Question

Please do a comprehensive and well detailed report. Financial reports and statement can be sourced online or via finance yahoo financials. (I posted a link

Please do a comprehensive and well detailed report.

Financial reports and statement can be sourced online or via finance yahoo financials. (I posted a link previously but was warned that is a violation)

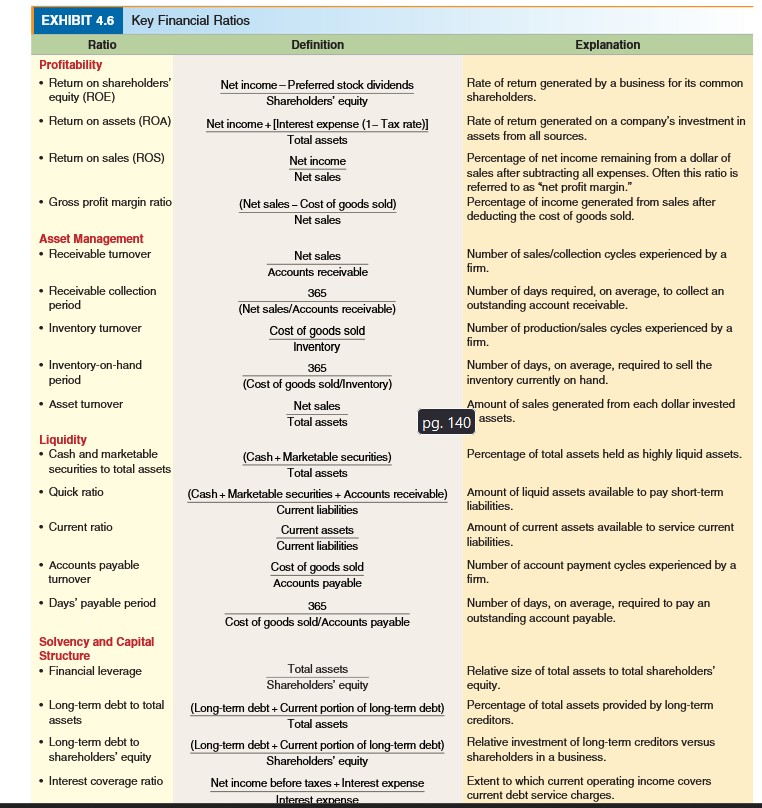

1. Compare and contrast Amazon Inc and Wallmart Inc- publicly traded companies in the same industry for a three year period (2022, 2021, 2020) using horizontal and vertical analysis (Income Statement, Balance Sheet and Statement of Cash Flows), together with a minimum of ten (10) ratios, but at least two from each of the following categories:

Liquidity

Solvency/Capital Structure

Asset Management

Profitability/Efficiency.

A list of the key ratios in each category was attached as a picture. (NOTE: PLEASE VIEW THE ATTACHED PICTURE FOR THE LIST OF KEY RATIOS IN EACH CATEGORY)

2. Please start the analysis with a discussion of each company, for example, what they sell or make, their target market, any marketing or other strategies they employ, or how they compete.

3. I suggest you acquire copies of each companys financial statements, available online at the SECs EDGAR service or the companys investor relations website.

4. Put charts in the body of your discussion for the various ratios. Breaking the ratios down by type (such as liquidity, profitability) can be another way to make the written report more coherent. Often times it is helpful to not only have an entire page of ratio calculations as an exhibit but to put charts in the body of your discussion for the various ratios.

5. Give a depth of analysis. Anyone can crunch the numbers. specifically interested in your interpretation of what the horizontal/vertical analyses and the ratios tell you about how well (or how poorly) these companies have met strategic and other goals they have identified.

(Hint: Strategy is often found in the management discussion and analysis or the letter to shareholders in the annual report documents.)

There isnt a minimum or maximum page requirement, but a solid report will be 8-10 pages in length.

Kew Finannial Ratins Explanation late of retum generated by a business for its common hareholders. late of retum generated on a company's investment in ssets from all sources. 'ercentage of net income remaining from a dollar of ales after subtracting all expenses. Often this ratio is eferred to as "net profit margin." 'ercentage of income generated from sales after leducting the cost of goods sold. Jumber of sales/collection cycles experienced by a m. Jumber of days required, on average, to collect an utstanding account receivable. Jumber of production/sales cycles experienced by a rm. lumber of days, on average, required to sell the iventory currently on hand. imount of sales generated from each dollar invested assets. 'ercentage of total assets held as highly liquid assets. Imount of liquid assets available to pay short-term abilities. Imount of current assets available to service current abilities. Jumber of account payment cycles experienced by a rm. Jumber of days, on average, required to pay an utstanding account payable. ielative size of total assets to total shareholders' quity. 'ercentage of total assets provided by long-term reditors. lelative investment of long-term creditors versus hareholders in a business. ixtent to which current operating income covers urrent debt service charges

Kew Finannial Ratins Explanation late of retum generated by a business for its common hareholders. late of retum generated on a company's investment in ssets from all sources. 'ercentage of net income remaining from a dollar of ales after subtracting all expenses. Often this ratio is eferred to as "net profit margin." 'ercentage of income generated from sales after leducting the cost of goods sold. Jumber of sales/collection cycles experienced by a m. Jumber of days required, on average, to collect an utstanding account receivable. Jumber of production/sales cycles experienced by a rm. lumber of days, on average, required to sell the iventory currently on hand. imount of sales generated from each dollar invested assets. 'ercentage of total assets held as highly liquid assets. Imount of liquid assets available to pay short-term abilities. Imount of current assets available to service current abilities. Jumber of account payment cycles experienced by a rm. Jumber of days, on average, required to pay an utstanding account payable. ielative size of total assets to total shareholders' quity. 'ercentage of total assets provided by long-term reditors. lelative investment of long-term creditors versus hareholders in a business. ixtent to which current operating income covers urrent debt service charges Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started