Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do all calculations for tax return. Diana and John Felix married and file a joint return 1 . Diana's mother, Denise, died on January

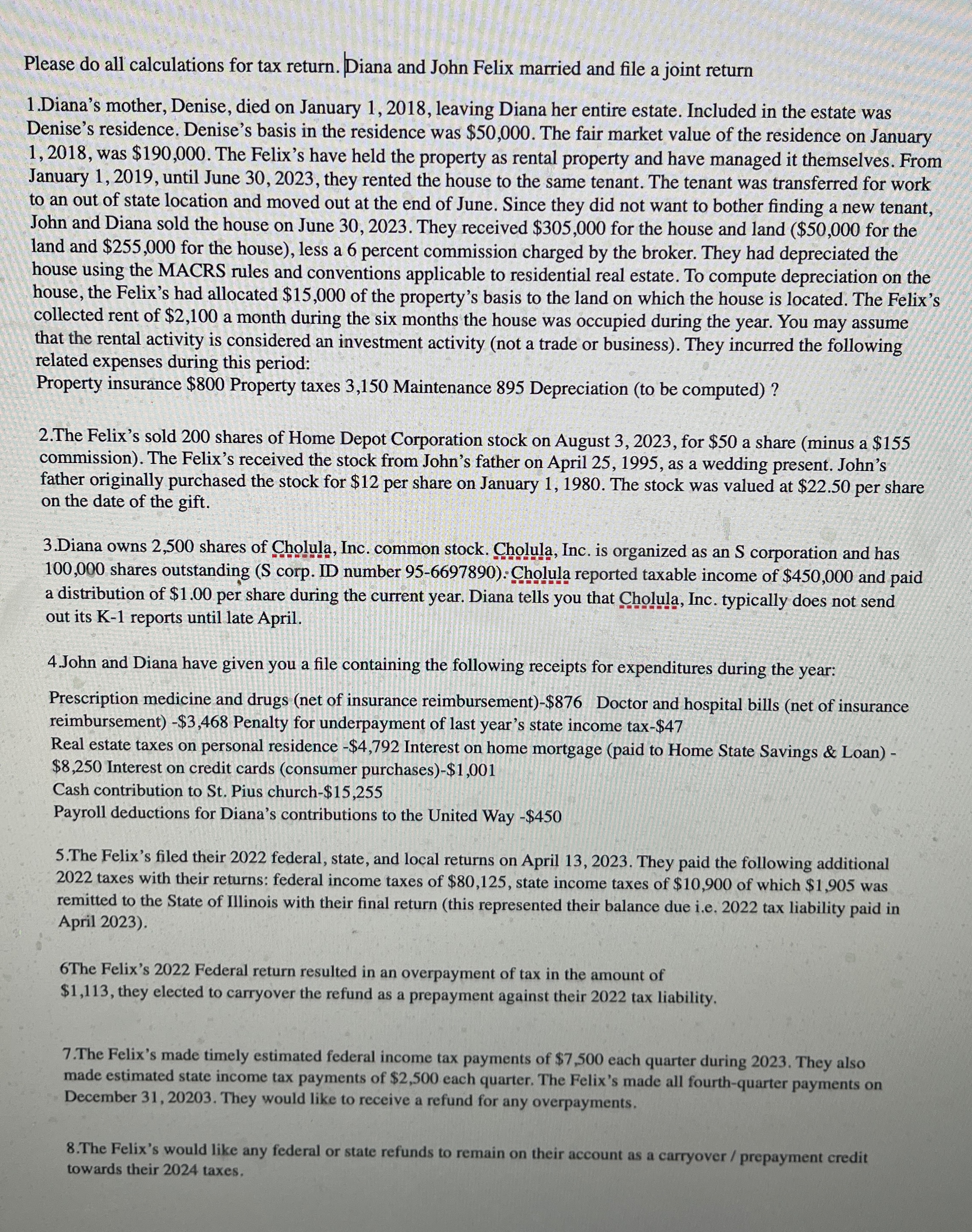

Please do all calculations for tax return. Diana and John Felix married and file a joint return

Diana's mother, Denise, died on January leaving Diana her entire estate. Included in the estate was Denise's residence. Denise's basis in the residence was $ The fair market value of the residence on January was $ The Felix's have held the property as rental property and have managed it themselves. From January until June they rented the house to the same tenant. The tenant was transferred for work to an out of state location and moved out at the end of June. Since they did not want to bother finding a new tenant, John and Diana sold the house on June They received $ for the house and land for the land and $ for the house less a percent commission charged by the broker. They had depreciated the house using the MACRS rules and conventions applicable to residential real estate. To compute depreciation on the house, the Felix's had allocated $ of the property's basis to the land on which the house is located. The Felix's collected rent of $ a month during the six months the house was occupied during the year. You may assume that the rental activity is considered an investment activity not a trade or business They incurred the following related expenses during this period:

Property insurance $ Property taxes Maintenance Depreciation to be computed

The Felix's sold shares of Home Depot Corporation stock on August for $ a share minus a $ commission The Felix's received the stock from John's father on April as a wedding present. John's father originally purchased the stock for $ per share on January The stock was valued at $ per share on the date of the gift.

Diana owns shares of Cholula, Inc. common stock. Cholula, Inc. is organized as an S corporation and has shares outstanding S corp. ID number : Cholula reported taxable income of $ and paid a distribution of $ per share during the current year. Diana tells you that Cholula, Inc. typically does not send out its K reports until late April.

John and Diana have given you a file containing the following receipts for expenditures during the year:

Prescription medicine and drugs net of insurance reimbursement $ Doctor and hospital bills net of insurance reimbursement$ Penalty for underpayment of last year's state income tax $

Real estate taxes on personal residence $ Interest on home mortgage paid to Home State Savings & Loan $ Interest on credit cards consumer purchases $

Cash contribution to St Pius church $

Payroll deductions for Diana's contributions to the United Way $

The Felix's filed their federal, state, and local returns on April They paid the following additional taxes with their returns: federal income taxes of $ state income taxes of $ of which $ was remitted to the State of Illinois with their final return this represented their balance due ie tax liability paid in April

The Felix's Federal return resulted in an overpayment of tax in the amount of $ they elected to carryover the refund as a prepayment against their tax liability.

The Felix's made timely estimated federal income tax payments of $ each quarter during They also made estimated state income tax payments of $ each quarter. The Felix's made all fourthquarter payments on December They would like to receive a refund for any overpayments.

The Felix's would like any federal or state refunds to remain on their account as a carryover prepayment credit towards their taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started