Answered step by step

Verified Expert Solution

Question

1 Approved Answer

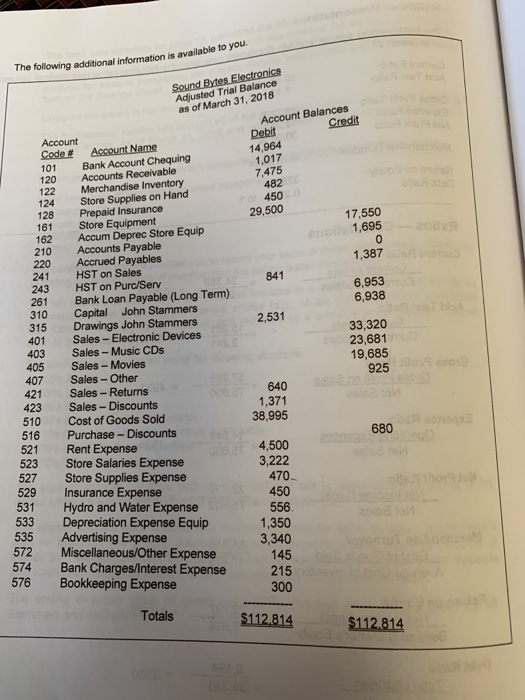

Please do a Journal, Special Journal, General Journal, General Ledger. thanks 4-13 Payment to Active Electronics Inc. for invoice #2819, $6,554. 4-13 Received the following

Please do a Journal, Special Journal, General Journal, General Ledger. thanks

4-13 Payment to Active Electronics Inc. for invoice #2819, $6,554.

4-13 Received the following bank debit memo. Called the manager of the community service group and he informed you that they changed bank accounts and iisued cheque on rhe wring accont. A correct cheque will be issued on Monday the 16th, $610.20.

4-16 Paid the outstanding Hydro bill today.

4-16 Received the new cheque to replace the account closed cheque.

4-24 Issued to Kylies DJ Service Sales Order #36, terms 2/10,n/30,$100 plus 13% HST Goods are on hold until May 4.

4-27 Sale to new customer, 300 plus 13% HST.The manager is checking on future credit terms for this customer. Received a partial payment of $100. Record this transaction as 2 transactions.

4-30 Received the following bank debit memo, $400( bank loan payment).

4-30 Issued cheque to pay worker for $640 for April work. Split the amount to Store Salaries Expense $540 and Bookkeeping Expense $100. ( ignore CPP, EI and Income Tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started