by client segment Middle Market Banking Corporate Client Banking $ 54,188 51,165 $ 56,656 48,343 $ 56,965 46,963 98,297 Commercial Real Estate Banking(a) Other(a) Total Commercial Banking loans 101,951 992 100,088 1,110 1,461 $ 208,296 $ 206,197 $ 203,686 Selected balance sheet data (average) Total assets $ 218,896 $ 218,259 $ 217,047 Loans: Loans retained 206,837 204,243 197,203 Loans held-for-sale and loans at fair value 909 1,082 $ 207,919 Total loans 1,258 $ 205,501 205,320 $ 198,112 207,787 197,846 Core loans Client deposits and other third-party liabilities Equity 170,901 177,018 172,734 22,000 20,000 20,000 Average loans by client segment Middle Market Banking Corporate Client Banking Commercial Real Estate Banking(a) Other(a) $ 55,690 50,360 $ 57,092 47,780 $ 55,474 46,037 100,884 99,243 95,038 1,563 985 1,386 Total Commercial Banking loans $ 207,919 $ 205,501 $ 198,112 Headcount 11,629 11,042 10,061